Download PDF Summary

Overall Budget

Deficits Return for 2025-26 and Persist Throughout Forecast. The May Revision projects a deficit of $12 billion General Fund for 2025-26. Compared to January, when the Governor claimed a balanced budget, the May Revision projects that General Fund tax revenue will be lower by $11 billion in 2025‑26, more than offsetting smaller upward adjustments in the past and current years. Estimated expenditures also have increased slightly compared to January, rising by $1.2 billion in 2024-25 to $233 billion General Fund before declining to the proposed level of $226 billion in 2025-26. Total state spending would reach nearly $338 billion in 2024-25 and then decline to $322 billion in 2025-26.

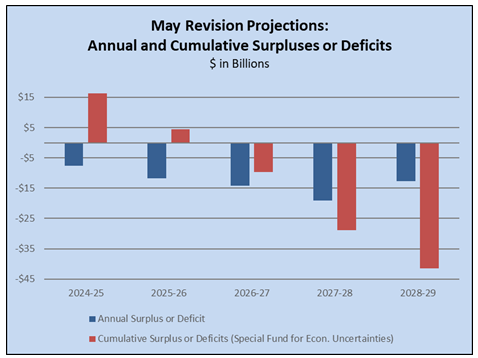

Revenues and expenditures would remain fundamentally out of balance for the duration of the budget forecast under the Governor’s plan, as shown in the chart below. The annual deficits, which range from $13 billion to $19 billion in future years, already assume that the Governor’s proposed solutions are enacted, meaning that additional actions would be needed to achieve a truly sustainable budget.

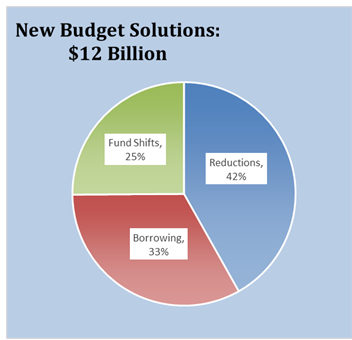

May Revision Solutions Total $12 Billion. The May Revision proposes a net of $12 billion in new or revised budget solutions for 2025-26, which are summarized in the chart on the next page. Only 42 percent of these solutions are ongoing General Fund spending reductions. About one-third of the solutions, or $4 billion, are one-time borrowing solutions that will increase costs to repay in the future.

Major components of these solutions for 2025-26 include the following:

- Spending reductions of $5 billion, primarily focused on the Medi-Cal program. Most of these reductions would phase in over time, and the Governor projects that these actions would amount to cost avoidance or reduced spending of nearly $15 billion by 2028-29.

- Increased borrowing of nearly $4 billion, primarily by delaying repayment of the $3.4 billion loan to cover Medi-Cal costs that Democrats approved earlier this year.

- Shifting $3 billion in costs from the General Fund to other state funds, including $1.5 billion for CalFIRE to Cap & Trade funds and $1.3 billion for Medi-Cal to the managed care organization tax authorized by Proposition 35.;

The newly proposed solutions of $12 billion are in addition to the $27 billion in solutions that the state enacted for 2025-26 as part of last year’s budget package. Those solutions included a $7.1 billion withdrawal from the state’s Rainy Day Fund, which the May Revision maintains. The lack of ongoing spending reductions in the May Revision and previous budgets helps create the annual and cumulative deficits identified on the previous page. While the Governor and Democrats are quick to blame the Trump administration for revenue and economic problems, California’s supermajority is squarely to blame for spending the surpluses of previous years into annual multibillion dollar deficits.

Health

A Staggering $12 Billion General Fund Cost for Undocumented Medi-Cal Coverage in 2025-26 Prior to Solutions. The May Revision estimates that more than one out of every four General Fund dollars spent in Medi-Cal goes towards coverage of the undocumented. In January 2025, the Governor estimated that the cost of full-scope Medi-Cal coverage for the undocumented in the current 2024-25 fiscal year was $8.4 billion General Fund. Now the Governor estimates that the costs for the current year have increased by an additional $1.1 billion to a total of $9.5 billion General Fund—a whopping 25 percent of all General Fund for Medi-Cal in 2024-25. The costs of the expansion, before adopting any solutions, for the upcoming 2025-26 fiscal year are even higher, at a shocking $12.4 billion General Fund, or 28 percent of all General Fund spending in Medi-Cal. These cost increases stem from skyrocketing undocumented enrollment, which is nearly 2 million individuals. While the Governor is proposing some solutions to reduce these costs by roughly $1 billion in 2025-26, even the adjusted $11.4 billion price tag is a damning indictment of an out-of-control program.

Governor Wants to Freeze Medi-Cal Enrollment for Undocumented Adults. With General Fund costs of the Medi-Cal eligibility expansion to undocumented individuals ballooning to $12.4 billion, the Governor proposes to halt new Medi-Cal enrollments to undocumented adults starting in January 2026. All existing undocumented adults currently on Medi-Cal would remain in the program, and any new undocumented children ages 18 and under may still enroll in Medi-Cal. The delay in implementation to January 2026 and the focus on only new enrollees barely results in immediate savings. In fact, the Governor’s proposal saves only $87 million in 2025-26.

Premiums and Benefit Cuts for Undocumented Adults Remaining on Medi-Cal. The Governor plans a $100 monthly premium for the undocumented adults that remain in the program, starting in January 2027, providing no savings in the 2025-26 fiscal year. The Governor also plans to remove coverage of certain benefits to undocumented adults on Medi-Cal, including long-term care and dental benefits, as well as eliminating payments to Federally Qualified Health Centers and Rural Health Clinics for services to the undocumented population—resulting in roughly $1 billion in savings in the 2025-26 fiscal year.

Making Seniors and the Disabled Suffer Once Again. The Governor reverses a recent bipartisan push to remove the Medi-Cal asset limit on seniors and disabled adults, and reinstates asset limits of $2,000 per individual and $3,000 per couple. This will hurt California’s seniors and disabled individuals dependent on Medi-Cal. The action is estimated to save $94 million in 2025-26.

Steals Funds From Medi-Cal Providers. In violation of the will of the voters on both Proposition 56 in 2016 and Proposition 35 in 2024, the Governor proposes to take an additional $1.3 billion in Managed Care Organization (MCO) tax funds as well as $504 million in tobacco tax supplemental payments away from Medi-Cal providers. These cuts could be challenged in court, but if they stand, will be sure to decrease the number of providers serving the Medi-Cal population, reducing health access for millions of Californians.

Fails to Repay Mysterious Medi-Cal Loan from March 2025. Instead of repaying the $3.44 billion Medi-Cal loan from March 2025 in the 2025-26 fiscal year, as required by current law, the Governor is proposing to change state law to push out repayment to future fiscal years.

Regulation of Pharmacy Benefit Managers. The Governor is proposing new legislation to require pharmacy benefit managers to be regulated by the Department of Managed Health Care. This is a departure from the proposal currently in SB 41 (Wiener), which makes the Department of Insurance the regulatory body. With a policy bill on the topic still in process, the Governor should refrain from jamming this complex policy issue in a budget trailer bill.

K-12 Education

Proposition 98 Guarantee. At May Revision, the revised Proposition 98 guarantee levels are estimated to be $98.5 billion in 2023-24, $118.9 billion in 2024-25, and $114.6 billion in 2025-26, reflecting a decrease of $4.6 billion compared to the Governor’s January budget. The majority of the decrease, $4.3 billion, is to the 2025-26 Proposition 98 guarantee. The 2024-25 Proposition 98 guarantee is calculated at $118.9 billion, but the revised budget continues to propose funding the guarantee at $117.6 billion, for a difference of $1.3 billion. According to the Department of Finance, this is to provide a buffer due to the uncertainty of revenue projections.

Proposition 98 Reserve and Local Control Funding Formula. The Governor’s January budget projected a final balance in the Public School System Stabilization Account (Proposition 98 Reserve) of $1.5 billion at the end of 2025-26. Under the May Revision, the Proposition 98 Reserve would be fully exhausted in 2025-26. This reflects a reduced mandatory deposit in 2024-25 to $540 million and a mandatory withdrawal of $540 million in 2025-26. The withdrawal in 2025-26 is due to the decrease in the Proposition 98 Guarantee for that year.

The January budget included a 2.43 percent cost-of-living (COLA) adjustment for the Local Control Funding Formula (LCFF), and the May Revision decreases this COLA to 2.3 percent. The May Revision uses $481 million in Proposition 98 reserves to fully fund the LCFF costs in 2025-26. The budget also proposes to defer $1.8 billion in LCFF funding from June 2026 to July 2026.

Student Support and Professional Development Discretionary Block Grant. The Governor’s budget proposed $1.8 billion one-time Proposition 98 General Fund for the Student Support and Professional Development Discretionary Block Grant. The May Revision decreases the proposed funding by $100 million for a revised grant total of $1.7 billion. This funding is meant to help Local Education Agencies (LEAs) with rising costs as well as other activities such as career pathways and dual enrollment expansion, teacher recruitment and retention, and professional development for teachers in mathematics, English language arts, and literacy.

Expanded Learning Opportunities Program (ELOP). The Governor’s budget included an additional $435 million ongoing Proposition 98 General Fund for the full implementation of ELOP. The May Revision increases the ongoing Proposition 98 General Fund to $516 million to reflect increased unduplicated pupil attendance. This would bring the total ongoing funding for the program to $4.5 billion. The May Revision continues to propose increasing the number of LEAs that must offer ELOP to all of their students by reducing the qualifying percentage of unduplicated students at an LEA from 75 percent to 55 percent. The May Revision proposes an additional $10 million Proposition 98 General Fund to increase the minimum grant amount per LEA from $50,000 to $100,000.

Higher Education

Modified Operating Budget Reduction. The May Revision modifies the Governor’s previously proposed operating reductions to the UC and CSU, shifting down from 7.95 percent reductions to 3 percent. This lower reduction proposal would leave UC and CSU with nearly $500 million in additional resources compared to January, but still cut by $274 million. Senate Republicans called for full rejection of this operating cut to Higher Education, so this revised proposal is a positive step but still insufficient to prioritize public universities. Notably, the cost of the Medi-Cal expansion to undocumented residents, as described in the Health section above, is more than enough to eliminate tuition for every California resident student in the UC and CSU systems.

Compact Deferral Maintained. The May Revision maintains the deferral to 2027-28 of the five percent increases previously agreed upon through the compacts to the UC ($241 million) and the CSU ($252 million). Thought the Governor characterizes these actions as “deferrals,” the ongoing state deficits suggest these are actually cuts.

Community Colleges' IT Projects Reduced. The May Revision substantially cuts Community Colleges' IT projects that were originally Governor’s Budget proposals.

The Collaborative Enterprise Resource Planning (ERP) proposal from the Governor's Budget equated to $168 million is withdrawn in the May Revision.

The May Revision considerably reduces the Governor's Budget's Common Cloud Data Platform proposal from $163 million to $151 million.

Housing and Homelessness

Community Development Block Grant Federal Funds. The May Revision includes $416 million in federal funds within the Department of Housing and Community Development to support long-term recovery efforts related to the 2023 and 2024 natural disasters.

Encampment Resolution Grant Program. The May Revision continues to include $100 million General Fund for the Encampment Resolution Grant Program. The program provides grant funding to assist local governments with resolving critical encampment concerns and transitioning individuals into safe and stable housing.

Natural Resources and Environment

Cap-and-Trade Extension (Rebranded as “Cap-and-Invest”). The May Revision proposes extending California’s Cap-and-Trade program under a new name—“Cap-and-Invest”—with updated guiding principles intended to promote market stability and attract private-sector investment in clean technologies. While largely symbolic, the proposal raises concerns about long-term fiscal sustainability, relying on an estimated $60 billion in program proceeds to fund utility bill credits despite the program’s historic revenue volatility. It also proposes to guarantee $1 billion annually for High-Speed Rail, which continues to face delays and cost overruns—potentially diverting funds from more effective and immediate emissions reduction strategies, such as agricultural engine replacement and forest fuel load reduction. The Governor states he will collaborate with the Legislature in the coming weeks to develop an expenditure plan for the program’s revenues. However, without clearly defined priorities or funding safeguards, the process risks repeating a familiar pattern in which political considerations override emissions impact and cost-effectiveness.

Budget Shift to Fund CALFIRE from Cap-and-Trade Revenues. The Governor proposes shifting $1.54 billion in the Department of Forestry and Fire Protection (CALFIRE) operations from the General Fund to the Greenhouse Gas Reduction Fund (GGRF), under the guise of aligning with the “polluter pays” principle. While the proposal helps address the General Fund deficit, this move effectively offloads a core, non-discretionary public safety function onto a volatile revenue stream.

Water Infrastructure and Delta Conveyance Streamlining. The May Revision reaffirms the Governor’s support for the Delta Conveyance Project, proposing statutory changes to expedite permitting and reduce bureaucratic delays. The Governor’s proposal lacks any new funding, and policy changes are best handled through the more deliberative policy process, rather than the budget, in order to promote firm legislative and public input.

Climate and Environment Fund Shifts and Reversions. A range of one-time fund reversions and shifts are proposed, including repurposing $75 million for Exide cleanup, canceling a new CALFIRE training center, and redirecting offshore wind funding to the Proposition 4 climate bond. These shifts are portrayed as fiscal prudence, but in practice they illustrate the fragility of California’s climate budget architecture. Projects previously touted as critical are quietly walked back or replaced with alternatives under vague justifications like “cost-effectiveness” or “federal funding availability.” The reversions further suggest a lack of coordinated long-term planning, with environmental priorities too often dictated by short-term budget pressure.

Cannabis Enforcement and Tax Fund Allocations. The May Revision shifts enforcement funding from the Cannabis Control Fund to the Cannabis Tax Fund and grants new authority to seal unlicensed premises. It also allocates $454 million for youth programs, environmental remediation, and public safety per Proposition 64. While these changes appear responsive to market dynamics and enforcement gaps, the funding shift again highlights a chronic overreliance on special funds to sustain core regulatory functions. Statutory tweaks to expand Board of State and Community Corrections grants may help local enforcement, but the piecemeal approach underscores how California’s legal cannabis framework remains fragmented and unstable—nearly a decade after legalization.

Energy and Utilities

Utility Bill Credits Simply a Rebate Paid by Customers. The Governor is touting $60 billion in utility bill credits that would be issued via the California Climate Credit over the duration of the extension of the Cap and Trade Program. The Governor fails to understand the California Climate Credit exists because the Cap and Trade Program is known to increase the price of electric and natural gas utility service to customers by taxing utility companies for their carbon emissions and forcing them to transition to more expensive energy sources. As a result, utility customers are paying more for their utility bills. The Climate Credit is simply a rebate of money paid by those customers to help offset the additional costs they are paying. The Climate Credit does nothing to address the expensive energy rates caused by California’s climate policies.

Port Upgrades for Offshore Wind Development-Fund Shift. As a budget solution, the May Revision shifts $43 million from the General Fund to the climate bond (Proposition 4, 2024) for upgrades to California ports to accommodate the development of offshore wind electricity generation. The 2022 Budget Act included $45 million General Fund, and the January budget proposed $228 million from the Climate Bond for this purpose. This shift reduces General Fund spending by $43 million and increases bond funding by a like amount.

Clean Energy Reliable Investment Plan (CERIP) Reversion. The May Revision reverts $33 million General Fund appropriated in 2023 for programs funding community renewable energy projects This funding via the CERIP was part of a larger agreement to provide $1 billion General Fund for clean energy programs under the agreement to extend operations of the Diablo Canyon Nuclear Power Plant. The state has received federal funding for community renewable energy projects, allowing the previously appropriated General Fund to be pulled back.

Transportation

Governor Doubles Down on High-Spend, uh, High-Speed Rail. The May Revision modifies the continuous appropriation for the high‑speed rail project to guarantee $1 billion annually from Cap and Trade revenues, rather than the 25 percent the project receives currently, which can fall below $1 billion. For the budget year, this would result in an increase of $64 million for the project.

This is a play to enable securitization of these revenues. Past efforts to securitize this volatile revenue source within the existing funding structure were unsuccessful. Ultimately, financing these revenues will cost Californians hundreds of millions more in interest costs. The Cap and Trade Program is slated to sunset in 2030, but an effort to extend the program to 2045 is underway. This means $20 billion could be securitized, adding at least $10 billion in interest costs, or more if interest rates are higher for this risky project.

The High-Spend Rail is already $95 billion over budget and more than a decade behind schedule. It is unlikely this small change will prevent derailment, but instead will cost Californians more, with no guarantee the full system will ever be built. This money would be better spent on more effective and immediate emissions reduction strategies, such as agricultural engine replacement and forest fuel load reduction.

Gas Taxes Increase Again. Despite claims to prioritize affordability for Californians, the Governor proposes no changes to existing law, continuing the automatic annual tax increases to gasoline and diesel fuel. Updated estimates reflect increases of 2.7 percent with gasoline taxes increasing by 1.6 cents per gallon (cpg), to 61.2 cpg, and diesel fuel taxes increasing by 1.2 cpg, to 46.6 cpg on July 1, 2025.

Public Safety and the Judiciary

Proposition 36 Implementation Largely Unfunded. Despite an overwhelming mandate from the voters and recent increases in nearly every category of crime, the May Revision only includes funding for the projected prison population increase that is expected to result from Proposition 36 (2024). The Governor does not include any funding for increased workload in the courts, mandated treatment services, or case management and supervision of treatment-mandated felons. In a glaring example of misplaced priorities, while the Governor refuses to acknowledge the voters’ mandate to hold criminals accountable by fully funding Proposition 36, he plans to continue new enrollments of undocumented immigrants into Medi-Cal through at least January 2026, the costs of which will far exceed the costs of funding Proposition 36.

Unnamed Prison Closure. The May Revision includes a proposal to close another prison (in addition to the three already shuttered by this administration) by October 2026 for an estimated annual savings of about $150 million when fully implemented. The Governor has not yet named the facility to be closed. While current prison population trends suggest that a fourth prison could be closed without jeopardizing public safety, Senate Republicans have long argued that these closures would not have been possible but for recent misguided criminal justice reforms, including Proposition 47’s easing of criminal sanctions in 2014 and Proposition 57’s virtually unlimited expansion of sentence-reducing credits in 2016. If the state were to begin holding criminals accountable again, CDCR could quickly find itself in a position of needing more prison capacity.

Federal Lawfare Continues. The May Revision includes $14 million for the Attorney General to continue his antagonistic relationship with the Trump Administration. The funds would be available to litigate matters including environmental protections, tariffs, abortion, and termination of federal grants. This funding is more than twice the amount originally provided to the Attorney General in 2016 to litigate against the first Trump Administration and would be in addition to the $50 million appropriated in the 2025-2026 First Extraordinary Session of the Legislature for similar purposes.

Attorney General “Slush Fund” Loan. The Litigation Deposit Fund, once referred to by some as the Attorney General’s slush fund due to its discretionary uses and lack of public accounting, was the source of nearly half a billion dollars in budgetary loans to the General Fund, beginning in 2023-24. However, after the first $400 million loan, the remaining balance in the fund that was “not required for currently projected operational or programmatic purposes” was transferred to the Unfair Competition Law Fund to provide better transparency. The May Revision proposes to loan $150 million of that transferred balance to the General Fund. An astute observer could question why, if the Attorney General has $150 million to loan to the General Fund, he needs $14 million, mostly from the General Fund, to wage legal warfare on the Trump Administration.

General Government

Billion Dollar Deficits But Governor Continues to Expand Bureaucracy. The May Revision includes $4.2 million in 2025-26, $6.4 million in 2026-27, and $6.2 million ongoing to expand state government through the proposed reorganization of the Business, Consumer Services,

and Housing Agency. The Governor’s May Revision includes funding for the creation of the new California Housing and Homelessness Agency, as well as funding to support the creation of the new Housing Development and Finance Committee. The proposal would provide millions to support new union-backed state workers, but fails to prioritize funding to build housing, and continues to lack critical housing reforms needed to reduce the high cost of housing across the state.

Governor Prioritizes “Belonging Campaign” Over Developmentally Disabled. The Governor’s May Revision continues to propose $5 million for a “feel good” research project to evaluate how connected Californians feel to their communities, even as the Governor is proposing reductions of nearly $100 million to both disabled families and the providers that support them. It is clear that with the Governor’s proposed reductions, the families within the state’s disabled community will no longer feel supported or connected, and may suffer from more than just a lack of “belonging.”

Rescinded January Budget Proposals. The May Revision proposes to rescind the following January 2025-26 budget proposals:

- CalCompetes Grant Program Funding. $61 million in one-time General Fund for the CalCompetes Grant program in 2025-26. The CalCompetes Grant program is a relatively recent program expansion intended to support businesses that are unable to participate in the CalCompetes Tax Credit program.

- Hope, Opportunity, Perseverance, and Empowerment (HOPE) for Children Trust Account Program Board. The May Revision includes a reduction of $50 million one-time General Fund in 2025-26 within the HOPE Program. The program was created in 2022 and provided $100 million General Fund. The HOPE program created trust accounts for children who have lost a parent or primary caregiver to COVID-19 and for children in long-term foster care.

- California Education Learning Lab Program. Eliminates the program over two years. Compared to January, the proposal would reduce expenditures by $5.3 million in 2025-26.

- California Education Interagency Council. Rescinds the proposal to establish the California Education Interagency Council, reducing expenditures by $5 million in 2025-26.

- Military Department Deferred Maintenance. Rescinds $4.8 million one-time General Fund in 2025-26 related to deferred maintenance projects at the Azusa, Sacramento-Okinawa, and Fresno-Hammer Field armories.

Labor and Employment

Unemployment Insurance (UI) Debt Interest Payment. The state is responsible for interest due on money borrowed from the federal government for UI benefit payments. The outstanding loan is currently $20 billion. The annual interest payment for 2025-26 is updated to $643 million, an increase of $8.5 million, reflective of continued borrowing to pay benefits. California’s unemployment rate remained above the national average at 5.4 percent in March, compared to the national average of 4.2 percent.

Proposed Reduction to State Employee Compensation. The May Revision proposes savings of $283 million General Fund ($767 million total funds) from reducing state employee salaries and wages. The state is already in negotiation with seven bargaining units under its normal contracting schedule, and the May Revision claims the state will “make every effort” to achieve these savings at the bargaining table. The proposal includes an unspecified budget provision to “impose reductions” if bargaining is unsuccessful. The state’s poor record of achieving savings through collective bargaining suggests that the Newsom administration will face challenges meeting these reduction targets.

Borrowing to Subsidize State Spending. As a budget solution, the May Revision includes a loan of $400 million from the Labor and Workforce Development Fund to the General Fund, continuing excessive state spending. The Governor asserts this funding is “not currently projected to be used for operational and programmatic purposes.” However, these funds from penalties paid by employers for labor violations are meant to educate employers and employees about state labor laws and employee rights. If these funds are not needed for this purpose, perhaps they could instead be used to benefit employers, employees, and California taxpayers by making supplemental principal payments on the UI debt owed to the federal government.

Human Services

Painful Cuts to the Developmentally Disabled. The Governor is once again balancing the budget on the backs of the intellectual and developmentally disabled with a $75 million cut to developmentally disabled service providers and a $23 million cut to families with disabled individuals enrolled in the Self-Determination program.

Foster Care Tiered Rate Structure Trigger. The May Revision proposes statutory language to make the foster care tiered rate structure implementation subject to the availability of General Fund in the spring of 2027. The cost of the tiered rate structure, at full implementation, is estimated to be approximately $932 million total funds ($749 million General Fund). The 2024 budget initiated the implementation of the expansive tiered foster care rate structure that is based on the needs of a child or youth, rather than their placement type.

Cuts the Family Urgent Response System. The May Revision proposes to cut by $13 million General Fund the Family Urgent Response System (FURS), which provides hotline support for current and former foster youth and caregivers who are dealing with emotional, behavioral, or other difficulties that require immediate support. The ongoing funding for the program would be $17 million General Fund.

Reduces and Adds Trigger to Benefits Expansions for Undocumented Immigrants. The May Revision eliminates the In-Home Supportive Services (IHSS) undocumented expansion coverage for adults 19 and older, for a reduction of $159 million General Fund ongoing. The May Revision also makes the planned expansion of the California Food Assistance Program (CFAP) to all undocumented immigrants ages 55 and over subject to the availability of General Fund in the spring of 2027.

Significant Reductions to IHSS. Counting the elimination of the IHSS benefits for undocumented immigrant adults ages 19 and over, the May Revision contains a cumulative $1 billion in General Fund reductions under the IHSS program, including $708 million ongoing to cap IHSS provider overtime and travel hours at 50 hours per week, and $111 million in 2025-26 to conform the IHSS Residual Program coverage with the timing of Medi-Cal coverage.

Child Care Cost-of-Living Adjustment and Emergency Child Care Bridge. The Governor’s May Revision suspends the 2025-26 child care COLA, for a reduction of $61 million General Fund in 2025‑26 and ongoing. The Revision also reduces Emergency Child Care Bridge (Bridge Program) funding by $43 million General Fund in 2025-26 and ongoing. This brings the ongoing funding for the Bridge Program down to $51 million General Fund. The Bridge Program provides additional supports to facilitate timely child care services for children in the foster care system.