PDF Version

Overview: Stumbling Forward for Now on an AI High. A recent surge of Artificial Intelligence (AI)-fueled revenue is enabling the Governor to paint an optimistic picture of state taxes and to continue recent reckless spending patterns, at least for the moment. However, a lack of any spending restraint in the Governor’s new budget proposal means that massive deficits will return in force each year beginning in 2027-28, even under the Governor’s rose-tinted projections. Meanwhile, the budget largely fails to address key priorities for public safety, fire prevention, affordability, and other issues that Senate Republicans recently outlined.

Governor’s Revenue Forecast Dramatically Higher than Nonpartisan Estimate. The Governor’s budget estimates that General Fund revenues will be $42 billion higher over the three years ending in 2026-27 compared to levels assumed in last summer’s enacted budget. This includes total General Fund revenues of $228 billion in the current 2025-26 fiscal year, which are higher than the enacted budget level by $19 billion. General Fund revenues then would grow by a meager 1.0 percent to reach $230 billion in 2026-27, which is $17 billion higher than forecast in last year’s budget package.

In November 2025, the nonpartisan Legislative Analyst’s Office (LAO) projected that General Fund revenues would exceed budgeted levels over the three-year window by $11 billion, roughly one-fourth of the Governor’s estimate. Both estimates attribute the increases to strong technology stock market and capital gains performance, particularly associated with California’s AI sector, but while the LAO cautions that the AI-driven gains are not likely to last, the Governor appears to be going all-in on a sustained AI boom to prop up his spending plans.

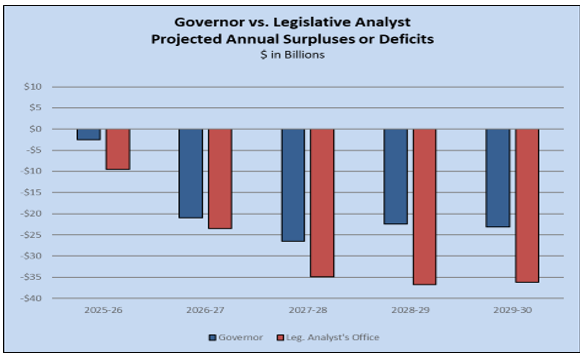

Governor Forecasts Massive Deficits for Years to Come. The Governor’s budget projects a General Fund deficit of $2.9 billion by June 2026, while the LAO’s estimate at that point is roughly six times higher at $18 billion. The chart on the following page compares the Governor’s and LAO’s annual deficit forecasts through 2029-30. (Note that these annual deficits differ slightly from the year-end totals typically cited as “the deficit” for a particular year.) The Governor’s lower deficit estimates correspond to his dramatically higher revenue forecast, benefitting significantly from higher actual revenues going back to 2024‑25, which carry forward to offset the annual shortfall in the current and budget years.

Even with his higher revenue forecast, however, the Governor’s budget projects the return of a massive $22 billion deficit by June 2027 and continuing annual deficits ranging from $22 billion to $26 billion each year thereafter. If left unaddressed, these deficits would generate a cumulative deficit of $67 billion by 2029-30. The LAO forecasts even higher deficits each year. Both forecasts clearly demonstrate that California faces ongoing, structural deficits under its current trajectory that are entirely unsustainable. Notably, these repeated deficits are occurring during a period of tax revenue growth, not during a recession, a remarkable result that reflects reckless budgeting choices made by Governor Newsom and supermajority Democrats in the Legislature in recent years.

No Plan for A Sustainable Budget. The Governor’s budget includes one significant proposal to help paper over the 2026-27 budget deficit, namely using another $2.9 billion from the state’s Rainy Day Fund reserve. Technically, the Governor’s budget refers to this action as “suspending the true-up” of the reserve under Proposition 2 (enacted in 2014), but the practical effect is to use reserves to support spending. Last year’s budget already included a withdrawal of $7 billion from the Rainy Day Fund, which the Governor’s new budget maintains, despite the improved revenue situation. The Governor’s Director of Finance indicated there would be additional proposals in the May Revision to address only the 2026-27 deficit, but there is no indication of any plan to return California’s budget to a sustainable path beyond Governor Newsom’s tenure.

Rapid Expenditure Growth Continues. General Fund expenditures under the Governor’s proposal would reach a revised total of nearly $238 billion in the current fiscal year, which is roughly $9.3 billion above the level enacted seven months ago for the 2025-26 budget. Proposed General Fund expenditures would grow by another $11 billion to $248 billion in 2026-27. The new spending level would be $20 billion above the enacted 2025-26 level, an increase that is driven largely by a 38 percent rise in spending on Health and Human Services programs.

When counting all state funds, such as gas taxes and Cap-and-Invest funds, the 2026-27 budget would reach $349 billion, an increase of about $6.5 billion from the revised current year. Federal funds would add another $190 billion in 2026‑27, an increase of $10 billion from current year levels. When including these federal funds, total budgetary spending would reach $539 billion in 2026-27, an increase of 3.1 percent from the prior year.

Reserves Grow Modestly. The proposed budget would suspend a deposit of $2.9 billion to the Rainy Day Fund that would otherwise by made in 2025-26, resulting in lower reserves, while maintaining last year’s action to withdraw $7.1 billion. The budget would then deposit $3 billion to the Rainy Day Fund in 2026-27 in accordance with Proposition 2’s requirements. These actions would raise the Rainy Day Fund balance to $14 billion in by the end of 2026-27, which is a relatively low 6.2 percent of General Fund revenues. Other reserves would include a balance of $4.1 billion in the TK-12 school reserve and $4.5 billion in the discretionary reserve (technically called the Special Fund for Economic Uncertainty). Altogether, these reserve balances would total nearly $23 billion by the end of 2026-27. Notably, however, there are no discretionary proposals to increase reserves. The only proposed departure from the constitutional formula is the Governor’s proposal to further reduce reserves by $2.9 billion in the current year.

No New Funding for Local Homelessness Programs. The Governor’s budget does not include any new funding for local homelessness programs above what was included in the 2025-26 budget agreement ($500 million General Fund). The January budget continues to seek enhanced accountability and performance requirements but fails to include specific details, passing the buck to the Legislature to determine what those priorities should include.

No New Funding for Housing Programs. The Governor’s budget fails to include additional funding for the state’s numerous housing programs. Last month Senate Republicans issued a letter setting out budget priorities for the upcoming year, including lowering costs for renters and helping more Californians buy homes. Unfortunately, the Governor’s budget fails to provide any funding for the expanded renter’s tax credit (AB 130, a 2025 budget trailer bill, expanded the tax credit subject to funding), which could provide some much-needed relief to Californians experiencing some of the highest rental costs in the nation.

TK-12 Education

Proposition 98 Education. The Governor’s budget includes $149 billion ($89 billion General Fund and $60 billion other funds) for all TK-12 education programs. Proposition 98 funding for TK-12 schools and community colleges in 2026-27 is $126 billion. The revised 2025-26 Proposition 98 guarantee is calculated at $121.4 billion, but the budget proposes to fund the guarantee at only $115.9 billion, creating a settle-up obligation of $5.6 billion. Proposition 98 General Fund spending per pupil would be $20,427 in 2026-27 and $27,418 per pupil from all funding sources. According to the Department of Finance, this is a Proposition 98 General Fund increase of 75 percent compared to 2018-19 and a 61 percent increase when accounting for all funds.

Local Control Funding Formula. The Governor’s budget proposes a $2 billion increase in the Local Control Funding Formula (LCFF). This reflects a 2.41 percent cost of living adjustment (COLA) and population growth adjustments.

Proposition 98 Reserve. The budget reflects a revised balance in the Public School System Stabilization Account of $4.1 billion at the end of 2026-27. This reflects mandatory revised deposits of $3.8 billion and $424 million in 2024-25 and 2025-26 respectively, and a mandatory withdrawal of $407 million in 2026-27. The budget also proposes to include a discretionary deposit in 2025-26 of $240 million. The balance over the three-year budget window triggers the previously authorized (but ill-advised) 10 percent cap on local school district reserves in 2025-26 and 2026-27.

Special Education Base Rate Increase. The budget includes a proposal to provide $509 million ongoing Proposition 98 General Fund to increase the special education base rates. The Department of Finance highlights that this increase is in response to the growing number of students in special education over the years.

Student Support and Professional Development Discretionary Block Grant. The Governor’s budget proposes $2.8 billion one-time Proposition 98 General Fund for the Student Support and Professional Development Discretionary Block Grant. This is in addition to $1.7 billion provided in the 2025-26 budget. Providing a one-time discretionary block grant provides local education agencies with more flexibility to cover costs that are specific to their individual priorities without creating ongoing funding pressure.

Community Schools Expansion. The Governor’s budget proposes $1 billion ongoing Proposition 98 General Fund to expand the community schools model. Community schools are public schools that seek to provide community partnerships that integrate education with whole family and child development. This includes, but is not limited to, integrated supportive services like mental health, social services, home visits, professional development, and extended learning time and opportunities.

Charter School Accountability. The Governor’s budget notes that new requirements for charter schools will be proposed. Additional details on these requirements were not available at the time this summary was written and will likely be provided in trailer bill language at a later time.

Higher Education

University Compact Increases Partially Restored. The Governor’s budget would provide the previously promised 5 percent increase representing the Year 5 component of the current compacts between the Governor and the University of California (UC) and California State University (CSU) systems. This increase amounts to $254 million for the UC and $265 million for the CSU. Additionally, the budget would provide a portion of the previously delayed Year 4 increase, amounting to $96 million for UC and $101 million for CSU. However, the budget would continue to delay the remainder of the Year 4 increase, totaling $241 million for UC and $252 million for CSU, as well as $31 million for UC intended to replace nonresident undergraduate tuition.

Base Budget Reductions Extended. The Governor’s budget would also further delay repayment to UC and CSU of a 3 percent base cut made in 2025-26, totaling $130 million for UC and and $144 million for CSU. The state would provide cash flow loans to those systems to offset the reductions until 2027-28.

Senate Republicans called for restoring the cuts made to UC and CSU in recent budgets, and the Governor’s budget partially meets this goal. However, California revenues clearly allow for full restoration of these cuts under a more prudent set of priorities.

Community Colleges Cost and Enrollment Increases. The Governor’s budget includes $241 million ongoing Proposition 98 General Fund to provide a 2.41 percent cost-of-living adjustment for Student-Centered Funding Formula apportionments and $55 million ongoing Proposition 98 General Fund for 1 percent enrollment growth in 2026-27. The budget indicates the intent to support overall enrollment growth of 1.5 percent between these actions.

Health

Governor Favors Helping Planned Parenthood Over Saving Hospitals from Closure. Despite many at-risk hospitals in need of funding to stave off closures, the Governor’s top “healthcare” priority is immediately providing $60 million in new General Fund to prop up abortion providers like Planned Parenthood. This funding is on top of $146 million in special funds currently in the budget for abortion provider grants. Shockingly, the Governor requests that the Legislature expedite this new $60 million through an early 2026 budget bill. Last month, Senate Republicans issued a letter setting out budget priorities for the upcoming year, including a $300 million request for hospitals at-risk of closure. The Governor proposed no funding to save these hospitals.

Despite a Drop in Overall Caseload, Medi-Cal Budget Still Grows Due to Undocumented Care. The Governor’s budget estimates that Medi-Cal enrollment will decrease by roughly 500,000 individuals in 2026-27, yet the General Fund spending will grow by $4.4 billion over the 2025 Budget Act to a record-high $48.8 billion in 2026-27. While some of this growth includes increased costs from recent federal policies, the $48.8 billion still includes more than $12 billion General Fund to cover the annual costs of 2 million undocumented individuals currently enrolled in Medi-Cal.

Some Non-Citizens Moved Off Full-Scope Medi-Cal. While the budget includes $1.9 billion in General Fund savings from previously enacted budget solutions to freeze new enrollment and decrease benefits to undocumented individuals, the Governor’s budget includes $786 million in additional General Fund savings by moving an estimated 200,000 temporarily legal non-citizens (such as individuals seeking asylum) away from full-scope Medi-Cal benefit eligibility and towards emergency and pregnancy only restricted-scope benefits. This action conforms with recent federal policy.

Human Services

Department of Social Services Total Budget. The Governor’s proposed budget for the Department of Social Services is $59 billion ($26 billion General Fund) for 2026-27, a General Fund increase of $1.3 billion from 2025-26.

CalFresh Cost Sharing and Eligibility Changes. The 2025 federal budget reconciliation bill, H.R. 1, shifts a portion of CalFresh administrative costs to California. The increased costs are estimated to be $383 million, reflecting a federal cost sharing change from 50 percent to 25 percent. CalFresh benefits cost sharing will not begin until October 2027, and the Newsom administration continues to monitor that potential fiscal impact. Early estimates have put that impact up to $2 billion. The budget also includes $66 million in reduced General Fund costs in 2026-27 due to federal eligibility changes.

In-Home Supportive Services (IHSS) Changes. The Governor’s budget includes several reductions related to IHSS, including $86 million General Fund to conform the IHSS residual program with the timing of Medi-Cal coverage, $3.5 million General Fund to eliminate the Backup Provider System, and $234 million to remove the state’s share of costs for growth in IHSS hours per case. Details have not been provided on how the state’s share of the IHSS hours per case growth will be “removed”. The Newsom administration indicates that discussions are underway with counties on how to achieve this.

Child Care and Early Education

Child Care Increases and Infrastructure. The Governor’s budget includes $7.5 billion ($5.1 billion General Fund) for child care and development programs in 2026-27. The budget includes $89 million to provide a cost-of-living (COLA) adjustment for Department of Social Services child care programs. The budget also includes an increase of $12 million one-time Proposition 64 (marijuana taxes) for child care infrastructure and notes that the funding is specifically for fire impacted communities.

Silent on Potential Fraud in Health and Human Services. Recent reports have documented widespread fraud in various health and human services programs in other states, including allegations of $1 billion in fraudulent claims in Minnesota. Senate Republicans called for greater anti-fraud efforts in their recent priority letter, but the Governor’s budget proposal is notably silent on potential fraud mitigation or investigations across health and human services programs.

Public Safety

Governor Rebuffs Voter-Enacted Crime Reduction Initiative…Again. Last month, Senate Republicans issued a letter setting out budget priorities for the upcoming year, including sufficiently funding Proposition 36. Unfortunately, the Governor’s budget fails to provide any new funding for this key public safety initiative that 68 percent of Californians voted to support in 2024. Notably, there is still no funding proposed for county probation departments that play a critical role in ensuring offenders’ adherence to court-ordered treatment under the measure. Equally notable, the Governor’s plan allows the funding provided in 2025-26 to county behavioral health departments for offender treatment to expire in 2026-27. It seems he is intent on ensuring the failure of this important public safety initiative.

Funding for State to Sue Federal Administration Expands. The 2024-25 Budget included $25 million one time, available through June 30, 2026, for the state (led by the Attorney General) to sue the federal administration in order to slow or stop the President’s agenda. In addition, the 2025-26 budget provided nearly $17 million annually for this purpose. The Governor’s proposed 2026-27 budget adds $10 million to the ongoing $17 million (for a total of $27 million annually) for the Attorney General to litigate against the federal administration. To date, the Attorney General has filed 52 cases against the current administration in just under a year.

Fentanyl Interdiction Funding Continues. A bright spot in the Governor’s 2026-27 budget proposal is that it would continue funding for the California Military Department to support law enforcement efforts to interdict illicit trafficking of fentanyl within the state that is set to expire at the end of 2025-26. The budget includes $30 million ($15 million in 2026-27 and $15 million in 2027-28) to continue this effort for another two years.

Energy and Utilities

Transmission Infrastructure Financing Program. The January budget proposes $323 million from the 2024 Climate Bond to support a financing program at the California Infrastructure Economic Development Bank (IBank) in an effort to accelerate the building of electrical transmission infrastructure. This funding implements Chapter 119, Statutes of 2025 (SB 254).

Resources and Environment

Wildfire Is Now a Permanent Cost for Taxpayers. The 2026-27 budget shows that wildfire is no longer treated as a seasonal emergency. It is now a year-round state expense. CAL FIRE alone will cost $5.3 billion, including $2.2 billion from the General Fund and more than 14,000 full-time positions. These costs continue whether fires are severe or mild, and they grow every year with wages, overtime, and pensions. The California Conservation Corps is also being turned into a standing wildfire workforce, with seven-day fire crews and a new residential fire base in El Dorado County. Senate Republicans called for prioritizing fire prevention in the state budget, but it is unclear how much of these departmental budgets will support actual prevention work such as forest thinning or prescribed fire rather than response personnel.

Proposition 4 Is Being Used to Pay for Everyday Climate and Environmental Work. The Governor’s budget relies heavily on Proposition 4 bond money to fund climate, water, wildfire prevention, coastal protection, parks, and wildlife programs. About $2.7 billion of the bond is already committed in the 2026-27 budget for projects like dam safety, flood control, forest health, and habitat restoration. Because this is borrowed money, Californians will be paying interest on these projects long after the construction is finished.

Cap and Invest Adds Both Cost and Instability. The state’s Cap and Invest program raises billions each year by charging companies for greenhouse gas emissions, but those costs show up in household utility and fuel bills. Utilities and fuel suppliers pass the cost of buying emissions allowances on to consumers, which makes electricity, gasoline, and home energy more expensive. At the same time, Cap and Invest revenue is unpredictable because it depends on market auctions and economic conditions, making it a shaky foundation for funding long-term climate and natural resource programs.

The Governor’s budget proposes $3.4 billion from Cap and Invest for 2026-27, including the following key components, in accordance with 2025’s SB 840 plan:

$1 billion for High-Speed Rail

$750 million for CAL FIRE

$250 million for other SB 840 Tier 2 priorities

$1.4 billion for various “Tier 3” priorities, assuming auction revenues are sufficient, including $141 million for Healthy & Resilient Forests and $396 million for Affordable Housing.

Why This Threatens Long-Term Environmental Protection. Together, these funding choices create a risky system. Bond money runs out, Cap and Invest revenue swings up and down, but wildfire and climate payrolls keep growing. As more of the state’s budget goes to maintaining large agencies and staffing levels, fewer dollars are left for the long-term investments that actually reduce wildfire risk, protect water supplies, and restore ecosystems. Over time, that makes California more vulnerable to environmental damage and drives costs higher for families and taxpayers alike.

Tax Policy

Changes to Marketplace Facilitators Provides Additional Revenue. The Governor’s budget proposes to change the tax delivery requirements for businesses facilitating the delivery of local goods, such as prepared food, known as Delivery Network Companies. These companies are currently exempt from the requirement to register as a marketplace facilitator (consistent with other large online marketplaces). The proposal would provide consistency between facilitators of goods, as well as $20 million in additional General Fund revenue.

Early Extension of CalCompetes Tax Credit Program. Although the CalCompetes Tax Credit program is not set to expire until 2027-28, the Governor’s January budget proposes to extend the program at its current level of $180 million annually through 2032-33.

Business Support and Employment

Unemployment Insurance Debt. The January budget proposes $662 million to pay the annual interest payment on the state’s Unemployment Insurance (UI) loan from the federal government, as required under existing law. Last month Senate Republicans issued a letter setting out budget priorities for the upcoming year, including supporting job creators by reducing the UI debt burden placed on them. Unfortunately, the Governor’s budget fails to provide any new funding to pay down this debt, resulting in increased federal tax burdens on California employers to repay the debt caused by state‑mandated pandemic shutdowns. California is the only state that failed to pay the federal government back for its pandemic-era UI loan.

Transportation

Tax Credits for Sustainable Aviation Fuel. The January budget proposes to provide tax credits against diesel tax liability to incentivize the development and production of sustainable aviation fuels. While proposal details are forthcoming, the Newsom administration provided an estimate of lost diesel tax revenues of $165 million initially, ramping up to $300 million at full program implementation. These revenues fund various transportation programs, and it is unknown which programs would be impacted.

Gas Taxes Increase Again. Despite claims to prioritize affordability for Californians, the Governor proposes no changes to existing law, continuing the automatic annual tax increases to gasoline and diesel fuel. Gasoline taxes are estimated to increase as of July 1, 2026, by 2.2 cents per gallon (cpg), or 3.6 percent, to 63.4 cpg, and diesel fuel taxes would increase by 1.6 cpg, or 3.4 percent, to 48.2 cpg.

High-Speed Rail Funding. The proposed budget includes $1 billion from Cap-and-Invest revenues for the California High-Speed Rail Project, consistent with Chapter 121 of 2025 (SB 840), bringing total funding for the project in 2026-27 to $1.5 billion.

General Government

Facing Multiyear Deficits, Governor Continues to Expand Bureaucracy. Despite years of deficits ahead, the Governor continues to propose yet more bureaucracy that would cost Californians millions of dollars annually. The budget includes a new Office of Civil Rights within the Government Operations Agency (to provide educational resources and training to local education agencies) and the reinstatement of the California Education Learning Lab with $4 million in General Fund (the Lab was eliminated in the 2025 Budget Act), to name a few.