Read Entire Analysis (pdf)

Executive Summary

Overview: Deficits and Missed Opportunities. It’s no secret that California is becoming increasingly unaffordable for many of its residents, as costs for housing, energy, and gasoline are at or near national highs. Many Californians are not sharing in the current prosperity of those in a few coastal communities like Silicon Valley. Senate Republicans believe that if the state is smart about managing its budget, we can keep moving forward by prioritizing the things that matter to Californians: good schools, safe communities, and a more affordable quality of life in California.

The 2017-18 budget misses opportunities through misplaced priorities and too few efforts to make California more affordable, such as addressing the high cost of housing. The state remains in the unfortunate position of facing recurring deficits, despite receiving record-high tax revenues, as a result of unrelenting spending growth. As a result, the budget reflects $3.5 billion in savings actions over two years in order to avoid a deficit in 2017-18.

Revenues Reach New Record. The budget reflects total General Fund revenues and transfers of $127.7 billion for 2017-18, an increase of $6.1 billion (5 percent) from the previous year, to set another record high. Compared to expectations one year ago, revenues are projected to be lower, but despite this softening outlook, significant annual increases ranging from 3.1 percent to 3.7 percent per year are still projected through 2020-21.

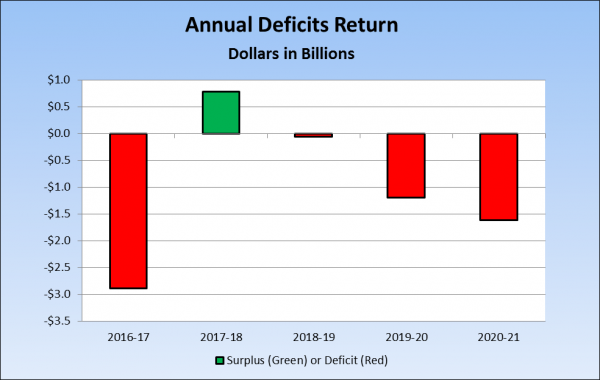

Spending Growth Creates Deficits. Total General Fund spending would reach a record $125 billion in 2017-18, an increase of $3.7 billion compared to the prior year. Although Senate Republicans cautioned against spending beyond our means, billions of dollars in long-term spending commitments made by Sacramento Democrats over the past several years have returned California to a deficit situation in 2016-17. Additionally, although the 2017-18 budget shows a modest surplus, the following year would see a slight operating deficit, and annual operating deficits in excess of $1 billion would return by 2019-20, as shown in the chart below.

Solutions Package Offers Temporary Savings. The budget includes $2.8 billion in spending solutions to address the deficit, most of which are one-time in nature and do not address spending growth going forward. However, the Governor’s “official” list of solutions excludes major savings actions such as a “bait and switch” on voters to redirect over $711 million in Proposition 56 tobacco tax revenues to plug the budget hole rather than increase access to care through Medi-Cal and Denti-Cal. On a positive note, the budget does reject the Governor’s ill-advised January proposals to freeze the child care expansion and to reduce middle-class scholarships.

Rainy Day Reserve Improved Though Likely Not Enough. The Rainy Day Fund (Proposition 2 of 2014) would grow to reach $8.5 billion by the end of 2017-18, or 6.6 percent of General Fund revenue. When combined with the discretionary reserve of $1.4 billion, the total reserve would reach $9.9 billion, or 8 percent of General Fund revenue. However, this is insufficient compared to the potential $20 billion shortfall a recession could bring.

Reversing Questionable Changes to State Spending Limit. In January the Governor proposed a significant technical change to a constitutional spending limit known as the “Gann limit” that would have provided California’s budget with more room to increase spending. After Senate Republicans raised significant concerns about the legality of this proposed change, the Governor reversed course and agreed to continue using the previously accepted method for the 2017 Budget Act.

Democrats Abuse the Budget Process to Protect Their Own. The 2017-18 budget package continues to demonstrate Senate Democrats’ willingness to abuse the special budget rules to force through non-budget policies. Most notably, this includes changes that lengthen the state’s recall process by five months, apply those changes retroactively, and make it more difficult to qualify a recall, all to benefit a current senator now facing a potential recall. Also, the budget imposes changes that seek to expand the influence of public employee unions throughout the state, such as forcing public employees’ private emails to be shared with public employee unions.

Proposition 98 Education Spending Sets New Record. Proposition 98 funding for K-14 education grows by over $5.4 billion over three years, reaching a record $74.5 billion in 2017‑18. Senate Republicans applaud the increase in local control provided through progress on the Local Control Funding Formula. Unfortunately, the budget does nothing to forestall the previously planned reductions to career technical education funding, and anticipated sales of K-12 school facilities bonds (which are off-budget) remain insufficient to meet facility needs.

Higher Education: Tuition Hikes, Audits, and Budget Choices. In response to recent State Auditor criticism, the budget plan holds $50 million in University of California (UC) funding back until UC acts on the audit’s recommendations and various other issues. It accepts UC and the California State University’s recent actions to raise tuition by 2.5 percent and 5 percent respectively. The UC certainly could improve transparency and cut waste prior to raising tuition, but Sacramento Democrats have created substantial pressure on UC finances over the past decade by providing only $286 million more General Fund compared to 2007-08, a mere 9 percent increase, while dramatically raising spending by billions of dollars in other areas of the budget.

Revised Shift of In-Home Supportive Services (IHSS) Costs. The 2017-18 budget reduces the shift of IHSS costs to counties substantially compared to the Governor’s January proposal, and would leave counties with a net cost of $141 million in 2017-18. However, it remains a cynical strategy for the state to ramp up costs in the program following the beginning of the Coordinated Care Initiative in 2012, and then seek to hand the higher-cost program back to counties.

Costs of “Resisting” the Federal Government Mount. The budget includes over $50 million General Fund for the Attorney General and for community grants to continue efforts to “resist” recent federal policy changes. The funding will pay for state legal staff to challenge the constitutionality of executive actions and will provide grants to private agencies to defend people in the country illegally, including some who commit violent crimes. This amounts to little more than political grandstanding, and using taxpayer dollars in such a manner shows disdain for the hard-working Californians who are forced to pay the bills.

Significant Transportation Spending Skips Roads. The budget includes increased spending of $2.8 billion generated from the new gas, diesel, and vehicle taxes. Of this $2.8 billion, $873 million would be spent on programs that do not fix or maintain California’s roads and highways. The extra tax dollars are being spent on other projects such as public transit, walking and biking paths, local planning, state and local park operations and maintenance, and university research programs. Additionally, only about 5 percent of the taxes will expand road capacity, despite the clogged roads and highways that force Californians to waste countless hours stuck in traffic.

Missed Opportunities for Infrastructure and Environmental Projects. The budget recognizes that California’s drought is over and removes funds that had been slated in January for drought response. Unfortunately, the budget largely overlooks opportunities to redirect resources to major needs such as widespread tree mortality and critical flood infrastructure repair needs. (The budget also does not specify how to spend Cap and Trade revenues, instead deferring that issue to policy legislation.)

Taxpayer Rights Reduced Under Late Tax Agency Changes. Under the guise of reform, Sacramento Democrats introduced unprecedented changes to the Board of Equalization at the end of the budget process. While some reforms were needed, the last-minute actions ignore more extensive discussions of thoughtful improvements and instead increase bureaucracy while minimizing taxpayers’ rights to appeal to elected tax representatives.

Underfunding of Trial Courts Compounded by Change in Court Collections Authority. The enacted budget provides $37 million in new funding for the trial courts, which still leaves them with more than $400 million in unmet operational needs. This chronic underfunding, which has continued for the past decade, has resulted in court closures, decreased services to the public, and for many Californians, difficulty accessing justice. Additionally, the budget eliminates longstanding authority for a judge to suspend a person’s driver’s license for failure to pay court-ordered debt, further compounding budget problems.

Expansion of Tax Credit to Self-Employed. The 2017 budget expands the state Earned Income Tax Credit (EITC) to workers with self-employment income. Previously, only workers who earned wages from an employer were eligible to participate. This important change levels the playing field for workers who are self-employed.

Too Many Unknowns for Supplemental Pension Payment. The budget provides a loan of $6 billion as a supplemental payment to the California Public Employment Retirement System (CalPERS) to pay down unfunded liabilities. By providing this additional payment now, the state may be able to lower the future estimated employer contributions and potentially save $11 billion over the next 20 years. While additional payments to CalPERS are necessary, the proposal included in this budget was rushed and left too many crucial questions unanswered.

Pension and Retiree Health Costs Continue to Climb. State spending on retiree health and pension obligations continues to outpace almost any other area of the budget. The budget provides $10.7 billion in spending for pension and retiree health in the 2017-18 budget, an increase of 11 percent over spending in last year’s budget. By the 2020-21 budget, costs for pension and retiree health are on pace to exceed $12.7 billion.