Overall Budget

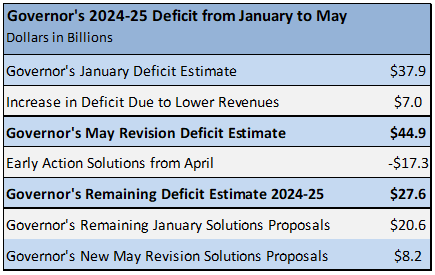

Governor’s Estimate of Deficit Grows to $45 Billion. The May Revision now estimates the budget deficit will reach $45 billion for the upcoming budget year. This is an increase of $7 billion (18 percent) compared to the Governor’s characterization of the deficit as $38 billion in his January budget. The increase is largely due to a reduction of $10 billion in tax revenues compared to the January estimates, partially offset by lower spending obligations. After removing $17 billion to reflect “early action” budget solutions that the Legislature enacted in April, the Governor describes the remaining budget deficit as nearly $28 billion, as summarized in the table below. The Governor then proposes additional solutions of $8 billion on top of the remaining January proposals to address the deficit.

Governor’s Deficit Differs from Nonpartisan Estimate. The Governor’s January deficit estimate of $38 billion was markedly lower than the $68 billion projection offered by the nonpartisan Legislative Analyst’s Office (LAO) at that time. Since January, the LAO updated its deficit estimate to $73 billion, following weaker-than-expected tax revenue receipts in December and January. The primary differences between the Governor’s new estimate of $45 billion and the LAO’s $73 billion are that (1) the Governor assumes revenues would be $13 billion higher than the LAO, and (2) the Governor preemptively removes some proposed savings from the deficit total, even though those savings are not part of the budget “baseline.” These include a $9 billion Proposition 98 education borrowing scheme, which the LAO has sharply criticized, as well as $2 billion in state costs that would result from implementation of SB 525 (Durazo), the 2023 health care minimum wage bill. Thus, the Governor artificially reduces the size of the deficit. The LAO is expected to update its estimate of the deficit for the May Revision by May 17th.

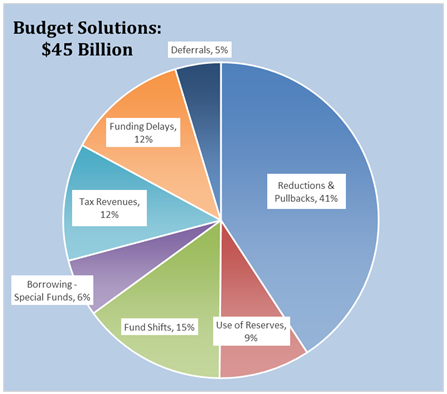

Budget Solutions Mix Improves But Still Largely Short-Term. The combined January and May Revision budget solution proposals total nearly $45 billion, including $8.2 billion in additional solutions at the May Revision. Overall, the mix of solutions has improved since January, though more than half are still one-time or short-term. About 41 percent of the solutions are characterized as spending reductions, though some of these are recoveries of previously approved funds that went unspent for various reasons and would have been recovered anyway. The $45 billion solutions package includes the components summarized in the chart below.

May Revision Solutions Total $8 Billion. The May Revision includes a net of $8 billion in new or revised budget solutions, which are included in the chart above. Total new solutions amount to about $17 billion, but these would be partially offset by a delay in proposed use of reserves. Major components of these are the following:

- Spending reductions of nearly $11 billion, including $2.2 billion in reductions to state operations, $510 million to Middle Class Scholarships, and $550 million to Preschool and Transitional Kindergarten facilities grants.

- Tax revenue increases of $1.4 billion, including $900 million from a suspension of the Net Operating Loss (NOL) corporate tax ($5.5 billion in 2025-26) and an increase of $690 million from the Managed Care Organization (MCO) tax.

- Increased borrowing of $1.6 billion, including $607 million from state special funds and $450 million in new lease-revenue bonds for the Capitol Annex. Note that the Governor classified the new bonds as a “fund shift” rather than borrowing, even though bonds, by definition, are loans.

- Shifting $3.4 billion in costs from the General Fund to other state funds, including $375 million in child care costs to cannabis funds and federal funds.

- A delay of $8.9 billion in Rainy Day reserve usage from 2024-25 to 2025-26. This improves the deficit situation in 2025-26, and is offset by other solutions for 2024-25.

“Early Action” Items Reflected in May Revision. The Governor’s deficit removes $17 billion from the deficit projection, based on “early actions” the state took in April. At that time the state passed AB 106 (Gabriel), a “budget bill junior” that authorized $1.6 billion in solutions for 2023-24 and prior years. That bill also declared the legislature’s intent to pass additional solutions later on that will total $17 billion toward addressing the deficit in 2024-25. Most of those solutions consist of one-time actions such as borrowing, spending delays, and fund shifts, while only 21 percent consist of spending reductions.

Reserve Use Partly Delayed. The May Revision would withdraw $4.2 billion from General Fund reserves in 2024-25, delaying use of $8.9 billion from the Rainy Day Fund until 2025-26. The state's remaining reserve balances at the end of 2024-25 would total nearly $23 billion and include a Rainy Day Fund balance of $19 billion and a discretionary reserve of $3.4 billion (Special Fund for Economic Uncertainty). The May Revision would use all of the public school reserve of $2.6 billion.

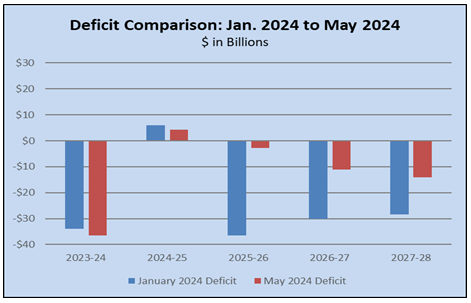

Long-Term Deficit Outlook Improves from January. The May Revision includes $28 billion in solutions proposed to improve fiscal balance in 2025-26. In part these proposals reflect the conversion of some delays and deferrals to ongoing reductions. These proposals, combined with an increase in future year revenue projections, lead to the Governor’s improved long-term outlook. Unfortunately, the Governor’s multiyear forecast still indicates that spending will exceed revenues every year through at least 2027‑28, thus creating operating deficits in each of those years. In January, the Governor’s forecast showed annual deficits averaging more than $30 billion per year, but the 2025-26 deficit would now be $3 billion, with deficits of $11 billion and $14 billion the following two years, respectively. The chart below compares the May deficit estimates with the January estimates.

Tax Policy

Net Operating Loss Suspension and Limiting Business Tax Credits. The May Revision proposes temporarily suspending the use of net operating loss (NOL) deductions for taxpayers with business income in excess of $1 million (mostly medium to large businesses) for tax years 2025, 2026, and 2027. The May Revision also proposes to limit the use of business incentive tax credits, including research and development credits, to offset no more than $5 million in tax liability for tax years 2025, 2026, and 2027. This proposal would exempt low-income housing and Pass-Through Entity Elective tax credits from the $5 million tax cap. The Governor also proposes a “trigger” to restore current tax law if sufficient revenues are available in 2025-26, and would also extend the carryover periods for both the NOLs and the credits by three years. The NOL suspension and tax credit limitation proposals are projected to result in additional state revenue of $900 million in 2024-25, $5.5 billion in 2025-26, and $5.9 billion in 2026-27.

Health

Governor Breaks Promise to Medi-Cal Providers by Raiding the Managed Care Organization (MCO) Tax Funds. The Governor proposes to not enact the previously agreed-upon Medi-Cal provider reimbursement rate increases scheduled to go into effect on January 1, 2025, and instead reroutes $6.7 billion of the planned MCO tax proceeds away from provider rates and towards multi-year General Fund budget relief. This is a major reversal of the carefully crafted deal with Medi-Cal providers in 2023 and violates the trust of legislators who voted for the tax in AB 119 (2023). But the real victims are the 13 million Californians enrolled in Medi-Cal who will experience further declines in healthcare access as many Medi-Cal providers completely close or stop serving Medi-Cal enrollees altogether.

Yet Another MCO Tax Bill Coming. Adding to our dependency on Washington DC, the Governor is proposing yet another MCO tax trailer bill in order to generate more federal funds to balance the budget. This time the bill will expand the existing tax to include calculations using health plan Medicare revenues. This will produce $690 million in additional General Fund relief in 2024-25 and an additional $2.3 billion in later years. Sadly, none of this additional funding will be dedicated to Medi-Cal provider rate increases.

Governor Continues to Hide Impact of Healthcare Minimum Wage Bill. In January, the Governor asked the Legislature for immediate action to add “trigger language” to the 2023 health care minimum wage hike bill (SB 525) in order to reduce the potential costs of the bill to Medi-Cal, unofficially estimated by the administration at $2 billion annually. Despite that immediate action request, no proposed language to add a trigger has been circulated, and the Legislature did not enact any such bill. Furthermore, the Governor never provided an official savings estimate for adding this trigger language. Now in the May Revision, the Governor is still not accounting for these wage increases into the state budget. This means that either the state budget deficit is actually billions higher than the Governor is admitting, or the Governor is happy saddling health care providers like hospitals and clinics with the full burden of these wage hikes.

Proposed Cuts to Local Public Health, Healthcare Workforce Grants, and Behavioral Health Programs. The Governor proposes eliminations to various health care programs to generate General Fund savings. These include health care workforce incentive programs ($301 million in savings), school-based behavioral health services ($426 million in one-time savings), behavioral health infrastructure ($451 million in one-time savings), behavioral health-focused temporary housing ($133 million in savings), and funding for county public health departments ($53 million in savings). While most of these programs have merit on their own, their adoption during the surplus budgets of 2021 and 2022 was unsustainable.

K-12 Education

Proposition 98 and Local Control Funding. At May Revision, the Proposition 98 guarantee is estimated to be $109 billion for the 2024-25 Budget Year, nearly identical to the Governor’s January Budget. The revised 2023-24 Proposition 98 Guarantee is nearly $103 billion, a decrease of about $3 billion from the January budget. The 2022-23 Proposition 98 guarantee is down an additional $800 million for a total decrease of $8.8 billion that year. The total revised guarantee for the 2022-23 is about $97.5 billion. The January budget included a 0.76 percent cost-of-living (COLA) adjustment for the LCFF, and the May Revise increases this COLA to 1.07 percent.

School Facility Funding Cuts. The Governor’s May Revision furthers school facility cuts by eliminating the remaining $375 million one-time General Fund for the School Facilities Program in 2024-25. The early action package also included a cut of $500 million for this program, for a total proposed cut of the full $875 million. Additionally, the May Revision cuts $550 million General Fund for the California Preschool, Transitional Kindergarten and Full-Day Kindergarten Facilities Grant Program (FDK Program). The Governor’s January budget originally proposed to delay this funding from 2024-25 to 2025-26.

Reduces the Golden State Teacher Grant Program. The May Revision proposes to reduce the Golden State Teacher Grant Program by about $60 million one-time General Fund, leaving $50 million in one-time funding for the program.

Cuts Future Funding for Disabled Preschool Students. The Governor’s May Revision proposes to eliminate approximately $48 million in 2025-26 and $98 million ongoing beginning in 2026-27 for costs related to increasing the number of students with disabilities served in the California State Preschool Program (CSPP). Currently providers are required to serve at least 5 percent of students with disabilities; this funding would have increased that requirement to 10 percent by 2026-27.

Higher Education

Slashed Scholarship Funding. The May Revision reduces funding to the Middle Class Scholarship Program by $510 million ongoing General Fund. The goal of making higher education more affordable would become unrealistic with this cut, resulting in a reduction in funding for financial aid programs, while the Governor would continue to expand spending in other areas of the budget.

Housing and Homelessness

Homeless Housing, Assistance and Prevention (HHAP) Grant Program. The May Revision would eliminate $260 million in supplemental grant funds for HHAP in 2025-26. The 2023-24 Budget Act included $1 billion for the HHAP program, and the Governor continues to propose the use of the $1 billion for local entities between the 2023-24 and 2024-25 budget years.

Multifamily Housing Program. The Governor’s January budget proposed a reduction of $250 million for the Multifamily Housing Program, and the May Revision would increase the proposed reduction to $325 million, which was originally provided as part of the 2023 Budget Act.

Adaptive Reuse Program. The May Revision would eliminate all funding for the Adaptive Reuse Program, resulting in savings of $127.5 million in 2023-24.

Foreclosure Intervention Housing Prevention Program. The May Revision proposes to eliminate the Foreclosure Intervention Housing Preservation Program, resulting in total savings of $474 million General Fund in 2023-24. The January Budget proposed a $237.5 million reduction for the program.

Natural Resources and Environment

Cap and Trade Fund Shifts. The May Revision proposes redirecting $1.7 billion in 2024-25 from the General Fund to the Greenhouse Gas Reduction Fund to bolster climate initiatives. This proposal would also channel an additional $3.6 billion from the General Fund over five years into transit, clean energy, zero-emission vehicles, and nature-based solutions, leaving the existing programs within the Cap and Trade Program with fewer resources to address other critical priorities.

Water Storage Cuts. General Fund commitments previously allocated for critical water storage projects would be reduced by $500 million one-time in 2025-26. Details on how this reduction would affect current projects, which aimed to provide the state’s crumbling water infrastructure with much-needed upgrades, is unclear. This reduction in funding for water storage facilities ignores California's ongoing need for increased water resilience.

Air Pollution Control Fund Loan. The May Revision continues to raid special funds supported by fees imposed on hardworking Californians by proposing a $300 million loan from the Air Pollution Control Fund to the General Fund. While this loan may help improve the state’s economic outlook overall, it's a short-term fix that could impede the state's air quality improvement initiatives—which would be an affront to hardworking families struggling to afford California’s high cost of living.

Vulnerable Community Toxic Cleanup Reduction. The Governor proposes a significant funding reduction ($136 million in 2023-24 and $268 million over four years) for the Department of Toxic Substances Control’s Cleanup in Vulnerable Communities Initiative Program. Despite maintaining $65 million ($107 million over three years) from a shift to the Greenhouse Gas Reduction Fund, the reduction undermines efforts to clean up hazardous sites in disadvantaged areas.

Outdoor Equity Grants and Habitat Conservation Fund Cuts. Other significant revisions to address the budget problem include 1) cutting $50 million from outdoor education and access programs, and 2) moving up the 2030 sunset date for the Habitat Conservation Fund to 2024-25. Accelerating the sunset date would lead to a $45 million one-time reversion to the General Fund, and a 20 million ongoing reduction. These cuts limit underserved communities' access to outdoor spaces and weaken habitat preservation efforts.

Energy and Utilities

Clean Energy Reliable Investment Plan. In addition to the early action, which shifted $100 million from 2024-25 to future years, the May Revision shifts $900 million of the cost for this program from the General Fund to the Greenhouse Gas Reduction Fund (cap and trade revenues). Notably, the entire $1 billion planned for this program is retained.

Middle Mile Broadband Initiative (MMBI). The May Revision would modify the Governor’s January budget request, which included $250 million in 2024-25 and $1.25 billion in 2025-26, and instead proposes to eliminate the funding entirely. In lieu of funding, the May Revision proposes provisional language to allow the Director of Finance to augment the MMBI budget by up to $1.5 billion upon notification of the Legislature. The MMBI previously received $3.9 billion for the project, to be spent over multiple years, and the May Revision would continue that level of funding.

>strong>Broadband Grant Programs. An early action reduced the Broadband Loan Loss Reserve by $150 million and delayed $100 million in Last-Mile Broadband funding from 2024-25 to 2026-27. The May Revision reduces the Loan Loss Reserve by an additional $500 million and delays an additional $200 million in Last-Mile Broadband funding from 2025-26 to 2027‑28. As a result of these actions and proposals, the Last-Mile Broadband funding remains whole at $2 billion over the long term while the Loan Loss Reserve would be reduced from $750 million to $100 million.

Transportation

Transit Bailout Maintained. An early action delayed $1 billion General Fund for local transit agencies from 2024-25 to 2025-26, leaving $2 billion in the current year, $1 billion in 2024-25, and $1 billion in 2025-26. The May Revision proposes to shift an additional $555 million of the remaining General Fund to instead be funded by Greenhouse Gas Reduction Fund (cap and trade revenues), for a total of $817 million funded by cap and trade revenues rather than General Fund, as originally planned. Notably, these changes still result in the full $4 billion maintained for the transit bailout via the formula Transit and Intercity Rail Capital Program.

Competitive Transit and Intercity Rail Capital Program Reduced. The May Revision reduces this program by $125 million over several years and maintains a proposed shift of $530 million from the General Fund to the Greenhouse Gas Reduction Fund (cap and trade revenues). However, the program maintains overall funding of $3.5 billion.

Safety Grade Separations. The May Revision reduces funding for safety grade separation projects by $350 million in 2025-26.

Active Transportation Program Reduced. The May Revision reduces funding for projects to support active transportation, like walking and biking, by $300 million in 2025-26 and $99 million in 2026-27.

Public Safety and the Judiciary

Reductions to State Operations – Trial Courts and Department of Justice (DOJ). As part of a statewide, all-departments strategy to reduce state operations spending by 7.95 percent, the May Revision includes proposed unallocated reductions of $97 million ongoing for Trial Court Operations and $15 million ongoing for the DOJ ($10 million for the Division of Law Enforcement and $5 million for the Division of Legal Services).

Department of Corrections and Rehabilitation (CDCR). The May Revision includes General Fund solutions for CDCR totaling $101 million in 2024-25 and $112 million annually thereafter. The majority of savings ($81 million annually) are from the proposed deactivation of 46 housing units across 13 prisons, encompassing about 4,600 beds. Given recent declining inmate population trends and the administration’s projection of continued declines in the near future, deactivating housing units is appropriate, although the administration has not yet provided any detail on which housing units would close. In light of recent increases in crime, closing housing units would be preferable to closing entire prisons, which would be much harder to bring back online if increasing crime were to result in a reversal of declining prison population trends.

In addition to the proposed housing unit closures, the remaining CDCR solutions include reducing mandatory annual Correctional Officer training hours from 48 to 40 ($14 million savings in 2024-25, $23 million ongoing), cancelling a fire suppression service contract with Los Angeles County ($2 million savings in 2024-25, $5 million ongoing), and reducing the weekly number of visitation days at Level IV prisons from three to two ($4 million savings annually).

General Government

State Operations Savings. The May Revision proposes to reduce nearly all departments’ operating budget by 7.95 percent beginning in 2024-25, including personnel, operating costs, and contracting. Details on how departments would implement these savings remain to be determined by the Department of Finance. The proposal would generate savings of $2.2 billion in 2024-25 and $2.7 billion annually. The May Revision would also make permanent a previous proposal to eliminate vacant positions from state departments, yielding estimated savings of $763 million annually.

Capitol Annex Project. The May Revision shifts funding for the Capitol Annex project from the State Project Infrastructure Fund to the General Fund, and then proposes statutory changes that would authorize the use of lease revenue bond funds for the project, resulting in savings of $450 million General Fund in 2024-25 and $250 million General Fund in 2025-26.

CalCompetes Grant Program. The May Revision pulls back the Governor’s January budget proposal to provide $60 million for the CalCompetes Grant program in 2024-25.

Labor and Employment

Unemployment Insurance (UI) Debt Interest Payment. The state is responsible for interest due on money borrowed from the federal government for UI benefit payments. The outstanding loan is currently $19.2 billion. The annual interest payment for 2024-25 is estimated at $333 million. As an early action, $100 million of the interest payment was shifted from General Fund to the Employment Training Fund. The May Revision proposes to use an additional $50 million from the Employment Training Fund for the interest payment in 2025-26.

Human Services

Pauses the Child Care Slot Expansion. The Governor’s May Revision pauses the child care slot expansion plan at current slot levels, saving $489 million in 2024-25 and $951 million in 2025-26 (multiple funding sources).

Foster Care Rate Reform Trigger. The May Revision proposes statutory language to make the proposed foster care rate structure implementation subject to the availability of General Fund in the spring of 2026. The cost of the rate structure, at full implementation, is estimated to be approximately $1 billion total funds ($896 million General Fund).

Delays and Reduces Benefits Expansions for Undocumented Immigrants. The Governor’s May Revision eliminates the In-Home Supportive Services (IHSS) undocumented expansion coverage for all ages, for a reduction of about $95 million General Fund ongoing. Additional details are needed on this proposal to fully understand which populations are impacted. The May Revision also delays the planned automation for the expansion of the California Food Assistance Program by two years. This would result in about $31 million in savings in 2024-25 and $115 million in 2025-26. Automation would begin in 2026-27, and benefits would roll out in 2027-28.

Reduces CalWORKs Supportive Services. The Governor’s May Revision reduces CalWORKs supportive services by about $174 million ongoing General Fund. These reductions are for the Home Visiting Program and Mental Health and Substance Abuse Services.