Read Complete Analysis (pdf)

Executive Summary

Overview: An Unbalanced Budget, Leading to Years of Deficits. The enacted budget is balanced only in a narrow, legal sense of the word. Under a more common sense view, this budget is not balanced—it uses deficit spending and gimmicks to help pay the bills for the next year, followed by multibillion deficits for at least the next several years. Prior to this recession, the state had record-high revenues and reserves, but the state’s recent spending spree left the budget in a precarious position, even before revenues began dropping. The forecast now shows multibillion dollar deficits for the foreseeable future, but the budget does far too little to restrain spending to a level that will create a financially sustainable path forward. The spending reductions or deferrals that are included primarily target schools, including elementary, high school, and colleges, rather than pulling back on doomed pet projects like High-Speed Rail or recent expansions to other state programs that are clearly unaffordable. Additionally, the budget takes actions that will prevent people from returning to work: it promises to crack down on independent contractors with nearly $22 million to enforce the harmful policies enacted in 2019 by Assembly Bill 5, and it imposes new mandates and more than $4 billion in new taxes on businesses that will make a jobs recovery all the more difficult.

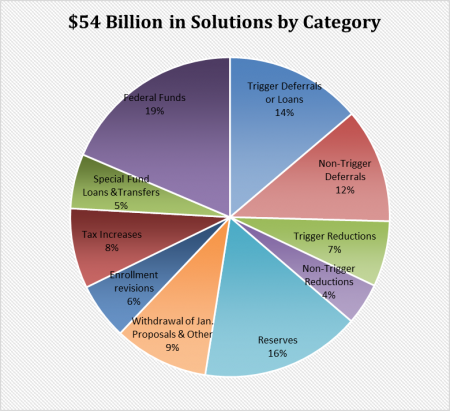

Budget “Solutions” Rely Heavily on Federal Funds and Borrowing. The enacted budget includes the major categories shown in the chart below to address the $54 billion budget deficit. Notably, only $5.9 billion of all the solutions, or 11 percent, represent actual spending reductions.

Extraordinary Federal Assistance, but Governor Seeks More. Federal assistance will provide an astonishing $214 billion combined to either the state or directly to individuals and local governments in California. The state also would direct over $6 billion of its federal share to assist school districts, cities, and counties. Despite this extraordinary level of federal assistance, the Governor is asking for still more bail-out money from Washington, DC, all the while continuing to fund an onslaught of lawsuits against federal authorities.

Over $7 Billion in COVID Response Expected, with Little Accountability. The budget includes $716 million for contingency COVID spending, part of a total of $7.4 billion in total expected response costs, but the budget fails to include reporting or other measures to hold the Governor accountable.

Approves AB 5 Enforcement Funding Despite Deficit. Despite AB 5 handicapping the flexibility of workers statewide, especially during the COVID-19 crisis, the budget approves nearly $22 million for AB 5 enforcement as proposed in the January budget.

Millions for COVID-19 Labor “Education” But Little Relief For Struggling Businesses. The budget allocates $32.5 million to the Labor Agency to enforce the slew of new labor laws related to COVID-19 as well as provide employer and employee “education”. At the same time, no funding was provided to specified businesses for the two weeks’ paid COVID-19 leave that the new policy mandates.

Discriminatory School Growth Funding. The final budget denies students attending non-classroom based public charter schools the same funding that students attending traditional and classroom-based charter schools receive. The budget also limits enrollment growth funding to planned growth documented in either the 2020-21 district budget or 2019-20 spring enrollment report.

Defers K-12 Spending. Total funding in the budget for K-12 is approximately $99 billion ($48 billion General Fund and $ 51 billion all other funds). Proposition 98 is funded at $71 billion, which results in Proposition 98 per pupil spending of $10,654. The budget authorizes up to $11 billion dollars in deferrals, which means schools will get the funds in the future but must use reserves or borrowing now to maintain operations. While deferrals are preferred over cuts by schools, they create large future payment obligations for the state.

Reductions to Higher Education. The budget reduces higher education spending between the University of California and California State University by $558 million, which would be potentially restored if sufficient federal funds are received. The budget also increases deferrals to the California Community Colleges by an additional $791 million Proposition 98 General Fund over the Governor’s May proposal, bringing the total deferral amount authorized to $1.4 billion. The additional deferral amount is rescinded if sufficient federal funds are received.

State Worker Pay Cut Offset by Other Concessions. The June budget package assumed $2.9 billion in employee compensation cuts. Short-term reductions made at the bargaining table nearly meet that goal in the short term, but salary reductions are partially offset by lower employee pension contributions and employee leave days. The short-term savings come at the expense of higher future costs.

State Funds to Backfill Lost County Revenue. The budget includes $750 million General Fund to backfill lost county “realignment” revenues for social services programs, but makes these funds contingent on counties’ compliance with state health directives and guidance.

Shifts Supplemental Pension Payments to Supplant State Obligation. To create General Fund savings, at a price of not paying down debt, the budget shifts billions in previously approved supplemental pension payments to supplant what the state would normally pay towards pension obligations.

Eliminates $453 million in Funding for Housing. The 2020 budget reduces funding for housing programs across the state, taking back $453 million from the 2019 Budget Act for various mixed-income and infill infrastructure projects critical to support the state’s long-term plan to increase the production of housing units.

Funds to Help Local Governments. The 2020-21 budget provides up to $2.7 billion to help local agencies combat homelessness and provide other health and safety services, as follows:

- Additional Funding to Combat Homelessness. The budget provides $300 million General Fund in 2020-21 to the Homeless Housing and Assistance Prevention program (HHAP), including $90 million to Continuums of Care, $130 million to each city with a population of 300,000 or more, and $80 million to counties.

- Project Homekey, CEQA Exemption Tied to Prevailing Wage. The budget provides $50 million to the Department of Housing and Community Development for Project Homekey, but would restrict the program to only those projects that include prevailing wage contracts.

- Federal CARES Act Funding. The budget provides $2.3 billion from the state’s portion of federal CARES Act funding for public health, public safety, and homelessness programs. The budget restricts these funds, however, to those cities and counties strictly adhering to state and local public health directives, providing the Administration with the authority to withhold or redirect these critical funds.

New Taxes Could Hinder Employment and Extend Crisis. The budget includes several tax increases that take $4.4 billion away from California businesses in 2020-21. The changes include temporarily suspending net operating losses for medium and large companies and temporarily limiting to $5 million the amount of tax credits that can be used, including the research and development tax credit. The suspension and limitation would be in effect for the next three years, through 2023-24. These changes would generate $3.3 billion in 2021-22, and $1.5 billion in 2022-23.

Modest Support for Businesses Ineligible for Federal Relief. The budget includes $75 million to support the Small Business Loan Guarantee Program operated by the Small Business Finance Center at the California Infrastructure and Economic Development Bank (I-Bank). This would expand on the Governor’s earlier emergency action to provide $50 million to the I-Bank.

Minor Small Business Tax Relief. The budget includes a first-year exemption from the $800 minimum tax paid by limited liability companies, limited partnerships, and limited liability partnerships, consistent with corporations in California. These changes would reduce state revenues by $100 million General Fund annually, and would be subject to annual authorization. The budget also provides $103 million General Fund to create the Small Business Hiring Credit Fund for the purpose of applying credits against qualified sales and use taxes.

Sales Tax Exemptions Extended. The budget extends, for 18 months, the sales tax exemptions for diapers and menstrual products that were included in the 2019 Budget Act. These exemptions are projected to reduce revenues by approximately $35 million annually. Local sales tax would also decrease, bringing total revenue losses to roughly $75 million annually.

Plan for Democrats’ $25 billion Borrowing Scheme. The budget requires planning for the Democrats’ scheme to essentially borrow $25 billion against future tax revenues in order to maintain their ever-growing thirst for state spending and new programs. If such a scheme were implemented, it would, practically speaking, create a new form of state borrowing, potentially without voter approval.

Earned Income Tax Credit Expansion to Undocumented Immigrants. The budget expands the state’s Earned Income Tax Credit program to all undocumented immigrants that have an Individual Taxpayer Identification Number for tax filing purposes. The expansion is estimated to cost $130 million at the same time the state is borrowing billions from K-12 schools, cutting university funds, raising taxes, and neglecting communities such as the developmentally disabled.

Future Suspension of Tobacco Tax Funded Medi-Cal Provider Incentives. The budget uses all of Proposition 56 tobacco tax revenues for loan repayments and supplemental payments to Medi-Cal providers. Unfortunately, the budget also allows for a suspension of the Proposition 56 supplemental payments on July 1, 2021 in order to sweep the funds for general spending in future budget years, a clear violation of the voters’ approval of Proposition 56.

Pause of Increases to Cannabis Taxes Contrasts with Other Tax Hikes. The budget temporarily prohibits the increase of both the mark-up rate on wholesale cannabis until July 1, 2021, and the increase of cultivation taxes for inflation until January 1, 2022. This treatment stands in contrast to the $4 billion in new taxes Democrats levied on other businesses through the budget.

Senate Republicans Help to Halt Closure of Barstow Veterans Home. Senate Republicans along with numerous veterans’ organizations successfully stopped Governor Newsom from removing 175 elderly and disabled veterans from their residence in order to save a mere $400,000 in General Fund in 2020-21. Instead, the 2020 Budget Act requires the state Department of Veterans Affairs to research all future options for the home including expanding the number of skilled nursing beds to safely serve California’s aging veteran population.

Gas and Diesel Taxes Increase Again. Already among the highest in the nation, California’s gas and diesel taxes automatically increased again on July 1, 2020, taking about $517 million more from Californians in 2020‑21. Despite Republican efforts, legislative Democrats and the Governor refused to provide Californians with a small amount of relief in this difficult economy by delaying this tax increase.

Despite Major Challenges, High-Speed Rail Presses On. The budget includes $2.9 billion to continue the high-speed rail project, despite more cost increases, uncertain funding, project delays, and a $54 billion state budget deficit. The deadline to adopt the 2020 High-Speed Rail Business Plan was also delayed through a budget trailer bill as the Administration appears to be hoping for a change in the White House.

Emergency Preparedness and Response Funding. The enacted budget approves many of the Governor’s emergency preparedness and response proposals, including $50 million General Fund for community power resiliency, among other actions.

Funding to Increase Surge Capacity During Wildfire Season. The budget includes $86 million in General Fund spending this year and $135 million ongoing to the Department of Forestry and Fire Protection (CalFire) for a staffing relief package. This funding is for additional seasonal staff at the peak of the fire season, while also supporting a plan to phase in permanent, year-round positions.

Continues Wasteful Spending on Land Acquisitions. While the budget reflects a scaled back proposal opposed to the initial plan to spend $20 million on a New State Park, it still includes $5 million from the General Fund to secure a new, undisclosed property.

Future Expansion of Welfare. Beginning in 2022, the budget expands the time an adult can receive welfare aid from 48 months to 60 months, but does nothing to actually restore people to independence faster. The budget appropriates $1 million for automation to effectuate this change. The Department of Finance estimated this expansion would cost the state hundreds of millions General Fund annually.

Judicial Branch Trigger Reduction. In lieu of the $255 million trigger cut proposed by the Governor in May, the budget includes a $200 million General Fund baseline reduction for the Judicial Branch. $150 million could trigger off in 2020-21 if the state receives enough federal bailout funds, in which case the full amount would trigger off in 2021-22.

“Sea Change” in Public Safety Policy. That is how the California District Attorneys Association describes the collection of soft-on-crime changes included in the public safety budget trailer bills. Policy changes that were improperly jammed through the budget process make sweeping changes to sentence enhancements, parole, prosecution of misdemeanor crimes, and criminal history inquiries, and ban future sales of a new type of firearm by classifying it as an assault weapon.

Unworkable Juvenile Justice Realignment Forced on Counties. After initial attempts at juvenile realignment stalled in July, a trailer bill introduced just 72 hours before being passed on the last day of the regular session abandoned the agreement negotiated in good faith with counties and instead foisted a deeply flawed realignment plan on them. According to five statewide associations of county officials, the plan not only will not work for the realigned population, but it also threatens existing local efforts in the juvenile justice arena and purposely disadvantages counties least prepared to serve the new population.

Backfilling Federal Funds to House Undocumented Felons. California’s sanctuary state status has made it ineligible for federal assistance through the State Criminal Alien Assistance Program. The budget includes a $68 million ongoing General Fund augmentation for the Department of Corrections and Rehabilitation to backfill this loss of federal funding.

Mortgage Relief Funds Finally Released. The 2020-21 Budget Act includes $331 million from the National Mortgage Settlement Fund to provide financial, counseling and legal assistance to distressed homeowners. The state Supreme Court recently upheld previous court rulings and directed the Newsom administration to spend $331 million in mortgage settlement funds to assist homeowners.

Regulatory Overreach with New California Consumer Financial Protection Law. A policy bill that Democrats jammed through the budget process renames the Department of Business Oversight (to the Department of Financial Protection and Innovation), creates a new California Consumer Financial Protection Law, and establishes a new regulatory bureaucracy for currently unlicensed entities, such as credit reporting agencies and merchant cash advance lenders.

Defers Cap-and-Trade Expenditure Plan. The enacted budget package does not include a discretionary expenditure plan. However, it does provide a $150 million re-appropriation for the heavy duty vehicles and off-road equipment investments program and $134 million to support state departments’ administration of programs allocated from the Greenhouse Gas Reduction Fund in prior years.