Download Complete Analysis (pdf)

Executive Summary

Overview. The budget picture looks dramatically better now than it did just seven months ago. California tax revenues, which are heavily reliant on higher-income earners, have shown to be less affected by COVID-19 and the government’s response than expected. The Governor’s budget estimates that $15 billion in one-time revenues are available to spend, though it also projects major ongoing budget deficits in future years. The Governor appropriately calls for early legislative votes to approve certain proposals, including school assistance and economic stimulus. However, some of the details and the Governor’s other spending proposals are misguided. There are no investments to fix the embattled Economic Development Department, for example, but the Governor proposes to borrow $1 billion for zero-emission vehicle subsidies. The state needs to focus heavily on helping California workers and businesses recover normal lives and get back on their feet, but although the Governor’s budget includes some critically needed steps, it also throws a grab-bag of budget trinkets around.

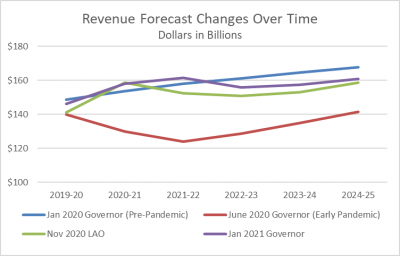

One-Time Revenue Surprise. The Governor’s budget reflects substantially higher one-time revenues that dramatically improve the budget outlook compared to just seven months ago, when the 2020 Budget Act was signed under a high degree of uncertainty. General Fund revenues for 2021-22 are now estimated to be $161 billion, which is 30 percent higher than forecast as part of the 2020 Budget Act plan. However, these temporarily higher revenues are followed by a projected drop in revenue to $156 billion for 2022-23 and minimal growth after that point. The chart below shows these trends as well as the dramatic changes in revenue forecasts over the past year, starting from the pre-pandemic January 2020 forecast.

Spending One-Time Available Revenues. The Governor’s budget estimates the unexpected one-time discretionary revenues to be nearly $15 billion, compared to an estimate of $26 billion by the nonpartisan Legislative Analyst’s Office. The Governor proposes to spend most of these revenues on a Jobs and Economic Stimulus package (26 percent) and on building reserves (20 percent), though a long list of other programs would also receive funds.

Overall Expenditures Also Increase. General Fund spending would reach nearly $156 billion in the current year, an increase of $22 billion (16 percent) from the level authorized by the 2020 Budget Act, and would rise again to reach nearly $165 billion in 2021-22. This new spending level for 2021‑22 would be 5.5 percent higher than the updated current year level. Spending from all state funds would reach $227 billion in 2021-22, virtually identical to the revised current year. Federal funds would provide an astonishing $228 billion in 2020-21, tens of billions more than normal, and another $151 billion in 2021-22, while additional federal assistance would flow directly to individuals.

Deficits and Budget Cuts Loom. Despite the short-term revenue surprise, rapid spending increases prior to the pandemic had already put the state on the verge of operating deficits. Expenditures continue to grow faster than revenues in the forecast for at least the next several years. Thus, the Governor’s budget predicts operating deficits that grow to more than $11 billion by 2024‑25. Also, while the Governor’s budget proposes billions in new spending in some areas, the budget also includes cuts of $1.3 billion expected beginning in 2022-23, mostly to Health and Human Services programs like Medi-Cal and developmental services. These planned cuts call into question the prudence of some of the proposed new expenditures in the Governor’s plan.

Combined Reserves Reach Nearly $22 Billion. The state’s Rainy Day Fund (Proposition 2 of 2014) is projected to reach $15.5 billion by the end of 2021-22. The Governor’s budget also includes a discretionary reserve of nearly $2.9 billion, a Safety Net Reserve of $450 million, and a public school reserve of $3 billion, which would bring total reserves to $21.9 billion when combined with the Rainy Day Fund. This combined reserve would reach 12.8 percent of revenues.

Early Budget Approvals Sought in Several Areas. The Governor is asking the Legislature to approve two groups of proposals faster than normal, an “Immediate Action” package in January and an “Early Action” package by March, as follows:

- The “Immediate Action” package totaling $5 billion in January to respond quickly to the pandemic’s effects on schools and businesses:

- $2 billion to assist schools with reopening efforts.

- $2.4 billion for stimulus efforts such as $600 payments each for people who receive Earned Income Tax Credits.

- $575 million for grants to businesses and nonprofits.

- The “Early Action” package totaling more than $6.5 billion for various proposals, some of which do not appear directly tied to COVID-19 response:

- $4.7 billion in Proposition 98 to address learning loss by extending school in person instruction time.

- $973 million for various jobs and workplace training efforts.

- $561 million for environmental sustainability, primarily for zero-emission vehicles or agricultural sustainability.

- $50 million for county probation improvements.

- $100 million to support emergency student financial aid.

- $20 million to bolster Community College student retention and recruitment.

More Funding for COVID-19 Health Response. The Governor plans on spending an additional $4.4 billion on direct COVID-19 response above the $8.6 billion estimated in last year’s budget. This new funding will include $2 billion for COVID testing, $473 million for contact tracing, $372 million for vaccines, and $1.2 billion for supporting programs for vulnerable populations. The Governor estimates that at least 75 percent of this spending will be reimbursed by the federal government.

School Reopening Payments. The Governor’s budget proposes $2 billion in one-time Proposition 98 General Fund for incentive grants to schools to offer in-person instruction as early as February 2021 for all students in transitional kindergarten through grade 6 and high-needs students. The funding is subject to immediate action by the Legislature and is available on a per-pupil basis for schools, with the exception of non-classroom based charters and independent study programs, which are open for in-person instruction by specific dates.

Schools are eligible to receive between $450 and $700 per student if they meet certain requirements, including completing a plan for ongoing testing of students and staff. Funding is flexible and can be used for any purpose that supports in-person instruction. A second funding round is available for schools able to complete the requirements by March 1, 2021. Schools in counties with average daily case rates above 28 cases per 100,000 people over seven days would not be eligible to reopen, though districts could still receive funding if they meet all other requirements.

Addressing Learning Loss. The Governor’s budget proposes $4.6 billion in one-time Proposition 98 General Fund to provide districts the ability to develop targeted strategies that address learning loss related to the pandemic. This funding is subject to early action by the legislature and can support community learning hubs, summer school, extended school year, extended school days, and other academic interventions targeted for high-needs students.

Lack of Plans to Improve EDD. The budget does not propose significant reforms for the Employment Development Department (EDD) beyond the numerous “task forces” already in place. This lack of action is despite the massive fraud, delays, and mismanagement associated with EDD in 2020. While there appear to be a significant number of additional federally-funded staff, EDD management has argued in the past that it is difficult to bring staff up to speed. Even so, the Governor has proposed no reforms to make sure staff can get the job done.

Proposition 98 Education. Proposition 98 funding for K-14 education reaches a new high at $85.5 billion in 2021-22. This is a $14.9 billion increase over revised budget act figures. Proposition 98 spending per pupil grows to $13,015 in 2021-22, a 5.2 percent (or $644) increase over revised 2020-21 levels. Per-pupil spending from all sources decreases from $18,837 to $18,000. This decline is related to one-time Federal Funds. Additional Proposition 98 augmentations include:

- $2 billion base increase for the Local Control Funding Formula (LCFF), reflecting a 3.84 percent cost of living adjustment (COLA). This COLA amount is a compounded effect of applying a 2.31 percent COLA for 2020-21 (which was not provided in last year’s budget) and a 1.5 percent COLA for 2021-22. Total LCFF funding is $64.5 billion for 2021-22.

- $3 billion deposit into the Public School System Stabilization Account.

Pays Down Majority of School Deferrals. The June 2020 Budget Act deferred $12.5 billion in Proposition 98 payments ($11 billion for K-12 schools and $1.5 billion for community Colleges). The Governor’s Budget proposes to pay down $9.2 billion of this amount. The remaining deferral after this payment includes $3.7 billion for K-12 schools and $326 million for community colleges.

School Supplemental Payment Revised. The Governor proposes to remove the 2020 Budget Act multi-year plan to supplement Proposition 98 and mitigate then-expected declines due to revenue reductions. Instead and in recognition of the extraordinary needs of students and the public school system related to the COVID-19 Pandemic, the Budget includes a one-time supplementary payment to K-14 schools of $2.3 billion in 2021-22.

Educator Professional Development. The budget proposes $315 million in one-time Proposition 98 General Fund for educator professional development. Notable augmentations include the following:

- $250 million for the Educator Effectiveness Block Grant. This will provide local educational agencies with resources to expedite professional development for teachers, administrators, and other in-person staff, in high-need areas including accelerated learning, re-engaging students, restorative practices, and implicit bias training.

- $50 million to create statewide resources and provide targeted professional development on social-emotional learning and trauma informed practices.

- $8.3 million for the California Early Math Initiative to provide teachers with professional development in mathematics teaching strategies for young children pre-K through third grade through the statewide system of support.

- $7 million to the University of California Subject Matter Projects to create high-quality professional development on learning loss in core subject matter content areas.

- $5 million to fund professional development and instructional materials for local educational agencies who are offering, or would like to offer, courses on ethnic studies.

University Funding Increases. The California State University (CSU) would see a base increase of approximately $200 million in ongoing General Fund, and $225 million in one-time initiatives. The largest ongoing proposal is a 3-percent unrestricted base increase, linked with the following expectations: (1) developing a plan to eliminate their achievement gaps by 2025, (2) permanently increasing the share of courses they offer online by at least 10 percentage points over their pre-pandemic levels, and (3) establishing a “dual admissions” pathway, whereby students complete their lower division coursework at community colleges but are guaranteed admission to the public universities upon completion of their associate degree for transfer (or a University of California equivalent). This increase is not connected to specific enrollment expectations.

The Governor’s budget increases ongoing General Fund for the University of California (UC) by $136 million and provides a total of $225 million for one-time UC initiatives. As with CSU, the largest ongoing proposal is a 3 percent unrestricted base increase and the largest one-time proposal is for deferred maintenance. The base increase is linked with the expectations listed above, and, as with CSU, is not connected to specific enrollment expectations.

Community College. The Governor does not propose any mid-year action to roll back the $1.5 billion in current year Proposition 98 payment deferrals. Instead, the Governor is proposing $1.1 billion one-time Proposition 98 General Fund to pay down deferrals in the budget year. For 2021-22, $326 million in deferrals would remain in place.

The Governor’s budget proposes $641 million in Proposition 98 General Fund proposals. Of these, eight are new ongoing spending commitments for $213 million and eight are one-time initiatives, totaling $428 million. The largest ongoing proposal is to provide a 1.5 percent cost-of-living adjustment. This base increase is linked with the overarching expectations listed above.

State Stimulus Payments for Earned Income Tax Credit and Undocumented Recipients. The budget proposes nearly $2.4 billion General Fund to provide a $600 state stimulus payment for more than 4 million individuals eligible in 2019 for the Earned Income Tax Credit (EITC) program, as well as for undocumented immigrants that have an Individual Taxpayer Identification Number (ITIN) and would be eligible for EITC in 2020.

New Mental Health Efforts. The Governor’s budget spends new General Fund to enhance county behavioral health treatment and capacity including: $750 million for counties to acquire and rehabilitate properties to increase treatment beds, $532 million to implement a new Medi-Cal behavioral health treatment benefit called CalAIM, $233 million for a 3-county pilot program to enhance treatment services for seriously mentally ill individuals deemed incompetent to stand trial, and $200 million for Medi-Cal managed care plan incentives to increase K-12 student behavioral health services.

Wildfire and Forestry Package. The budget proposes $1 billion to support forest health and fire prevention activities, dedicating $323 million for early action in the spring to support fire prevention projects before the next fire season. The plan also provides $143 million General Fund to support 30 new fire crews, and $48 million to continue phasing in Black Hawk helicopters and large air tankers.

Deferred Maintenance. The budget proposes a $300 million one-time General Fund for statewide-deferred maintenance, emphasizing “greening” of state infrastructure. The proposal would include projects to install electric vehicle charging stations at state-owned facilities, despite the Governor's directions for departments to rethink renewing building leases and consider permanent telework to generate savings.

Agricultural Package Triggers Two-Thirds Vote. As part of a package to create jobs and accelerate economic recovery, the budget provides $385 million (various funding sources) for targeted climate-related investments in the agricultural industry. The budget also includes a proposal to change the flat fee model currently used to purchase pesticides and move to a tiered fee structure phased in over the next four years. Revisions of this fee would require a two-thirds vote by the legislature.

Toxic Site Cleanup, Agency Reform. The Budget includes $300 million one-time General Fund for toxic site cleanup and investigations of high-priority contaminated properties across the state, which will be prioritized based on public health risk criteria. The Budget also proposes governance and fiscal reform for the Department of Toxic Substances Control to address future clean-ups of orphan sites.

Cap and Trade Expenditure Plan. The Governor’s budget proposes a nearly $1.4 billion Cap and Trade Expenditure Plan. While the exact details are pending, the plan currently dedicates $394 million to achieve the state’s ambitious zero-emission vehicle goals by 2035 and 2045. The plan would also provide $323 million to accelerate fire prevention projects before the 2021 fire season by increasing the pace and scale of existing fire prevention efforts to reduce wildfire risk and jumpstart economic recovery in the forest sector.

Zero-Emission Vehicles. The Governor proposes to spend $1.5 billion to install electric vehicle charging and hydrogen fuel stations, and to subsidize zero emission vehicles (ZEVs) for low-income individuals, as part of the strategy to ban the sale of gasoline cars in 2035. The electric and hydrogen stations will be paid for by continuing a vehicle tax that would otherwise expire, forcing Californians to continue paying higher taxes now and in the future, only to be forced to buy more expensive ZEV vehicles down the road.

Transit. Transit ridership was trending downward prior to the pandemic. COVID-19 has had a significant impact on transit ridership, with regional ridership decreases ranging between 50 and 75 percent. Despite transit’s uncertain future, the Governor proposes spending $1.3 billion on transit in the 2021-22 fiscal year.

Small Business Grants. The budget proposes a total of $1.1 billion for the state’s Small Business COVID-19 Relief Grant Program. The total includes $500 million announced in November for the program, and includes a set-aside of $25 million for small cultural institutions, such as art galleries and museums.

Infill Infrastructure and Affordable Housing. The budget proposes $500 million for the state’s Infill Infrastructure Grant (IIG) Program. The Governor estimates this funding would support the development of more than 7,500 affordable homes. Unfortunately, while providing funding for the program may benefit local jurisdictions, it will do nothing to reduce the high cost to build in this state.

Low-Income Housing Tax Credits. The budget proposes $500 million General Fund within the Tax Credit Allocation Committee for the state housing tax credit program, which works in conjunction with two federal tax credit programs to reduce a project’s funding gap.

Federal Rental Assistance. The budget includes $2.6 billion in federal funds for rental assistance, with an expectation that the Legislature will take early action in early 2021 to expedite the distribution of these funds. The state would receive $1.4 billion in a direct allocation and $1.2 billion would be allocated directly to local jurisdictions.

CalCompetes to Allocate Both Tax Credits and Grants. The budget includes $180 million in additional CalCompetes tax credits for 2020-21 and 2021-22, and also includes a new grant program within CalCompetes for budget year, providing an additional $250 million General Fund for this new program that is intended to reward job creation and retention.

Homelessness. The Governor’s budget includes $1.75 billion General Fund for activities intended to address the state’s homelessness crisis, building on programs established in the current year. The proposals include the Department of Housing and Community Development’s Homekey Housing, wrap-around services within the Department of Health Care Services, and protecting vulnerable older populations through the Department of Social Services.

Corrections Pandemic Operations. The Governor’s budget includes about $1.4 billion in new funding for the Department of Corrections and Rehabilitation’s (CDCR) operational costs of dealing with the pandemic. Major costs include $554 million for COVID-19 testing ($379 million for employees, $175 million for inmates); $241 million to continue reimbursing counties while state prison intake remains suspended; and $241 million for medical surge capacity.

First Prison Closure Proposed. SB 118, the 2020-21 public safety budget trailer bill, requires CDCR to identify two state prison facilities as candidates for closure – the first by January 10, 2021 and the second by January 10, 2022. The Governor’s budget includes a proposal to close the Deuel Vocational Institution on September 30, 2021.

Trial Court Operations. In addition to $118 million General Fund to backfill declining revenues to the Trial Court Trust Fund, the budget proposes $72 million General Fund ongoing to help the trial courts maintain access to justice and address pandemic-related challenges.

Cannabis Regulatory Reform. The Governor proposes to create a single Department of Cannabis Control to perform licensing and enforcement over the cannabis industry. This will remove these functions from the Department of Food and Agriculture, Department of Public Health, and the Department of Consumer Affairs. A similar proposal was derailed by COVID-19 last year.

Workforce Development. The budget allocates $25 million, intended for early action by the Legislature, to expand High Road Training Partnership grants—an existing workforce development demonstration project that focuses on upskilling workers.

State Employee Bargaining. The Administration indicated that CalHR would be reopening negotiations with employee organizations to potentially eliminate the compensation reductions taken last year. The 2020 Budget Act reduced state employee compensation by $2.8 billion across the board.

Private Child Care Facilities Unionize and Begin Negotiations with State. The Public Employment Relations Board recently certified the Child Care Providers Union (CCPU) and despite not its members not being state employees, CalHR indicated they will act as the Governor’s bargaining representative and negotiations are set to begin soon. The budget does not assume funding for potentially bargained for increases to child care provider’s wages.

Growing Unemployment Insurance Debt to Federal Government The budget reflects a Unemployment Insurance Federal Trust Fund debt of $21.5 billion by the end of 2020, growing to $48.3 billion in 2021. This surpasses the debt California owed the federal government during the Great Recession. As a result, the budget includes a $555 million General Fund interest payment to the federal government for these loans but provides no alternative plan to paying back the principal debt—absent an alternative plan, the debt will be paid through increased payroll taxes on businesses.

Status-Quo Pension Debt Repayment. The budget allocates $3 billion General Fund in constitutionally-required Proposition 2 debt repayments to reduce pension obligations. It should be noted that despite the $167.2 billion unfunded pension liability and a $91.9 billion unfunded retiree health care liability, the budget does not commit more than what it is required constitutionally.

State “Gann” Spending Limit. The Governor’s budget estimates the state reached the constitutional spending limit (known as the Gann limit) in 2019-20, putting the state close to the trigger (the state must exceed the limit over two years before action is triggered). No action is proposed at this time as the numbers will be updated with the release of the May Revision.