Executive Summary

Governor’s Deficit Substantially Lower Than Nonpartisan Estimate. The Governor’s January budget package projects a deficit of $38 billion by the end of 2024-25. This is $30 billion lower than the $68 billion deficit estimated by the nonpartisan Legislative Analyst’s Office (LAO) in December. The most significant part of the difference results from the Governor’s projection that tax revenues will be higher by $15 billion compared to the LAO estimate. Much of the remainder is the result of differing assumptions regarding whether to treat Proposition 98 education adjustments as part of the baseline or as a solution that the Legislature needs to adopt.

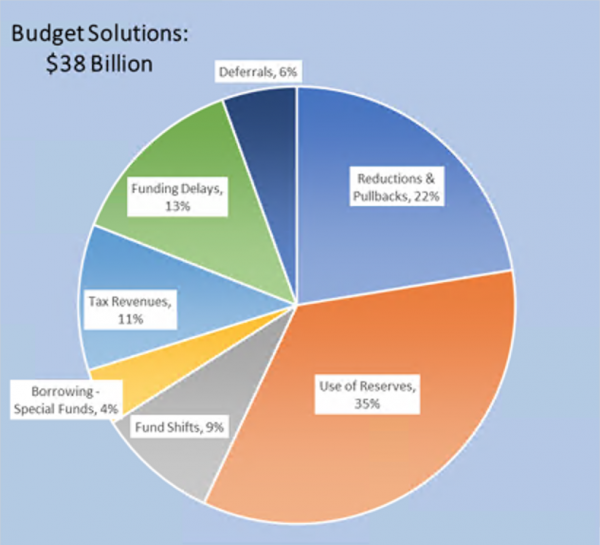

Short-Term Solutions Despite Long-Term Deficits. In order to address the deficit, the Governor proposes a mix of solutions totaling $38 billion that largely use one-time actions and budget gimmicks, rather than actual, on‑going reductions that would create a truly sustainable budget. The solution categories are summarized in the chart and descriptions below.

- Reserves. $13 billion by drawing down budget reserves, including $12 billion from the state Rainy Day Fund and $900 million from the Safety Net Reserve.

- Reductions and Pull-Backs. $8.5 billion from various reductions and pull-backs of previously approved increases, most significantly including $2.9 billion for various climate programs, $1.2 billion for housing programs, and $350 million for previously approved local projects.

- Delays. $5.1 billion to delay previously scheduled spending, including $1 billion for transit and inner city rail and $613 million for developmental services payment rate increases.

- Fund Shifts. $3.4 billion by shifting General Fund expenses to state special funds, including $1.8 billion to the Greenhouse Gas Reduction Fund (cap and trade) and $1.3 billion in state retirement contributions to Proposition 2 debt payments.

- Revenue Changes. $4.1 billion by increasing the state’s share of the managed care organization tax ($3.8 billion) and $300 million through greater limits on corporate net operating loss (NOL) deductions.

- Deferrals. $2.1 billion through various deferrals, most notably by shifting $1.6 billion in state payroll from 2024-25 to the following year (a cash accounting shift that is a “savings” on paper only). This category also includes $499 million to postpone increases for the University of California and California State University. Note that “deferrals” differ from “delays” ostensibly by including a higher level of obligation to actually provide the funds in the future.

- Internal Borrowing. $1.6 billion by authorizing the General Fund to borrow more money from state special funds, such as the AIDS Drug Assistance Rebate Fund ($500 million). This adds to last year’s borrowing, when the state borrowed $2.7 billion from special funds to close that deficit.

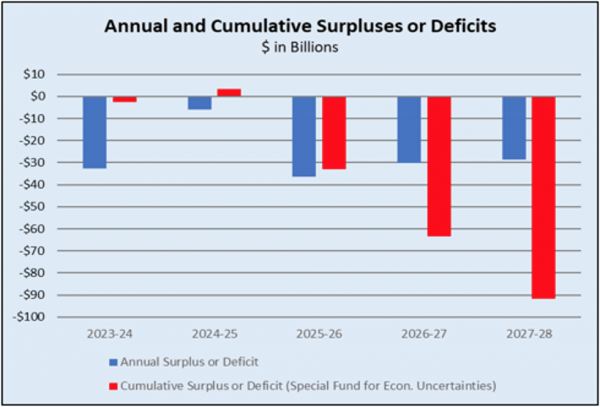

Massive Deficits Persist Throughout Forecast. The Governor’s multiyear forecast also indicates the state will have operating deficits each year through 2027-28, as illustrated in the chart below. Because the proposed solutions are largely one-time in nature, expenditures never adjust to match revenues in the Governor’s budget forecast.

Revenues Fall Far Short. California’s tax revenue outlook remained more uncertain than usual at the time of the 2023-24 budget’s passage last summer, a result of the federal government shifting the tax filing deadline to November. Even so, the LAO had projected that tax revenues would be lower than assumed in the enacted budget. The Governor’s January budget reflects revenues of $198 billion in 2023-24, lower than budgeted by $10 billion, which would grow slightly to $204 billion in 2024-25. Altogether, the Governor’s budget estimates that revenues will be lower by nearly $43 billion combined through the 2024‑25 budget year than assumed in last summer’s enacted budget.

Expenditures Remain Unsustainable. General Fund expenditures under the Governor’s proposal would reach a revised total of $231 billion in 2023-24, which, surprisingly, remains about $5 billion above the enacted budget level of $226 billion. Expenditures would then decline by about 10 percent to $209 billion in 2024-25 before starting to grow again. Because the Governor’s deficit solutions rely heavily on one-time delays and shifts, as described above, expenditures remain above revenue in each year of the Governor’s forecast through 2027-28.

Some Reserves Remain After Budget Solution. The proposed budget would utilize $13 billion from the state’s reserves, maintaining an estimated $18 billion in total reserves. The proposed withdrawals and remaining reserve balances include the following categories:

- Withdrawal of $10.4 billion from the mandatory balance, and $1.8 billion from the discretionary balance of the state’s Rainy Day Fund. This would leave $11.1 billion in the Rainy Day Fund.

- Withdrawal of $5.7 billion from the Proposition 98 Rainy Day Fund, leaving a balance of $3.8 billion.

- Withdrawal of $900 million from the Safety Net Reserve Fund, zeroing out the balance.

- A $3.4 billion balance in the discretionary reserve (the Special Fund for Economic Uncertainty).

Housing and Homelessness

Significant Reduction in Funding for Housing Production. The budget proposes to eliminate $1.2 billion in funding provided to various housing programs in previous years. A few notable reductions include $300 million from the Regional Early Action Planning Grant program, $250 million from the Multi-Family Housing Program, and $200 million from the Infill Infrastructure Grant program.

Delays in Homelessness Funds. The Governor’s budget proposes various delays for homelessness programs including $260 million for the Homeless Housing, Assistance, and Prevention Program. What remains lacking is an acknowledgement that throwing billions of dollars at this problem is not working. Recent counts show an increase of 11,000 homeless in the last 12 months, putting the state at about 181,400 homeless Californians, despite spending billions on the problem.

K-12 Education

Proposition 98 Education. The Budget includes $127 billion ($76 billion General Fund and $50 billion other funds) for all K-12 education programs. The revised Proposition 98 funding for K-12 schools and community colleges is about $99 billion in 2022-23, $106 billion in 2023-24, and $109 billion in 2024-25. These revised levels reflect decreases of $9.1 billion in 2022-23 and $2.7 billion in 2023-24 compared to the 2023 budget act. Proposition 98 General Fund spending per pupil would be $17,653 in 2024-25 and $23,519 per pupil from all funding sources.

Local Control Funding Formula. The budget notes a $1.4 billion decrease in the Local Control Funding Formula (LCFF). This reflects a 0.76 percent cost-of-living adjustment (COLA) and population growth adjustments. The budget proposes withdrawing $2.8 billion from the Proposition 98 reserve in 2023-24 and $2.2 billion in 2024‑25 to support LCFF costs. The budget also uses $39 million in re-appropriation and reversion funding.

Proposition 98 Reserve. The budget reflects a revised final balance in the Public School System Stabilization Account of $3.8 billion at the end of 2024-25. This decrease reflects a revised deposit of $339 million in 2022-23 and net withdrawals of about $2.8 billion in 2023-24 and $1.9 billion in 2024-25. The account balance would be $5.7 billion in 2023-24, triggering the previously authorized (but ill-advised) local school district reserve cap.

School Facility Funding Cuts and Delays. The budget proposes cutting the School Facilities Program funding in 2024-25 by $500 million one-time General Fund. There would also be a delay of $550 million from 2024-25 to 2025-26 for the California Preschool, Transitional Kindergarten and Full-Day Kindergarten Facilities Grant Program. This is the second delay of this funding, which was delayed from 2023-24 to 2024-25 in the 2023 budget act.

Literacy Screening. The budget includes $25 million ongoing Proposition 98 General Fund in the K-12 Mandate Block Grant to support training educators to screen students in kindergarten through second grade for reading difficulties, including dyslexia. The screenings are to be rolled out by 2025-26.

Charter School Funding Eligibility. The budget proposes statutory changes that would make charter schools eligible for funding from the Education Revenue Augmentation Fund (ERAF). The ERAF was created in 1992 and redirects a share of property taxes statewide from cities, counties and special districts to K-14 schools. Charter schools were established the same year as ERAF, and it has never been clarified if they are eligible for this funding.

Higher Education

Compact Increase Deferrals. As part of the Governor’s deficit solution package, the budget would defer the five percent increases previously agreed upon through the compacts, including $240 million to the California State University and $228 million to the University of California to 2025-26. Notably, the CSU trustees recently voted to approve a 6 percent tuition increase to help plug a budget deficit.

Resident Undergraduate Enrollment Growth Deferral. As an additional part of the Governor’s deficit solution package, the budget would defer $31 million General Fund to offset revenue reductions associated with replacing 902 nonresident undergraduate students enrolled at three UC campuses.

Health

Getting More from the Managed Care Organization (MCO) Tax? The Governor’s budget scores an additional $3.8 billion in General Fund relief from the MCO tax approved by the Legislature in 2023. The tax was officially approved by the federal government in December 2023, but the Governor is now seeking early action by the Legislature to request that the federal government approve a new smaller MCO tax only on Medi-Cal managed care plans that would add $1.5 billion in General Fund proceeds above the 2023 Budget Act estimates. In addition, the administration will also accelerate the use of an additional $2.3 billion that had been set aside for Medi-Cal provider rate increases in future fiscal years for additional General Fund budget relief in 2024-25. The administration claims that the proposed Medi-Cal provider rate increases will be funded as planned but that in future fiscal years the General Fund will have to cover more of the cost of the higher rates. More details will come when the draft trailer bill language is released.

$4.1 Billion to Continue Medi-Cal Eligibility Expansion to the Undocumented. Despite the obvious need to help at-risk hospitals stay open and build more mental health treatment beds for the homeless, the Governor’s budget maintains $4.1 billion in General Fund for the last phase of the planned expansion of full-scope Medi-Cal eligibility to all low-income undocumented individuals. On January 1, 2024, an estimated 700,000 undocumented individuals aged 26-49, became eligible for full-scope Medi-Cal. The state currently spends an estimated $2 billion annually for the previous expansions to those undocumented individuals age 25 and under and age 50 and above.

Regret on Health Care Minimum Wage Bill? Just months after signing the costly health care minimum wage bill (SB 525), Governor Newsom is now asking the Legislature for immediate action to change the law to add an annual “trigger” to make the minimum wage increases subject to General Fund revenue availability and to exempt state-run facilities such as University of California healthcare facilities. Details are unknown at this time, but this action will likely save more than $2 billion in 2024-25.

Delayed Funding for Mental Health Beds. Despite the overwhelming need to treat our growing homeless population, the Governor is proposing to delay $375 million in General Fund for mental health infrastructure, including funds for long-term treatment beds and short-term crisis beds. The administration is banking on the voters approving Proposition 1 on the March 2024 ballot, which would allow for a $6.38 billion bond to expand the capacity of mental health treatment beds.

Developmental Services

Breaking a Promise to the Developmentally Disabled. The Governor proposes to break a promise to the families and service providers of the developmentally disabled by slowing down, by one year, the planned implementation of service provider rate increases. Despite the Governor finding enough funding for the undocumented Medi-Cal expansion and for abortion industry subsidies, the Governor is proposing to delay $613 million General Fund in 2024-25. This delay will hamper the delivery of needed services to one of the state’s most vulnerable populations.

Human Services

In-Home Supportive Services Expansion. The 2024 budget continues the expansion of In-Home Supportive Services (IHSS) to undocumented immigrants of all ages, with costs of approximately $383 million General Fund for benefits and $15 million for administration. It will take a few years to reflect the full costs of this expansion as more individuals enroll.

CalWORKs Cuts and Reversions. The budget includes a reversion of $336 million General Fund from the 2022-23 CalWORKs Single Allocation, plus $41 million in 2023-24, and a cut of $41 million in 2024‑25. The budget also cuts funding for employment services intensive case management by $47 million General Fund in 2024-25 and ongoing. Expanded subsidized employment is also reverted by $134 million in 2023-24 and reduced by $134 million in 2024-25 and ongoing.

Social Services Housing Program Funding Delays. The budget delays a combined $195 million General Fund to 2025-26 across several housing programs, including the Bringing Families Home Program, Home Safe Program, and the Housing and Disability Advocacy Program.

Foster Youth Housing Supplement Cut. The budget reflects a cut of $195,000 in 2024-25 and $19 million General Fund in 2025-26 and ongoing to the housing supplements provided in the 2023-24 budget for foster youth in Supervised Independent Living Placements.

Child Care

Child Care Slot Expansion and Rate Increases. The Governor’s budget would continue to fund the expansion of slots, initiated in previous budgets, and includes $2.1 billion for about 146,000 child care slots to be filled in 2024-25. The 2021 budget act set a goal of creating 200,000 new slots by 2026-27. The rate increases initiated by the current bargaining agreement with Child Care Providers United will also continue to be implemented at about $724 million GF in 2024-25.

Public Safety

Cannabis Enforcement Funding Subsidizes General Fund Program Spending. Holding true to the relatively low priority the Governor places on public safety, his 2024-25 budget proposes a $100 million loan to the General Fund from the cannabis tax revenues earmarked for public safety (i.e., enforcement) by Proposition 64 (2016). This is despite continued complaints from the cannabis industry that one of the most significant challenges for legal operators is the continued existence of the illegal cannabis industry.

Corrections Costs Continue to Climb Despite Shrinking Population. Despite nearly $300 million in actual and projected General Fund savings in 2024-25 from the June 30, 2023 closure of the Division of Juvenile Justice, the expected termination of the California City Correctional Facility contract in March 2024, and the planned closure of Chuckawalla Valley State Prison beginning in 2024-25, the Governor’s budget proposes General Fund expenditures for the Department of Corrections and Rehabilitation of $14.1 billion in 2024-25. This is an increase of more than $90 million above the enacted 2023-24 spending level. The most significant factors contributing to this continued cost growth are employee salaries and benefits ($620 million) and various inmate medical cost increases (totaling $130 million).

More Slush from Attorney General’s Slush Fund. The 2023-24 Budget Act authorized a $400 million loan to the General Fund from the Litigation Deposit Fund (LDF), which is referred to by some as the Attorney General’s slush fund due to its general lack of transparency. The Governor’s budget proposes to loan an additional $100 million from the LDF to the General Fund. Apparently there is more slush in the slush fund than was originally acknowledged.

Energy and Utilities

Clean Energy and Reliability Investments. The Governor proposes to reduce spending on clean energy and reliability by $312 million with partial reductions across various programs. The largest single reduction is $196 million in the Equitable Building Decarbonization program. The proposal also includes funding delays of $670 million and fund shifts of $144 million across various programs to lessen the burden on the General Fund. These changes come after modest program reductions in the prior budget left $7.3 billion to be spent over six years.

Defers Some Broadband Investments Again. The Governor proposes to defer $100 million for last‑mile broadband infrastructure grants from 2024-25 to 2026-27. Last year’s budget included shifting funds into 2024-25, 2025-26, and 2026-27. While these deferrals do not reduce overall funding, they slow the progress to close the digital divide.

Reduces Local Financing Funds for Broadband Infrastructure. The Governor proposes to cut $250 million for the Loan Loss Reserve Fund, used to finance local broadband infrastructure development. After this reduction $500 million would remain in the program, with $150 million available in 2024-25.

Resources and Environment

Changes to Overall Climate Spending. The budget proposes $6.7 billion in General Fund adjustments for climate-related programs. These adjustments aim to maintain a balanced budget by reducing spending by $2.9 billion, delaying $1.9 billion in expenditures to subsequent fiscal years, and shifting $1.8 billion to other funds, predominantly the Greenhouse Gas Reduction Fund (GGRF).

Continuing Multiyear Wildfire Funding Commitments. Since 2021, the budget has committed $2.8 billion for forest health and fire prevention through multiyear budgeting. The Governor’s budget upholds $2.7 billion of these commitments for fire prevention and response. However, it reduces $101 million from the General Fund, affecting programs such as the Biomass to Hydrogen/Biofuels pilot ($43.5 million) and High-Risk Region Conservancy Projects ($27.7 million), focusing on fuel reduction efforts with direct benefits. Recent budget investments in wildfire prevention are a welcome change from budget years past, and this proposed budget provides a prudent solution to get more bang for our buck by focusing funding on fuel reduction efforts with immediate benefits.

New Spending for Flood Protection. The budget proposes $94 million from the General Fund for flood safety efforts. This includes $33 million for Corps of Engineers and Urban Flood Risk Reduction projects, $31 million for ongoing Central Valley flood risk projects, and $30 million for repairs due to 2023 storm damage at flood control facilities and state-owned Delta lands. While the funding is not nearly enough to address the billions needed for water infrastructure improvements across the state, these projects remain essential despite the deficit.

Reevaluating Methane Reduction Programs. The budget proposes $46 million in General Fund adjustments, temporarily shifting and delaying $24 million to the Greenhouse Gas Reduction Fund for the Livestock Methane Reduction Program and reallocating $23 million for the Enteric Methane Incentives Program. These are welcome adjustments to the budget as the necessity and effectiveness of these programs have been under scrutiny since their introduction in the previous year's budget.

Proposal to Increase the Mill Assessment Returns. The budget includes a proposal to change the flat fee model currently used to purchase pesticides and move to a phased-in increase over the next three years. Revisions of this fee would require a two-thirds vote by the legislature. Additionally, the budget proposes allocating $33 million ongoing from the Greenhouse Gas Reduction Fund and special funds to support the Department of Pesticide Regulation's efforts in managing pesticides and transitioning to more climate-friendly pest management practices in California.

Cannabis

Revised Allocation Of The Cannabis Tax Fund. The budget estimates $586.9 million will be available to meet the requirements of Chapter 56, Statutes of 2022 (AB 195). This legislation mandates allocating funds to “Allocation 3 Programs,” focusing on youth education, environmental protection, and public safety. The estimated budget includes $341.3 million for youth substance use disorder programs, $113.8 million for addressing environmental impacts from illegal cannabis cultivation, and another $113.8 million for public safety-related activities.

Tax Policy

Overall Tax Policy Change Effects. The Governor’s budget proposes six tax policy changes that would provide $400 million in revenue in 2024-25. In some cases the Administration labels the changes as “conforming” to federal policy, but in reality the state can choose whether or not to conform to federal policy. The majority party has chosen not to conform in other areas in the past, and the current proposals are choices as well.

Changes to Net Operating Loss for California Businesses. The largest revenue-generating tax policy change in the Governor’s budget is the proposal to limit Net Operating Loss (NOL’s) that are carried forward from prior years to 80 percent of any subsequent year’s net income, restricting NOL usage to 80 percent or less of taxable income. This change would apply to all businesses and is projected to generate $300 million in revenue from California businesses in 2024-25.

Business, Workforce Development and Employment

New Funding for CalCompetes Grant Program Even Without Performance Review. The budget proposes $50 million General Fund to extend the recently established CalCompetes Grant program through 2024-25, even though the program is in the early stages of implementation and outcome data is not available yet, leaving the Legislature unable to determine whether the program is actually achieving results.

Shifts Portion of UI Interest Payment to Special Fund. The Governor proposes a payment of $331 million to pay the annual interest payment on the state’s Unemployment Insurance (UI) loan from the federal government. Of this amount, $100 million would come from the Employment Training Fund and the remainder would be paid by the General Fund. Although this is an allowable use of the Employment Training Fund, the purpose of the fund is to invest in a skilled and productive workforce and the money in the fund comes from employers.

Employment Development Department (EDD) Problems. The proposed budget includes $327 million ($163 million General Fund) for EDD IT systems, improved service for claimants, and fraud prevention. This money would fund the third year of a five-year modernization plan which began in 2022-23.

Apprenticeship and Workforce Training Programs. The Governor proposes reductions of approximately $100 million General Fund and delayed funding of $735 million for various apprenticeship and workforce development programs. The largest single cut is $45 million to the High Road Training Partnerships Program. Notably, the Displaced Oil and Gas Worker Pilot program is reduced by $10 million, from $40 million to $30 million.

Transportation

Gas Taxes Increase Again. The Governor proposes no changes to existing law, which would continue the automatic annual tax increases to gasoline and diesel fuels. Gasoline taxes would increase by 2 cents per gallon (cpg), or 3.5 percent, to 59.9 cpg, and diesel fuel taxes would increase by 1.3 cpg, or 2.9 percent, to 45.4 cpg on July 1, 2024.

Transit Bailout. The Governor proposes a one-year delay of half of the $2 billion in transit bailout funding planned for 2024-25. The proposal also includes shifting $261 million of the remaining bailout funding from the General Fund to the Greenhouse Gas Reduction Fund.

Transportation Infrastructure. The Governor proposes a cut of $200 million General Fund previously planned for projects promoting walking and biking, leaving $850 million General Fund for these projects, which was one-time funding largely included in prior budgets. The proposed budget would also shift $530 million for transit and rail projects from the General Fund to the Greenhouse Gas Reduction Fund.

Zero-Emission Vehicles. The Governor proposes to modify spending on zero‑emission vehicle (ZEV) subsidies, infrastructure, and equity projects by cutting $38 million General Fund, shifting $475 million from the General Fund to the Greenhouse Gas Reduction Fund, and delaying $600 million from 2024‑25 to 2027-28. Despite the cuts, shifts, and delays, a total of $10 billion remains for ZEV programs over a seven-year period.

Local Government

City of Fresno Infrastructure Funding Delay. The budget proposes to delay $200 million in funding provided in the 2023 Budget Act for the City of Fresno’s Public Infrastructure plan, leaving $50 million available in 2023-24, and $100 million available in both 2025-26 and 2026-27.

Local Projects Pulled Back. The 2023-24 budget package included roughly $750 million for a list of local projects requested by various legislators. The Governor’s budget proposes to withdraw funds for any project for which the state has not yet sent out the money, an estimated total of $350 million. A list of which projects are included in this proposal is not yet available.