Executive Summary

Continues Long-Term Trend of Spending Growth and Deficits. The 2025-26 budget would spend $228 billion General Fund, a decline of about $5 billion from the updated prior year level. Despite the deficit, the budget would still spend $17 billion General Fund more than the enacted budget for 2024 25. The dominant factors driving spending growth are various expansions in Health and Human Services programs, most notably the recent Medi-Cal expansion to undocumented immigrants. General Fund revenues would drop by about $13 billion in 2025-26 to $209 billion compared to the prior year, but this level would remain $12 billion above the level seen just two years ago in 2023-24.

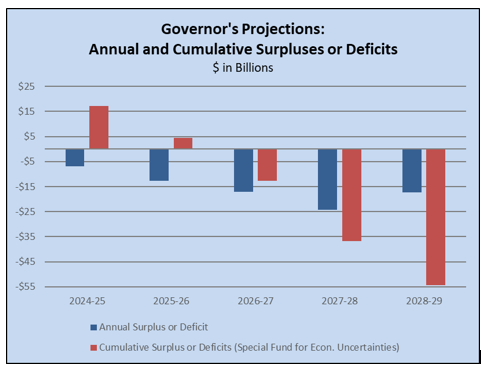

The three future years included in the forecast continue to reflect a long-term growth trend in spending, which would outpace revenues for years into the future. The budget is purportedly balanced in 2025-26, but the majority party has papered over the deficit for one year using largely short-term solutions, including $7 billion in new borrowing. The lack of ongoing spending adjustments puts California on pace to create annual operating deficits ranging from $17 billion to $24 billion over the next several years, as shown in the chart below, even without a decline in revenue or further increase in spending.

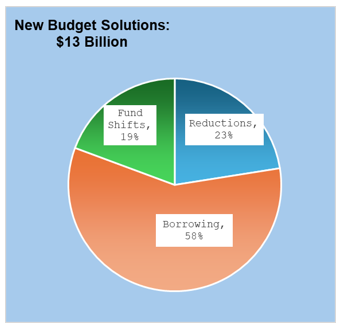

Budget “Solutions” Once Again Short-Term. The new deficit solutions in the enacted budget total nearly $13 billion through 2025-26. Unfortunately for the long-term sustainability of the state budget, over half these solutions are new borrowing, most notably including over $4 billion in loans to the Medi-Cal program. Less than one-fourth of the solutions are characterized as spending reductions. The $13 billion solutions package includes the components summarized in the chart on the next page.

The state also took preemptive actions during the 2024 budget process to address the deficit projected at that time for 2025-26. These actions included $27 billion in budget solutions for 2025-26, including the withdrawal of $7.1 billion from reserves as well as fund shifts, tax increases, and reductions, though some of those solutions have eroded in value.

While Governor Newsom and legislative Democrats have sought to blame the Trump Administration for California’s budget woes, the reality is that massive deficits returned to California beginning in 2023-24, well before the 2024 presidential election. California’s own overspending is the true culprit responsible for the state’s ongoing budget deficits.

Housing and Homelessness

Significant Housing Reforms Could Increase State’s Housing Production. After years of Senate Republicans calling for significant CEQA and housing policy reform, the 2025-26 budget includes a number of policy changes that could move the needle on housing production Environmental organizations and labor unions have weaponized CEQA to achieve their goals, resulting in policies that both delay housing development for years and drive up the cost to build. Two 2025 budget trailer bills include changes that revise CEQA requirements for projects that should result in expedited permitting and approval, reducing the cost to developers and increasing the number of both single and multifamily homes built across the state.

Additional Housing Funding. The budget provides $120 million for the Multi-Family Housing Program, which provides low-interest loans for new construction, rehabilitation, and preservation of rental housing for lower-income households. The budget also provides $300 million General Fund for the California Dream for All program in 2025-26. The program offers shared-mortgage loans to eligible first-time homebuyers for up to 20 percent in down payment or closing cost assistance, not to exceed $150,000, towards the purchase of a new home. Lastly, the budget provides $500 million in supplemental tax credits within the State Housing Tax Credit program, which works in conjunction with two federal tax credit programs to reduce funding gaps within development projects.

Minimal New Funding for Homelessness Programs. The budget provides $100 million General Fund in 2025-26 for the Encampment Resolution Grant Program, but does not include new funding for the Homeless Housing Assistance and Prevention Program (HHAP). Instead, a budget trailer bill would appropriate $500 million General Fund for HHAP in 2026-27, but only if the latest round of funding has been substantially completed.

Health

Medi-Cal Enrollment Freeze for the Undocumented. The enacted budget halts new Medi-Cal enrollments to undocumented adults starting in January 2026. All existing undocumented adults currently on Medi-Cal would remain in the program, and any new undocumented children ages 18 and under may still continue to enroll in Medi-Cal. This action is estimated to save $78 million General Fund in 2025-26 and $3.3 billion annually by 2028-29.

Medi-Cal Premiums, Benefit Cuts for “Unsatisfactory Immigration Status” Adults. The enacted budget imposes a $30 monthly premium for all adults with “unsatisfactory immigration status” (UIS) that remain in the Medi-Cal program, starting in July 2027. The UIS population is larger than just the undocumented population, as it includes legal entry individuals in pursuit of green cards and those in asylum status. The premium proposal provides no budget savings in the 2025-26 fiscal year, but is estimated to result in savings of $250 million in 2027-28 and $675 million annually thereafter.

Steals Proposition 35 Funds from Medi-Cal Providers. In violation of the will of the voters when they approved Proposition 35 in 2024, the Democrats take an additional $1.3 billion in Managed Care Organization (MCO) tax funds in 2025-26 away from funding new Medi-Cal provider rate increases and instead uses it as a General Fund budget solution. This sweeping of Proposition 35 funds could be challenged in court, but if it is maintained, it misses an opportunity to increase the number of providers serving the Medi-Cal population. Without dedicated funding for Medi-Cal provider rate increases, health care access for millions of vulnerable Californians is in jeopardy.

Public Safety

Bare Minimum for Proposition 36 Implementation. The enacted budget provides less than a quarter of the $344 million funding need identified by the various stakeholders that will be critical participants in ensuring the success of the Homelessness, Drug Addiction, and Theft Reduction Act (Proposition 36). This budget essentially ignores the will of the voters, nearly 70 percent of whom voted for Proposition 36 despite the Governor’s vocal opposition to the measure.

Continuing to Soften the Prison Experience. The budget includes $9.4 million in 2025-26 and $13 million annually thereafter to convert the former Death Row housing block at San Quentin to an honor dorm, increase staffing and rehabilitative programming, and forge ahead with implementation of the California Model. The Governor’s signature prison reform plan focuses on trauma-informed programming, normalization of the physical environment, and generally making prison feel less like prison. It seems unlikely these measures will enhance public safety in any measurable way over the long term.

Partial Reversal of Ill-Advised Trial Court Reduction. The budget reverses $42 million of a $97 million unallocated reduction to trial court operations that was included in the 2024 Budget Act. This unallocated reduction would have required courts to re-calendar cases to meet statutory timelines for criminal caseloads, which ultimately would have led to worsening backlogs of civil cases. While the $42 million reversal is an improvement, the trial courts still face a $55 million ongoing reduction, which unfortunately means civil case delays and backlogs are still likely.

Human Trafficking and Child Exploitation Investigations. The budget includes $5 million General Fund and 12 positions ongoing, beginning in 2025-26, for the California Highway Patrol to assist local law enforcement agencies with multi-jurisdictional investigations into human trafficking and the distribution of child sexual abuse material. The budget also includes $7 million General Fund to make $5 million in baseline funding permanent for the Internet Crimes Against Children grant program administered by the Office of Emergency Services and to provide an additional $2 million to enhance the program.

Funding to Litigate Against Federal Administration. The budget provides another $20 million General Fund in 2025-26 for state and local prosecutors to step up their legal battles as the ruling party tries to thwart the policies of the current federal administration. $14.2 million ongoing is for the Attorney General’s efforts, and $6 million is provided on a one-time basis for the Los Angeles and Santa Clara County Counsel’s Offices and the San Francisco City Attorney’s Office.

Tax Policy

Single Sales Factor. The budget requires financial institutions (including banks and savings and loan businesses) to use a mandatory single sales factor tax apportionment beginning with taxable year 2025. The budget includes a revenue increase of $330 million in 2025-26, $280 million in 2026¬ 27, and $260 million in 2027-28 as a result of this tax policy change.

Expands the Hollywood Film Tax Credit. The budget prioritizes the Film and Television Tax credit program, increasing the available tax credits from $330 million to $750 million annually from 2025-26 through 2029-30. The budget assumes a revenue reduction of $15 million in 2025-26, growing to more than $200 million annually.

Wildfire Settlement Income Exclusion. The budget excludes from gross income any settlement amounts received by individuals or businesses for property damaged or destroyed by wildfires between January 1, 2021, and January 1, 2030.

Military Retirement Income. Beginning in tax year 2025 and through tax year 2029, the budget excludes from income for state tax purposes up to $20,000 in military retirement pay or Survivor Benefit Plan annuity payments.

Renters Tax Credit. AB 130, a 2025-26 budget trailer bill, increases the renters tax credit for qualified renters, but the increase would be subject to an annual appropriation in the budget act.

TK-12 Education

Proposition 98 TK-14 Funding. The Proposition 98 Guarantee for 2025-26 is $115 billion, a decline from 2024-25. The budget maintains a Proposition 98 funding level of $99 billion in 2023-24, and the revised 2024-25 Proposition 98 guarantee is calculated at $120 billion. The Proposition 98 Guarantee is funded at $118 billion for 2024-25, about $1.9 billion below the calculated guarantee. According to the Newsom Administration, this is to provide a buffer for changes in the guarantee due to revenue changes before the final calculations are made. If revenues remain the same, this would create a “settle-up obligation” of $1.9 billion that must be repaid in future years. If revenues decline, the obligation would also decline.

Spending per Pupil Continues to Increase. Proposition 98 spending per pupil would be $18,534 in 2025-26 and $25,155 per pupil from all funding sources. This is a Proposition 98 increase of $6,657 per pupil, or 56 percent, compared to six years ago in 2019-20, the year before the pandemic started. When accounting for all funds, it is an increase of $8,141 per pupil, or 48 percent. Despite the dramatic increase in per-pupil funding, the most recent student test scores remain similar to or below those achieved at much lower levels of funding. For example, California students were 33.5 points below the standard in mathematics in 2019 and 47.6 points below the standard in 2024.

Proposition 98 Rainy Day Fund and Local Reserves. The 2025 Budget Act leaves no funding in the Public School System Stabilization Account (school reserve) at the end of 2025-26. This reflects a withdrawal of the entire $455 million balance in 2025-26.

Local Control Funding Formula (LCFF). The budget includes a 2.3 percent cost-of-living adjustment (COLA) for the LCFF. When combined with population growth adjustments, this will result in a $2.1 billion increase in discretionary funds for schools. The budget also provides $174 million ongoing Proposition 98 General Fund for COLA adjustments for the LCFF Equity Multiplier and categorical programs such as Special Education, State Preschool, Youth in Foster Care, Child Nutrition, and the Charter School Facilities Grant Program.

Adds Billions in New Proposition 98 Deferrals. The budget defers $1.9 billion Proposition 98 General Fund from the 2025-26 fiscal year to the 2026-27 fiscal year. Deferrals are a way for the state to make late payments to schools when the state cannot meet its funding obligations. By pushing a portion of payments to schools into the following fiscal year, it allows the state to claim one-time savings.

Universal Transitional Kindergarten (TK) Full Implementation. The budget includes $2.1 billion ongoing Proposition 98 General Fund for the full implementation of universal transitional kindergarten. This total is inclusive of all prior years’ investments. The funding is estimated to provide access for 51,000 additional children, bringing the total TK enrollment to over 228,000. An additional $1.2 billion ongoing Proposition 98 General Fund is provided to support lowering the student-to-adult ratio from 12:1 to 10:1.

Proposition 98 Funding Split Adjusted to Favor TK Over Community Colleges. The budget adopts a new funding split between TK-12 schools and community colleges for the additional Proposition 98 funding as a result of the universal TK expansion. Prior to this budget, the additional Proposition 98 funding for TK was split between community colleges and TK-12 schools following the traditional 11 percent for community colleges and 89 percent for TK-12 schools. This budget shifts the full amount of the TK Proposition 98 expansion to the TK-12 side of the budget in 2025-26 and ongoing. This results in $233 million in ongoing Proposition 98 going from community colleges to TK-12 schools.

Higher Education

Operations Cuts Switched to Deferrals and Cash Loans for University Systems. The Governor’s May Revision proposed to cut the budgets for the University of California and California State University on an ongoing basis by 3 percent. Senate Republicans argued against these cuts to higher education. The final enacted budget instead reduces the systems’ budgets by 3 percent but refers to these cuts as base deferrals from 2025-26 to 2026-27, intending to restore them next year. The budget also authorizes a no-interest loans for the systems in 2025-26. With the overall budget forecast showing a deficit of $17 billion for 2026-27, the state’s claim that it will provide the funds that year lacks credibility.

Sonoma State Bailout. The CSU’s Sonoma campus has experienced a dramatic decline in enrollment in recent years, leading that campus to discontinue some majors and sports programs. The enacted budget provides $45 million in one-time General Fund to Sonoma State University to support a long-term turnaround plan focused on student recruitment, academic expansion, and athletic program support.

Community College Funding Increases. Community colleges will receive a cost-of-living-adjustment as well as increases to the Student-Centered Funding Formula, consistent with Proposition 98 treatment for TK-12. In addition, the budget provides various discretionary program increases, such as $15 million in one-time Proposition 98 for Dreamer Resource Liaisons.

Certainty to Middle Class Scholarship Recipients, Uncertainty in State Spending. The enacted budget maintains funding for Middle Class Scholarships at the level seen 2024-25, rather than cutting funding by over $500 million as the Governor proposed. However, the budget will pay the entire $918 million cost for 2025-26 from the 2026-27 budget, claiming to fund the program on a cash flow basis. This should provide students with a stable grant level, but the use of cash flow loans for this purpose may create complications in future budgets.

Child Care and Early Education

“Cost-of-Care Plus” Rate Increases. The 2025 Budget Act provides $802 million (General Fund and Proposition 98 General Fund) to continue to provide so-called “Cost-of-Care Plus” payments. While the annual statutory cost-of-living adjustment (COLA) is suspended for the 2025-26 fiscal year, the budget redistributes the funding that was intended for the COLA as an addition to the monthly Cost–of-Care Plus rates for the 2025-26 fiscal year. This redistributes about $89 million (General Fund and Proposition 98 General Fund) across child care and preschool programs.

"Hold Harmless" Reimbursement Extension. The budget includes $89 million General Fund to extend the pandemic-era "hold harmless" policies through June 30, 2026 for child care and preschool reimbursement. The hold harmless policies give providers that directly contract with the state 100 percent of their maximum reimbursable contract amount or the actual reimbursable program costs, whichever is less. This means that providers are getting paid for empty slots. The pandemic-era hold harmless policy originally intended to keep providers open during the pandemic shut-down, but it makes no sense now and is overdue for expiration.

New Bargaining Agreement and Alternative Rates Still Pending. The Newsom Administration is still in negotiations with Child Care Providers United on a new bargaining agreement. The current bargaining agreement expired on June 30, 2025. While no potential cost estimates have been provided for the new agreement, the prior bargaining agreement resulted in costs exceeding $2 billion over two fiscal years. Complicating the situation, the focus of the new bargaining agreement will likely be centered on the implementation of an alternative methodology to set child care reimbursement rates, which could result in new spending in the range of tens of billions of dollars annually.

Human Services

Public Safety Could Be Compromised by Squeezing Funds for Juvenile Justice Facilities. The Democrats’ budget alters the formula that allocates $209 million in annual funding to county probation departments for the operations of juvenile justice facilities, also known as the Juvenile Justice Realignment Block Grant (JJRBG), beginning in 2026-27. Under the new formula, the courts will have no choice but to send these youth (convicted of murder and rape) to less secure residential settings. Conditioning JJRBG on less restrictive programs in an attempt to manipulate judicial decisions is not appropriate or in the best interest of public safety.

“Reimagine” CalWORKs Changes. The budget continues the trajectory of the past decade with more reductions to accountability in the CalWORKs program, raising questions about whether or not the program still aligns with the original intent to help people become self-sufficient. The major changes to the CalWORKs program included in the budget are allowing verbal or written curing of sanctions, further expanding welfare-to-work activities, and making Job Club/Job Search optional. These changes result in a net General Fund savings of $17 million in 2025-26 and ongoing. There are additional savings of $4.6 million in 2025-26 and $14 million in 2026-27 and ongoing, with all of those savings remaining in the CalWORKs single allocation.

Increases the Potential Costs for California's Future Share of the CalFresh Program. The budget includes $200,000 General Fund to develop a strategic plan to maximize benefits to those eligible for CalFresh, which is currently entirely federally funded. However, the recent budget reconciliation bill adopted by the federal government would shift a portion of CalFresh benefit costs to the states beginning in 2028 if the state has a payment error rate over 6 percent. For California, that share of cost could be $650 million to $2 billion General Fund annually that would be needed in future years.

In-Home Supportive Services - Community First Choice Option Late Penalties on Counties. For the 2025-26 fiscal year, the budget would require the state and county to each pay 50 percent of the enhanced federal financial participation lost due to noncompliance of timely case reassessments for the In-Home Supportive Services (IHSS) Community First Choice Option (CFCO) program. This results in a General Fund reduction of $41 million. Beginning July 1, 2026, counties would be required to pay 100 percent of any reassessment late penalties.

Provides Funding for Californians at Risk of Homelessness. The budget provides a cumulative $210 million General Fund in one-time housing and homelessness investments meant to serve those at risk of or experiencing homelessness. The funding is provided across the Bringing Families Home, Home Safe, and Housing and Disability Advocacy Programs, and is available for encumbrance or expenditure until June 30, 2028.

Developmental Services

$75 million Cut to Disabled Service Providers. Current law states that until June 30, 2026, DDS will implement a hold-harmless policy for developmentally disabled service providers whose current reimbursement rates happen to exceed the recommended rates modeled in the 2019 rate study. Once the hold-harmless period ends, rates will be adjusted downward for these providers to align with the rate models for other providers within the same service category and region. This budget accelerates that timeline by four months, to February 28, 2026, in order to deny $75 million in funds to these providers. This hit not only disrupts the plans of these businesses, but it removes needed funding from the system that could have been used to provide services to the intellectually and developmentally disabled (I/DD) community.

Ongoing Cut to the Self Determination Program. The Self-Determination Program at DDS, created by a Senate Republican author in 2013, is an alternative way for individuals and families to have flexibility, control, and responsibility in managing their own services and supports. The enacted budget still curtails some client autonomy by making these individuals and families go through more bureaucratic hoops to obtain necessary services, resulting in cuts of $22.5 million in 2025-26 and $45 million annually thereafter. Rather than reinvesting these savings back into the program, the budget siphons these funds off for other General Fund priorities.

Environment and Natural Resources

Cap-and-Invest Extension Remains a Risk. Over $3 billion a year for High-Speed Rail, CAL FIRE, and other priorities depends on a new Cap-and-Trade plan, now to be known as Cap-and-Invest, which the Legislature still hasn’t enacted. Discussions will continue over the summer on a potential plan to extend Cap-and-Invest past its 2030 sunset date.

Water Reliability Funding Reverted. The budget reverts $51 million for water recycling, $47 million for dam safety, and $15 million for flood projects—putting drought response and water reliability at risk. Delaying these investments contradicts repeated claims of prioritizing infrastructure.

Wildfire Preparedness Hinges on Auctions. More than $1 billion for CAL FIRE now rides on unpredictable Cap-and-Trade auction revenues. This is a risky approach that leaves rural communities and property at greater risk due to volatile auction revenues.

Environmental Review Streamlined—Finally Addressing Regulatory Gridlock. Streamlining for the Delta Conveyance and wildfire mitigation reflects Republican-led calls to rein in CEQA abuse and bureaucratic delays. This is a necessary shift, even if legal challenges from opponents continue.

Labor and Employment

Interest Payment for Unemployment Debt. The Governor’s budget includes $643 million (General Fund) for the annual interest payment on the state’s $21 billion Unemployment Insurance loan from the federal government. These interest payments and the increased tax burden on California businesses would have been avoided if the Governor had used past surplus funds to pay off the federal loan.

Borrowing to Subsidize State Spending. As a deficit solution, the budget includes a loan of $400 million from the Labor and Workforce Development Fund to the General Fund, thus using one time loan funds to continue excessive ongoing state spending.

General Government

Los Angeles County Emergency General Fund Loan Authority. The budget includes authority for the Director of Finance to make up to $1 billion in General Fund loans to local government entities that have significant responsibilities for recovery from the January 2025 wildfires in Los Angeles County.

Agency Reorganization Creates New Duplication but Fails to Consolidate Homelessness Programs. The budget provides $4 million General Fund in 2025-26, and $6 million General Fund ongoing to split the current Business, Consumer Services, and Housing Agency into two distinct Agency bureaucracies: the California Consumer Protection Agency and the Housing and Homelessness Agency.

Tens of Millions in Wasteful Spending Provided in Budget. The budget includes $75 million in unnecessary General Fund spending for programs that will not enhance affordability, provide greater public safety, or improve educational outcomes for Californians. Notable expenditures include $20 million to hire an outside consultant to do the work of the Newsom Administration, $10 million to bail out the journalism industry, and $5 million to determine if Californians are happy.

National Semiconductor Technology Center's Design and Collaboration Facility. The budget provides $25 million General Fund to support capital expenditures incurred during the construction of the National Semiconductor Technology Center’s Design and Collaboration Facility.

California Hope, Opportunity, Perseverance, and Empowerment (HOPE) for Children. The budget claws back $40 million General Fund from the HOPE for Children Trust Account Fund to the General Fund in 2025-26, leaving a balance of $90 million after the transfer.

Expands the Governor’s College Corp Volunteer Program. The budget provides $68 million in 2025-26 and $84 million ongoing thereafter to permanently establish the College Corp Program within the Governor’s Office of Service and Community Engagement.

Transportation

Short-Term Olympic VIP Lanes Receive Funds. The budget includes up to $38 million to the California Department of Transportation to create a network of exclusive lanes to transport executives, athletes, and other people associated with the 2028 Olympic and Paralympic Games in Los Angeles.

Continues to Bail Out Local Transit with General Fund. The budget continues the misguided policy of bailing out local transit agencies, despite the lack of sufficient demand for services or necessary operating efficiencies to make many of those systems viable. This budget provides $812 million General Fund for transit entities. Additionally, the budget authorizes loans of up to $750 million for various Bay Area transit agencies.

Gas Taxes Increase Again. Despite claims to prioritize affordability for Californians, the Governor proposes no changes to existing law, continuing the automatic annual tax increases to gasoline and diesel fuel. Gasoline taxes increased on July 1, 2025, by 1.6 cents per gallon (cpg), to 61.2 cpg, and diesel fuel taxes increased by 1.2 cpg, to 46.6 cpg.

Federal High-Speed Rail Funds Terminated. After review, federal government terminates $4 billion in federal funds, as California continues waste money on increasingly out-of-reach High-Speed Rail project, with $980 million budgeted for 2025-26.

Misguided Proposal for Cap-and-Trade Funds. Still pending is the Governor’s proposal to allocate at least $1 billion annually to the high-speed rail project from Cap-and-Trade revenues. The Legislature plans to consider the reauthorization of the Cap-and-Trade program and funding allocations, including this proposal, later this year. The proposal to change the funding methodology is an effort to allow the Authority to sell bonds with future revenues as collateral.