Executive Summary

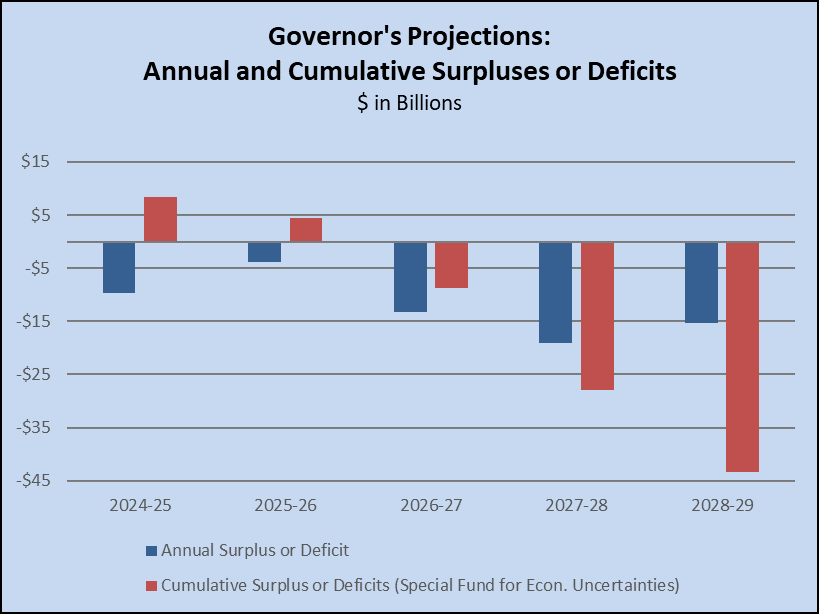

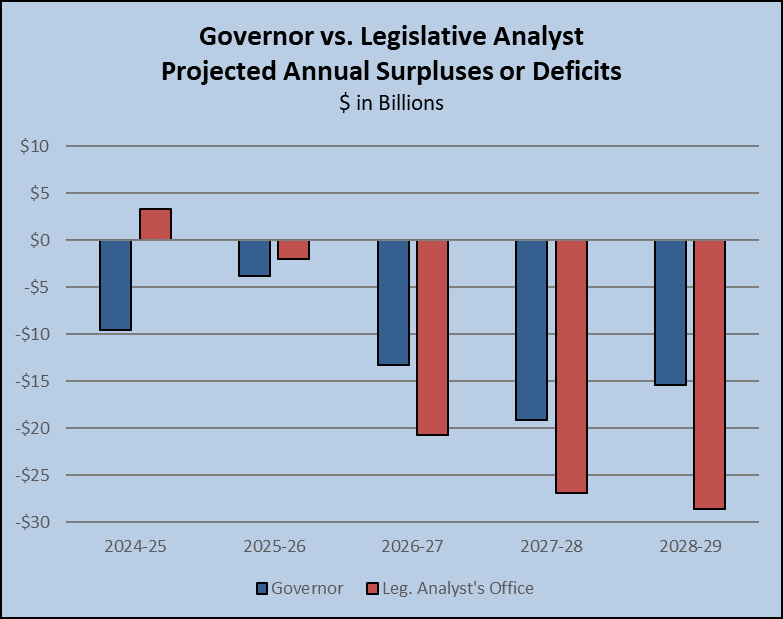

Governor Claims Small Surplus; Nonpartisan Analyst Projects Deficit. The Governor’s budget projects a small “surplus” of $363 million for 2025-26, resulting in part from an increase in revenue projections and the withdrawal of $7.1 billion from state reserves. However, the nonpartisan Legislative Analyst’s Office (LAO) estimated that the state would have a deficit of $2 billion. The difference in the Governor’s and LAO’s projections appears to be the net result of the Governor’s higher revenue projections, offset partially by higher expenditures, though details remain to be sorted out.

Although this difference is small as a percent of state spending, it is a crucial distinction because recognizing a $2 billion deficit would require proposing the same amount of solutions, which could affect numerous state programs. Since the Governor does not forecast a deficit, the budget does not include any proposed solutions. Also, many Californians would find it strange to claim there is a budget surplus when the state has to withdraw funds from its reserves to pay its bills.

Claims of a Balanced Budget Undercut by Previous Deficit Actions. Many Californians would find it strange to claim the budget is balanced when the state has to withdraw funds from reserves to pay its bills. The state took actions during the 2024 budget process to address the deficit projected at that time for 2025-26. These actions included $27 billion in budget solutions for 2025-26, including the withdrawal of $7.1 billion from reserves as well as fund shifts, tax increases, and reductions.

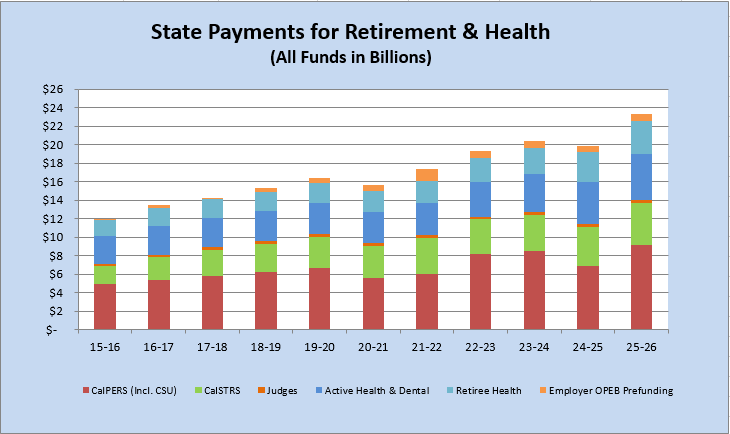

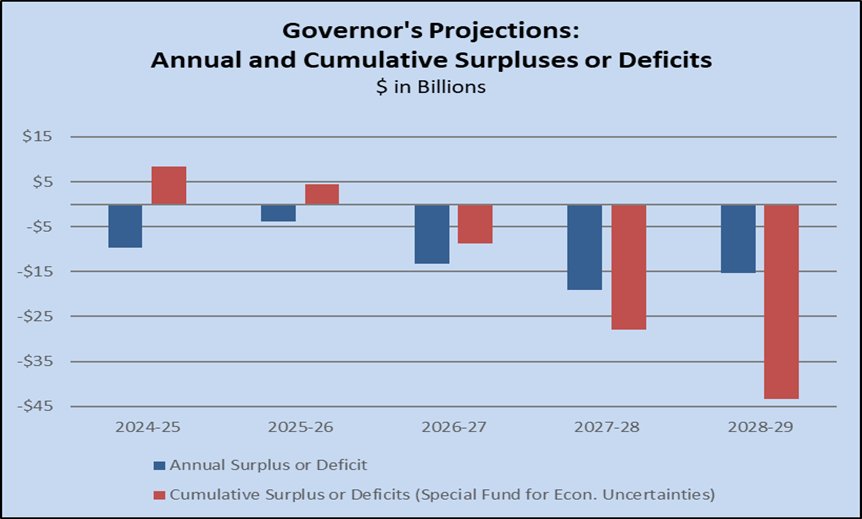

Massive Deficits Persist Throughout Forecast. The Governor’s multiyear forecast also indicates the state will have annual operating deficits ranging from $13 billion to $19 billion each year through 2028‑29, as illustrated in the chart below. If left unaddressed, these deficits would generate a cumulative deficit of $43 billion by 2028-29. In spite of this dismal projection, the Governor proposes no budget solutions to establish a structurally balanced budget.

Revenues Above Levels Previously Projected. The Governor’s budget reflects General Fund revenues of $218 billion in the current 2024-25 fiscal year, higher than the enacted budget level by $10 billion. This total would remain flat at $218 billion in 2025-26 under the Governor’s plan. When considering the three-year budget “window,” the Governor’s budget estimates that General Fund revenues will be higher by nearly $17 billion combined through the 2025‑26 budget year, compared to levels assumed in last summer’s enacted budget.

Expenditure Growth Driven by Health and Human Services (HHS) Expansions. When comparing the proposed General Fund spending for 2025-26 to the enacted 2024-25 budget, an astonishing increase of more than $17 billion can be seen. The table below summarizes the changes by major program area. Most notably, spending for HHS programs grows by nearly $12 billion from the enacted level. This increase is the result of higher-than-expected costs for Medi-Cal benefits for undocumented immigrants, as well as growth in the In-Home Supportive Services program and Child Care programs. In short, the Governor and legislative Democrats have continued to ramp up major expansions in new or expanded entitlement programs, even while slashing university budgets, underfunding fire prevention, borrowing, and withdrawing over half the state’s budget reserves.

| General Fund Expenditures by Agency | ||||

| (Dollars in Millions) | ||||

2024-25 | 2025-26 | |||

Agency | Enacted | Revised | Proposed Jan. 2025 | Change |

| Legislative and Executive | $4,367 | $7,427 | $4,438 | $71 |

| Courts | $3,222 | $3,182 | $3,356 | $134 |

| Business, Consumer Services, Housing | $1,324 | $3,754 | $285 | -$1,038 |

| Transportation | $209 | $237 | $160 | -$49 |

| Natural Resources | $3,786 | $6,430 | $3,694 | -$91 |

| Environmental Protection | $214 | $589 | $133 | -$81 |

| Health and Human Services | $71,193 | $76,036 | $83,137 | $11,945 |

| Corrections and Rehabilitation | $13,749 | $13,635 | $13,203 | -$546 |

| TK-14 Education (Proposition 98) | $82,612 | $85,053 | $84,603 | $1,990 |

| Higher Education (Non-Prop. 98) | $20,170 | $20,252 | $19,574 | -$596 |

| Labor and Workforce Development | $949 | $1,121 | $963 | $14 |

| Government Operations | $2,467 | $3,473 | $3,340 | $873 |

| General Government | $821 | $4,377 | $5,339 | $4,518 |

| Capital Outlay | $567 | $850 | $485 | -$82 |

| Debt Service | $5,856 | $5,635 | $6,183 | $327 |

| Total, General Fund Expenditures | $211,504 | $232,051 | $228,892 | $17,388 |

| ||||

Reserves Severely Diminished After Recent Withdrawals. The proposed budget would withdraw $7.1 billion from the state’s reserves in 2025-26, as planned during last year’s budget process. This would leave $17 billion in remaining reserves, which is a relatively low 6.8 percent of General Fund resources in 2025-26.

Federal Funds Uncertain for Health Mandate, Other Programs. The Governor’s budget is counting on the federal government to provide $6 billion to pay for the state’s recently enacted health facility wage mandate (SB 525, Durazo). The budget expands the Hospital Quality Assurance Fee to generate $6 billion in federal funds to help pay the costs, but the scheme requires approval from the Trump administration. The state projects total federal funds of $171 billion in 2025-26, primarily through Medi-Cal, and some of those funds could be at risk from federal cutbacks as well.

Housing and Homelessness

Budget Fails to Provide New Funding for Housing Programs. The January budget does not include any new funding for the state’s various housing programs. Rather, the Governor proposes yet another bureaucratic expansion with the creation of a new agency, the California Housing and Homelessness Agency. The proposal would move through the existing process overseen by the Little Hoover Commission, and few details are available at this time.

No Details, but Housing Policy Principles Outlined. Although the Governor does not include any new General Fund for housing programs, the budget does outline what is identified as “policy principles” for housing. These principles include ways to reduce the cost to build, improve accountability, and advance policies that promote climate change initiatives, such as transit-oriented housing development. It remains to be seen if the Governor will release specific trailer bill language to effectuate these principles or if the budget rhetoric is just intended to mitigate the obvious concerns for the lack of progress in addressing California’s housing woes.

Budget Fails to Provide New Flexible Funding for Local Governments’ Homelessness Programs. The Governor’s budget fails to include any new General Fund in 2025-26 for the Homeless Housing Assistance and Prevention program, a program local governments rely on to provide flexible funding necessary to support various local homelessness efforts.

Encampment Resolution Grant Program. The budget includes $100 million General Fund for the Encampment Resolution Grant Program. The program provides grant funding to assist local governments with resolving critical encampment concerns and transitioning individuals into safe and stable housing.

TK-12 Education

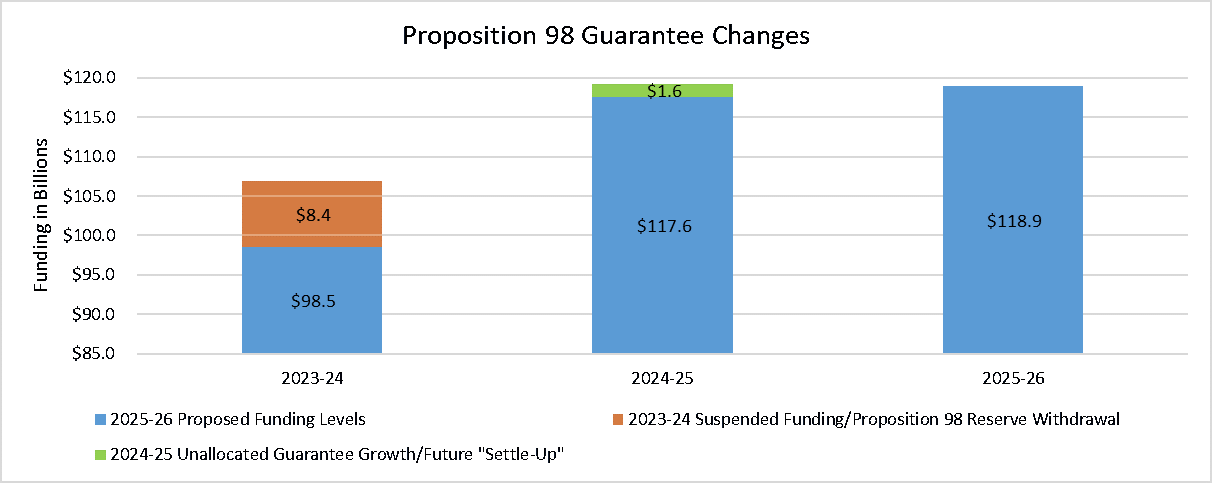

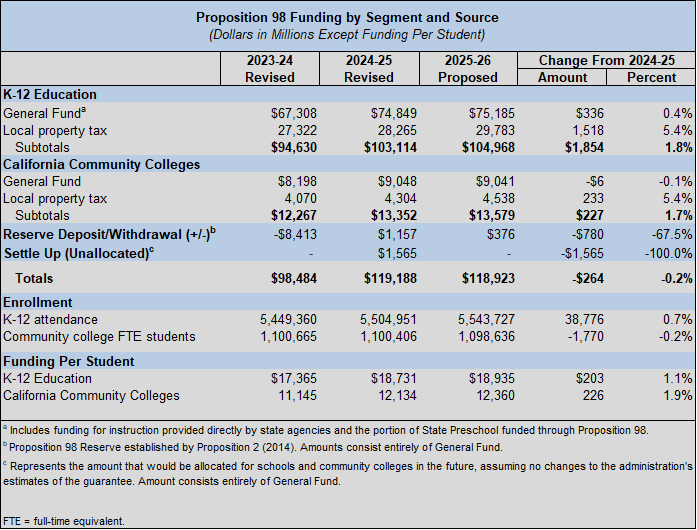

Proposition 98 Education. The Governor’s budget includes $137 billion ($83 billion General Fund and $54 billion other funds) for all TK-12 education programs. Proposition 98 funding for TK-12 schools and community colleges in 2025-26 is $119 billion. The budget maintains a Proposition 98 funding level of $99 billion in 2023-24. The revised 2024-25 Proposition 98 guarantee is calculated at $119.2 billion, however, the budget proposes to fund the guarantee at $117.6 billion, for a difference of $1.6 billion. According to the Department of Finance, this is to provide a buffer for changes in the guarantee before the final calculations are made.

Proposition 98 General Fund spending per pupil would be $18,918 in 2025-26 and $24,764 per pupil from all funding sources. This is a Proposition 98 General Fund increase of $7,041 per pupil, or 59 percent, compared to six years ago in 2019-20, the year before the pandemic started. When accounting for all funds, it is an increase of $7,750 per pupil, or 46 percent.

Local Control Funding Formula. The Governor’s budget proposes a $2.5 billion increase in the Local Control Funding Formula (LCFF). This reflects a 2.43 percent cost of living adjustment (COLA) and population growth adjustments.

Proposition 98 Reserve. The budget reflects a revised final balance in the Public School System Stabilization Account of $1.5 billion at the end of 2025-26. This reflects revised deposits of $1.2 billion and $376 million in 2024-25 and 2025-26 respectively, both of which are mandatory. The balance in 2024-25 is $1.2 billion, which does not trigger the previously authorized (but ill-advised) 10 percent cap on local school district reserves in 2025-26.

Student Support and Professional Development Discretionary Block Grant. The Governor’s budget proposes $1.8 billion one-time Proposition 98 General Fund for the Student Support and Professional Development Discretionary Block Grant. According to available information, the funding is intended for career pathways and dual enrollment expansion, teacher recruitment and retention, and professional development for teachers on mathematics, English language arts, and literacy.

Proposition 2 School Facility Funding. The Governor’s budget notes that the passage of Proposition 2 in November 2024 authorized $8.5 billion in state General Obligation bonds for K-12 schools, which will be allocated through the existing School Facility Program. The bond funding allocation is $4 billion for modernization projects, $3.3 billion for new construction, $600 million for charter schools, and $600 million for career technical education projects. It should be noted that the 2024-25 budget eliminated a planned $550 million one-time General Fund investment in the Preschool, Transitional Kindergarten, and Full Day Kindergarten Facility Grant program, and another planned $875 million one-time General Fund investment in the School Facility Program, in anticipation of the bond passing.

Literacy Screenings and Instruction. The Governor’s budget proposes $500 million one-time Proposition 98 General Fund for TK-12 Literacy and Mathematics Coaches, which builds upon $500 million one-time Proposition 98 General Fund provided in prior budgets. In addition, the Governor’s budget proposes $40 million one-time Proposition 98 General Fund to support training educators on literacy screenings and other costs, such as screening materials. The 2024 Budget Act also appropriated $25 million one-time Proposition 98 General Fund for professional development related to the implementation of literacy screenings for reading disabilities in kindergarten through second grade.

Higher Education

University Deferrals and Reductions Maintained. The Governor’s budget maintains previously planned deferrals and reductions to the University of California and California State University systems. The University of California’s five percent base increase of $241 million and $31 million for the replacement of 902 nonresident undergraduate students is deferred to 2027-28. The California State University five percent base increase of $252 million is deferred to 2027-28. Under last year’s budget actions, both the University of California and California State University are subject to a 7.95 percent General Fund operations reduction, representing $397 million and $375 million, respectively.

Community Colleges Categorical Cost of Living Adjustment. The Governor’s budget includes $230 million ongoing Proposition 98 General Fund to provide a 2.4 percent cost-of-living adjustment for Student-Centered Funding Formula apportionments and $30 million ongoing Proposition 98 General Fund for 0.5 percent enrollment growth.

Community College Facilities Bond Funding. Following the voters’ enactment of the Proposition 2 education bond, the budget proposes $52 million one-time bond funds allocated for infrastructure, modernization, and enrollment growth projects for 28 community college facilities.

Credit for Prior Learning Expansion. The Governor’s budget includes $100 million one-time Proposition 98 General Fund ($7 million of which is ongoing) to update and modify credit for prior learning policies. Students’ past experiences, such as military service, could earn course credit. This proposal is part of the Governor’s Master Plan for Career Education.

Health

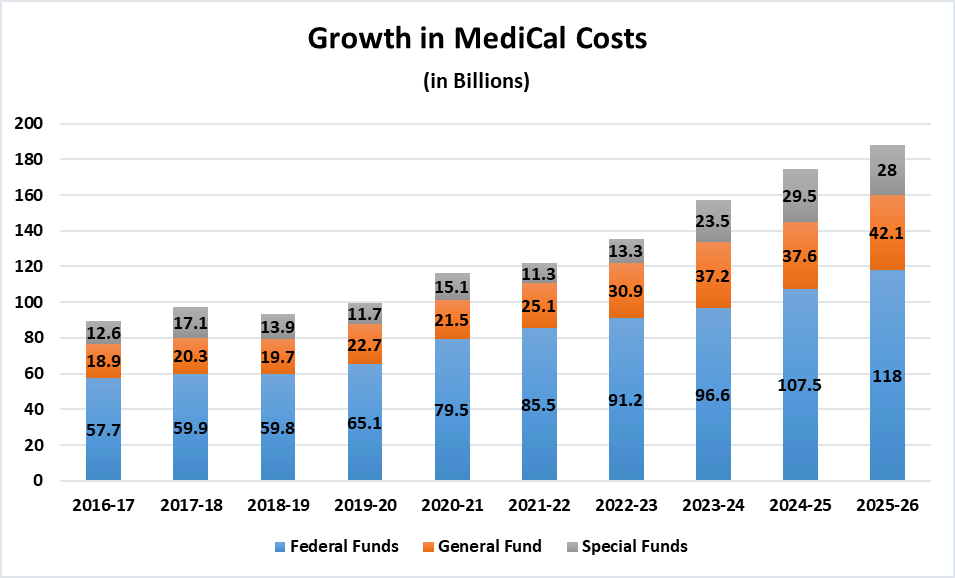

Higher Caseload, Pharmacy Costs, and Giveaways Increase Medi-Cal Budget. The Governor’s budget estimates that current Medi-Cal enrollment has increased to 15 million Californians at a cost of $38 billion General Fund in 2024-25, an increase of more than 450,000 individuals and $2.8 billion General Fund over the 2024 Budget Act estimates. The Governor also projects a $1.5 billion General Fund increase in pharmacy expenditures through 2025-26. For the 2025-26 budget year, the Governor proposes a record $42 billion General Fund for Medi-Cal expenditures, a $4.5 billion year-over-year increase from 2024-25, an amount that includes the ongoing costs of prior-year Democrat priorities such as the expansion of Medi-Cal to 1.5 million undocumented individuals and the increase in wage mandates for healthcare facilities, which took effect in October 2024.

Concerning Delay of Proposition 35 Implementation. Proposition 35, approved by the voters in November 2024 and supported by a large coalition of Medi-Cal providers, permanently authorizes the state to impose a tax on managed care plans (MCO tax), and restricts use of the MCO tax proceeds to Medi-Cal provider reimbursement rate increases. The Governor’s budget assumes that full implementation of Proposition 35 would be delayed until 2026 after the administration negotiates a new spending plan with the provider coalition. In doing so, the Governor sweeps an additional $1 billion of MCO tax for General Fund relief. Medi-Cal providers may question the Governor’s interpretation of the proposition requirements and could challenge the proposal to take more MCO tax for budget relief.

Free Diapers for Newborns. The Governor proposes the creation of a new state program to supply three-month’s worth of diapers for every family with a newborn baby. The Governor proposes using $7.4 million in General Fund in 2025-26 and $13 million in future years to cover this new benefit, which would be implemented through state contracts with hospitals. Legislators may question whether this program should be open to all Californians or should be limited to those families truly in economic need. It is also unclear how this proposal would overlap with existing health and human services entitlements.

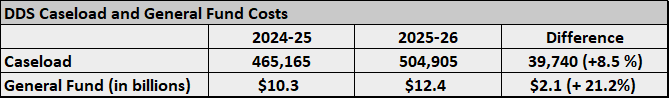

Developmental Services

Finally Implementing Rate Increases to Developmentally Disabled Service Providers. The Governor finally funds a long-delayed promise to families with developmentally disabled individuals by including an additional $2.3 billion General Fund through 2025-26 to increase the reimbursement rates for service providers. These rate increases will allow service provider vendors to hire more individuals in order to serve the growing demand for services. The Governor also plans to release a Master Plan for Developmental Services in March 2025 to outline future improvements in the delivery of services.

Human Services

Department of Social Services Total Budget. The Governor’s proposed budget for the Department of Social Services is $62 billion ($23 billion General Fund) for 2025-26.

CalWORKs Federal Pilot Program. California was selected as one of five states to participate in a federal pilot program that seeks to test alternative benchmarks to work participation rates. This means California’s entire CalWORKs program will be operating under alternative accountability measures. While details are still being worked out on how the state will advance the goals of the pilot project, prior authorizations were provided to the Department of Social Services to consider proposals to modify the existing welfare-to-work process, limit sanctions, and repeal the federal work participation rate penalty pass-through.

CalWORKs Grant Increase. The Governor’s budget includes a 0.2 percent increase to the CalWORKs Maximum Aid Payment levels, estimated to cost $9 million in 2025-26. This increase is funded entirely by the Child Poverty and Family Supplemental Support Subaccount, a fund source that the state previously realigned to counties. While this expansion is being covered by the subaccount, it should be noted that if the subaccount ever has insufficient funding to cover this increase or any prior grant increases, General Fund will be used to backfill the difference.

Child Care and Early Education

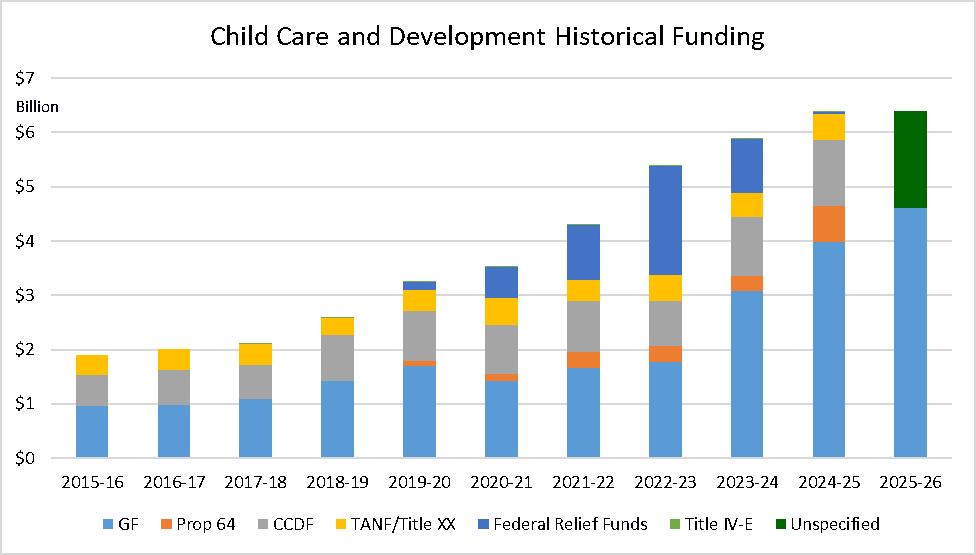

Child Care Collective Bargaining and Rate Increases. The Governor’s budget includes $6.4 billion ($4.6 billion General Fund) for child care and development programs in 2025-26. No new child care proposals have been included in the Governor’s budget, but are expected to appear at a later time. The current bargaining agreement with Child Care Providers United (CCPU) expires on June 30, 2025. The Administration is still in negotiations with CCPU for a new agreement, which is likely further complicated by the continued push to roll out an alternative rate methodology. The 2024 budget set a requirement that the Governor and Legislature establish reimbursement rates based on the alternative methodology by no later than July 1, 2025. No details have been provided on the potential cost of the new bargaining agreement with CCPU.

Public Safety

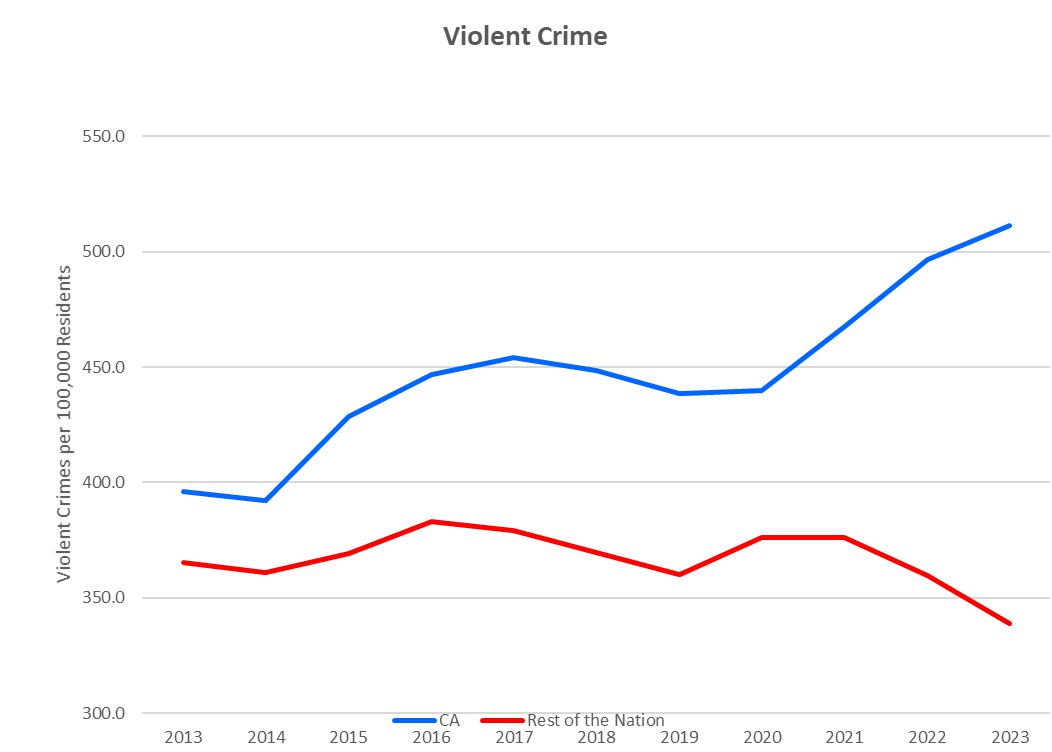

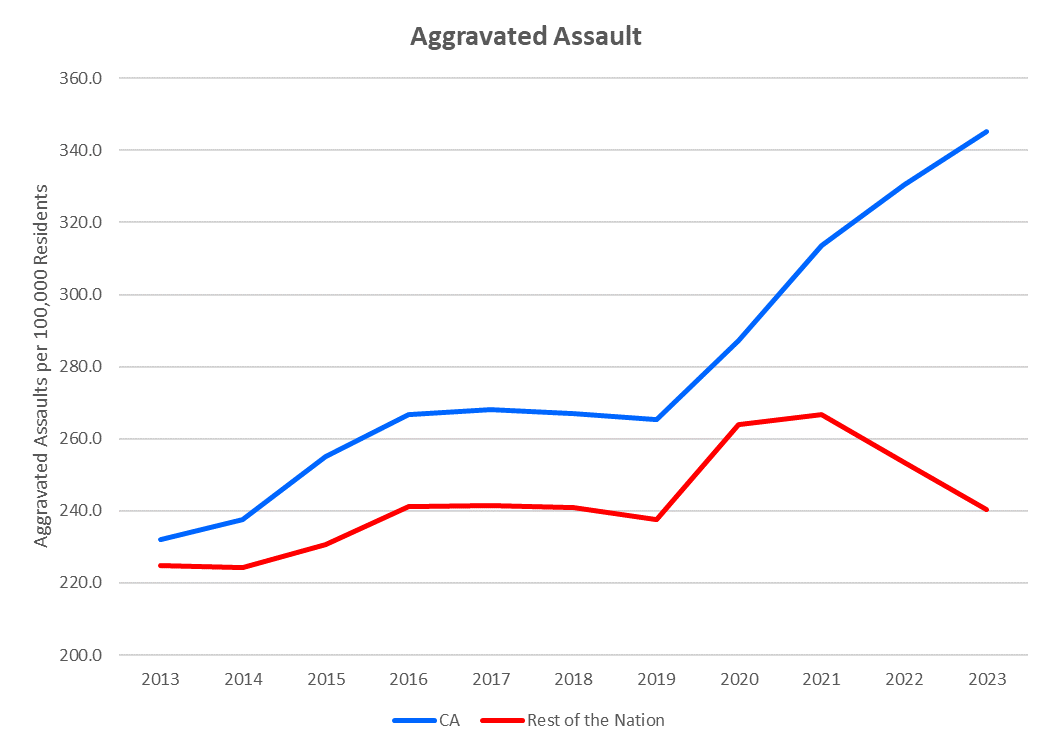

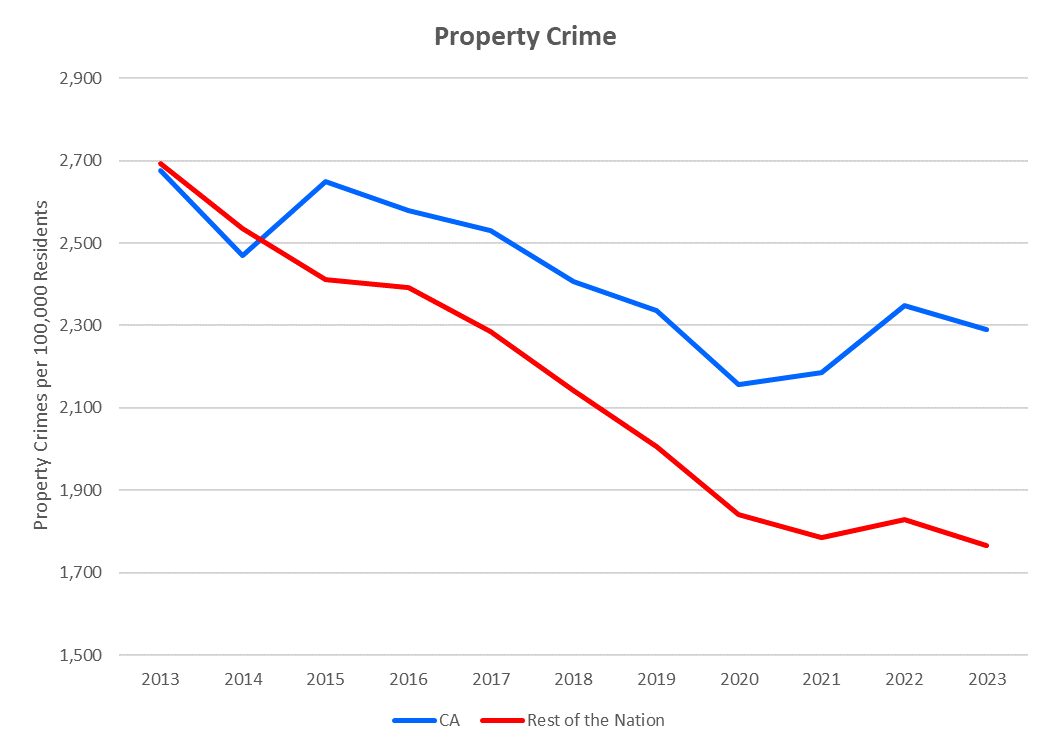

Worsening Crime Trends Continue With no Plan to Combat Them. Violent crime continues to increase in California. Property crime rates are worse in this state than the rest of the nation in all four categories tracked by the Federal Bureau of Investigation. Californians are 51 percent more likely to be victims of violent crime and 31 percent more likely to be victims of property crime than other Americans on average. Despite these alarming statistics, the Governor’s budget fails to reflect any comprehensive plan to address crime. In fact, the only truly new funding to combat crime is $5 million for the California Highway Patrol to increase investigations into human trafficking and distribution of child pornography (see below).

Child Pornography and Human Trafficking Investigations. The budget proposes $5 million General Fund and 12 positions ongoing, beginning in 2025-26, for the California Highway Patrol to assist local law enforcement agencies with multi-jurisdictional investigations into human trafficking and the distribution of child sexual abuse material. These resources will help to combat the recent alarming increase in child pornography that has been closely linked with human trafficking.

Bare Minimum for Proposition 36 Implementation. The Governor’s budget funds the projected increase in the state prison population of 818 inmates in 2024-25 and 1,606 in 2025-26, but fails to include any funding for the courts to hear more felony cases, nor does it provide any funding for cities or counties to provide court-ordered treatment and services to offenders that are at the heart of Proposition 36. This budget essentially ignores the will of the voters, nearly 70 percent of whom supported Proposition 36 despite the Governor’s opposition to the measure.

Continuing to Soften the Prison Experience. The budget proposes $7.8 million in 2025-26 and $13 million annually thereafter to increase staffing and expand rehabilitative programming at the San Quentin Rehabilitation Center. This new funding will further the San Quentin implementation of the “California Model”, which focuses on trauma-informed programming, normalization of the physical environment, and generally making prison feel less like prison. It seems unlikely these measures will enhance public safety in any measurable way over the long term.

Partial Reversal of Ill-Advised Trial Court Reduction. The Governor’s proposed budget reverses $42 million of a $97 million unallocated reduction to trial court operations that was included in the 2024 Budget Act. This unallocated reduction would have required courts to re-calendar cases to meet statutory timelines for criminal caseloads, which ultimately would have led to worsening backlogs of civil cases. While the $42 million reversal is an improvement, the trial courts still face a $55 million reduction in 2024-25 and ongoing, which unfortunately means civil case delays and backlogs are still likely.

Fire and Climate Issues

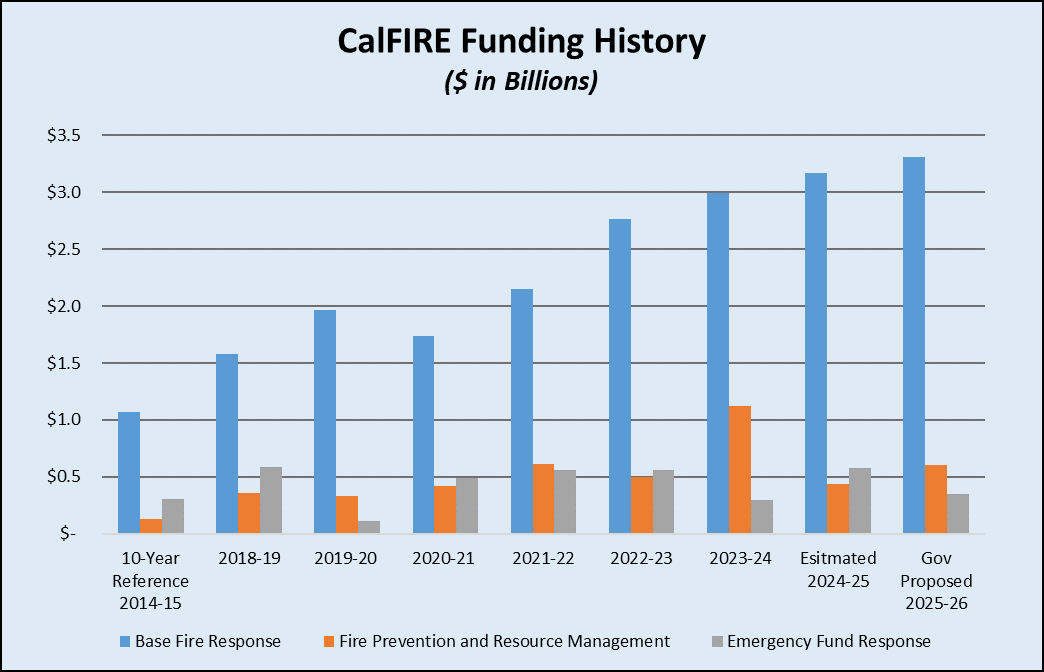

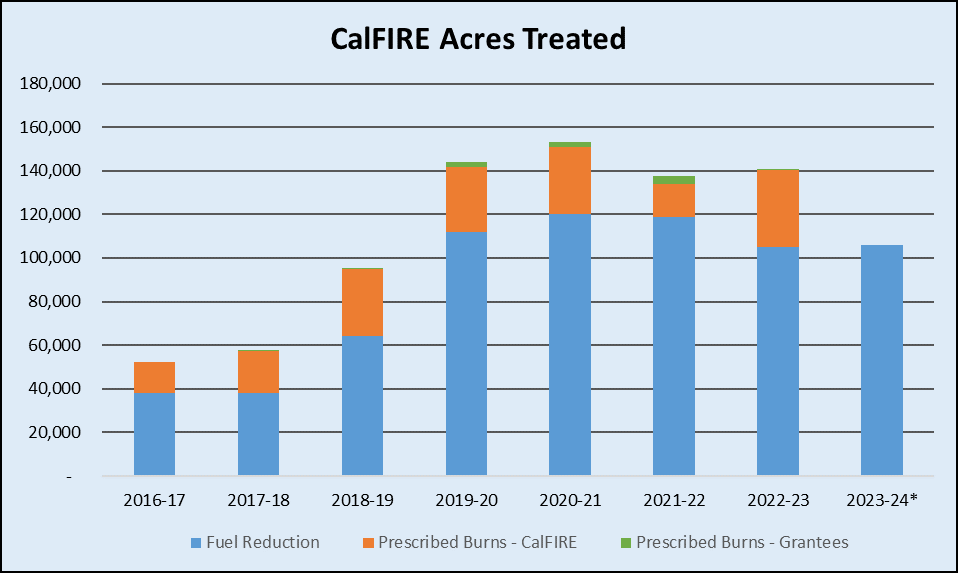

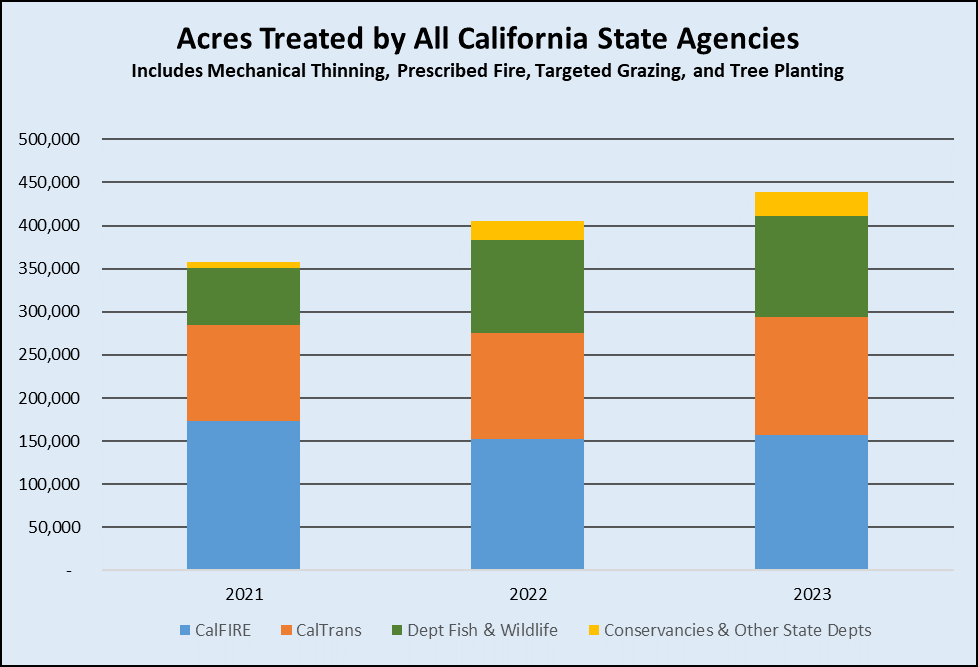

Fire Prevention Improved in Recent Years But Still Short of Need. An examination of recent trends in wildfire prevention and response shows that, although CalFIRE’s budget increased substantially during the recent surplus years, funding for prevention has dropped following a short-term increase. The state is ramping up toward meeting its goal of treating 500,000 acres of forest per year, established in a 2020 agreement with the federal government, but should continue to expand prevention efforts instead of letting prevention funds decline.

Bond Funds for Fire. The budget proposes $325 million from the climate bond for fire-related issues, including $82 million for forest health, $80 million for regional efforts, $59 million for local fire grants, and smaller amounts for state lands and wildfire mitigation. Without a clear focus on long-term forest management or ensuring grants are used effectively, however, these measures may fall short of reducing fire risks or addressing California’s escalating wildfire crisis.

Overall Climate Spending Relies on Bond Funds. The Governor’s budget heavily relies on allocating $2.7 billion in funds from the recently passed climate bond (Proposition 4) to manage the state’s resources and address an array of environmental and infrastructure challenges. Specific allocations include the following:

- Water Projects. $232 million is earmarked for dam safety, $183 million for water quality, $173 million for flood management, $153 million for water reuse, $148 million for Salton Sea restoration, and $174 million for water storage. However, the budget overlooks opportunities to link water quality with flood management, potentially leaving communities vulnerable to disasters and higher future costs.

- Coastal Resilience. Proposed spending includes $31 million for resilience projects, $20 million for sea level rise mitigation, and $8.5 million for dam removal.

- Extreme Heat Mitigation. With $47 million for urban greening, $38 million for fairground updates, and $16 million for community programs.

- Biodiversity. $176 million supports fish and wildlife conservation, $80 million goes to state conservancies, and $9.4 million is allocated for tribal nature-based projects. Tribal initiatives, however, receive disproportionately low funding, and the lack of coordination with wildfire prevention efforts could reduce overall effectiveness.

- Climate-Smart Agriculture. Allocations include $38 million for water efficiency, $36 million for healthy soils, and $20 million for invasive species.

- Outdoor Access. Parks receive $190 million for statewide programs, $84 million for deferred maintenance, and $11 million for recreation.

- Offsetting General Fund Expenditures with Bond Funds. The plan shifts $273 million from General Fund obligations to climate bond funding for land stewardship, recycling, and dam safety. This lacks transparency, as the selection criteria for these projects remain unclear, raising concerns about fiscal accountability.

- Port Upgrades for Offshore Wind Development. The Governor proposes $228 million for upgrades to California ports to accommodate the development of offshore wind electricity generation. Spending taxpayer dollars on port upgrades prior to fully assessing the environmental impacts and viability of floating windmills may be placing the cart before the horse.

- Transportation Fuel. The budget allocates $2.3 million to explore higher ethanol blends (E15). While a step forward, the plan overlooks the potential costs and benefits of transitioning, risking ineffective policies without adequate scientific backing or stakeholder input.

Tax Policy

Expands the Hollywood Film Tax Credit. The Governor’s January budget prioritizes the Film and Television Tax credit program, increasing the available tax credits from $330 million to $750 million annually from 2025-26 through 2029-30. The budget assumes a revenue reduction of $15 million in 2025-26, growing to more than $200 million annually.

Single Sales Factor Would Increase Taxes on Corporations. The Governor’s budget would increase General Fund revenues by $330 million in 2025-26 as a result of requiring multi-state financial firms to use a mandatory single sales factor policy instead of the equally weighted three-factor formula. With this change, a California-based financial corporation with significant payroll and property in the state could be able to reduce its tax bill with the proposed switch to a single sales factor, but an out-of-state financial corporation that has relatively high sales in California compared to its property and payroll would see the tax liability of the company increase.

Retirement Income Exclusion for Vets. The budget includes a reduction of $130 million in General Fund revenue (projected loss of $85 million General Fund annually thereafter) as a result of excluding from taxable income military retirement and survivor benefit payments received by a veteran from the federal government. The proposal would exclude up to $20,000 and would be limited to taxpayers with up to $250,000 in income for joint filers, and $125,000 in income for single filers.

Wildfire Settlements Income Exclusion. The budget proposes to exempt all wildfire settlements from state taxation for settlements paid in tax years 2025 through 2029, regardless of when the fire occurred. Republicans have proposed similar exemptions in the past that were not enacted, so this proposal is a welcome step, though relief for prior fires is still lacking.

Extension of Pass-Through Entity Elective Tax. The budget proposes to extend the state’s pass‑through elective tax if the federal government extends the state and local tax payment changes enacted in the Tax Cut and Jobs Act of 2017. These tax policies are set to expire after 2025.

Labor and Employment

CalCompetes Grant Program Prioritized. The budget proposes $60 million in one-time General Fund for the CalCompetes Grant program, which was created in 2021-22 and is meant to provide financial assistance to businesses unable to participate in the CalCompetes Tax Credit program.

New Funding for Social Enterprises. The budget includes $17 million in one-time General Fund for the Regional Initiative for Social Enterprises Program, a grant program intended to provide specialized support to people facing high barriers to work, connecting employment social businesses with the other job training programs.

Interest Payment for Unemployment Debt. The Governor’s budget includes $634 million (General Fund) for the annual interest payment on the state’s growing $21 billion Unemployment Insurance loan from the federal government. Previously, the Governor planned to use $50 million from the Employment Training Fund (paid by employers) to cover a portion of the 2025-26 payment. However, after the current year $100 million interest payment from this fund, it was determined further interest payments would require reductions to employment training programs meant to create a skilled and productive workforce. These interest payments and the increased tax burden on California businesses would have been avoided if the Governor had used past surplus funds to pay off the federal loan.

Employment Development Department Problems. The proposed budget includes $124 million ($62 million General Fund) for the Employment Development Department’s computer systems, improved service for claimants, and fraud prevention. This money would fund the fourth year of a five‑year modernization plan which began in 2022-23.

Erosion of State Operations Savings and Vacancy Sweep. In order to help address last year’s $71 billion deficit, the 2024-25 budget authorized statewide operations savings of up to 7.95 percent and the elimination of 10,000 vacant state positions. The Governor’s budget now reflects lower-than-projected results from these two actions. Savings for the 7.95 operations reductions are now projected to be $1.2 billion in 2025-26 and thereafter, compared to last year’s assumed savings of $2.7 billion. The number of vacancies swept would be 6,500, rather than 10,000, and the resulting savings would be $234 million General Fund, rather than the previously assumed $763 million. During last year’s budget process, the nonpartisan LAO and Senate Republicans raised concerns that the promised savings would in fact not appear as promised, and the Governor’s proposal now validates these concerns.

Transportation

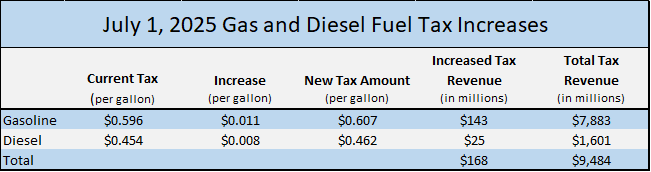

Gas Taxes Increase Again. Despite claims to prioritize affordability for Californians, the Governor proposes no changes to existing law, continuing the automatic annual tax increases to gasoline and diesel fuel. Gasoline taxes are estimated to increase as of July 1, 2025, by 1.1 cents per gallon (cpg), to 60.7 cpg, and diesel fuel taxes would increase by 0.8 cpg, to 46.2 cpg.

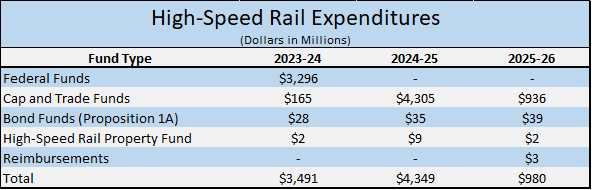

High-Speed Rail. Proposes $980 million in 2025-25 for continued construction and reflects increased current year spending of $2.3 billion, mostly from carryover Cap and Trade funds from the prior year.

General Government

Expands the Governor’s College Corp Volunteer Program. The budget provides $68 million in 2025-26 and $84 million ongoing thereafter to permanently establish the College Corp Program within the Governor’s Office of Service and Community Engagement.

Capital Funding for Non-Profit Technology Center. The budget provides $25 million to reimburse Natcast, a non-profit entity designated to operate the National Semiconductor Technology Center. The new facility is expected to bring in hundreds of millions of dollars in new research funding and create more than 200 new jobs over the next ten years.

Another New “Feel Good” Program. The budget would provide $5 million General Fund to launch what would be known as a “Belonging Campaign” within the Administration. This new program would include research projects to evaluate how Californians define belonging and how connected they feel to their communities.

Overall Budget Condition

Key Points

- Governor Claims Small Surplus; Nonpartisan Analyst Projects Deficit. Governor claims a balanced budget while nonpartisan analyst estimates a $2 billion deficit.

- Claims of a Balanced Budget Undercut by Previous Deficit Actions. Budget is supported by $27 billion in deficit solutions enacted last year, including a $7.1 billion reserve withdrawal.

- Expenditure Growth Driven by Health and Human Services (HHS) Expansions. Spending is up by $17 billion compared to enacted 2024-25 budget, driven by higher costs stemming from major recent HHS expansions.

- Deficits Persist Throughout Forecast. Lack of ongoing budget-balancing actions mean that deficits of $13 billion to $19 billion persist throughout the forecast.

- Reserves Severely Diminished After Withdrawals. Two years of reserve withdrawals leave California ill-prepared for future deficits.

- Federal Funding Uncertain for Health Wage Mandate and Other Programs. Budget counts on $6 billion in federal funds to pay for recent state health facility wage mandate, but Trump administration must approve the request.

Governor Claims Small Surplus; Nonpartisan Analyst Projects Deficit. The Governor’s budget projects a small “surplus” of $363 million for 2025-26, resulting in part from an increase in revenue projections and the withdrawal of $7.1 billion from state reserves. However, the nonpartisan Legislative Analyst’s Office (LAO) estimated that the state would have a deficit of $2 billion. The difference in the Governor’s and LAO’s projections appears to be the net result of the Governor’s higher revenue projections, offset partially by higher expenditures, though details remain to be sorted out.

A deficit of $2 billion is small as a percent of the $229 billion General Fund budget, leading the LAO to describe the budget as “roughly balanced” despite the shortfall. However, recognizing the likelihood of a deficit is a crucial distinction because it would require proposing the same amount of solutions. Finding $2 billion in solutions could affect numerous state programs. Since the Governor does not forecast a deficit, the budget does not include any proposed solutions.

Claims of a Balanced Budget Undercut by Previous Deficit Actions. Many Californians would find it strange to claim the budget is balanced, or even has a small surplus, when the state has to withdraw funds from reserves to pay its bills. The state took actions during the 2024 budget process to address the deficit projected at that time for 2025-26. These actions included $27 billion in budget solutions for 2025-26, including the withdrawal of $7.1 billion from reserves as well as fund shifts, tax increases, and reductions. The approach of addressing two years of deficits last year is to be commended, but taking the actions early does not equate to claiming the budget is inherently balanced now.

Revenues Above Levels Previously Projected. The Governor’s budget reflects General Fund revenues of $218 billion in the current 2024-25 fiscal year, higher than the enacted budget level by $10 billion. This total would remain flat at $218 billion in 2025-26 under the Governor’s plan. When considering the three-year budget “window,” the Governor’s budget estimates that General Fund revenues will be higher by nearly $17 billion combined through the 2025‑26 budget year, compared to levels assumed in last summer’s enacted budget.

Expenditure Growth Driven by Health and Human Services (HHS) Expansions. General Fund expenditures under the Governor’s proposal would reach a revised total of $232 billion in the current fiscal year, which is, surprisingly, $20 billion above the level enacted seven months ago for the 2024-25 budget. Preliminarily, this increase appears to be partially the result of expenditures shifting from 2023‑24 into 2024-25, but also higher revised estimates for HHS programs, including an increase of $2.8 billion in Medi-Cal expenditures following recent eligibility expansions.

When comparing the proposed General Fund spending for 2025-26 to the enacted 2024-25 budget, an astonishing increase of more than $17 billion can be seen. The table below summarizes the changes by major program area. Most notably, spending for HHS programs grows by nearly $12 billion from the enacted level. This increase is the result of higher-than-expected costs for the recent expansion of full Medi-Cal benefits for undocumented immigrants, as discussed further in the Health section. This expansion also creates significantly higher costs in the In-Home Supportive Services program, as discussed in the Human Services section. Child care spending has also skyrocketed due to recent expansions, and is now growing by an unsustainable 20 percent per year. In short, the Governor and legislative Democrats have continued to ramp up major expansions in new or expanded entitlement programs, even while slashing university budgets, underfunding fire prevention, borrowing, and withdrawing over half the state’s budget reserves.

| General Fund Expenditures by Agency | ||||

| (Dollars in Millions) | ||||

2024-25 | 2025-26 | |||

Agency | Enacted | Revised | Proposed Jan. 2025 | Change |

| Legislative and Executive | $4,367 | $7,427 | $4,438 | $71 |

| Courts | $3,222 | $3,182 | $3,356 | $134 |

| Business, Consumer Services, Housing | $1,324 | $3,754 | $285 | -$1,038 |

| Transportation | $209 | $237 | $160 | -$49 |

| Natural Resources | $3,786 | $6,430 | $3,694 | -$91 |

| Environmental Protection | $214 | $589 | $133 | -$81 |

| Health and Human Services | $71,193 | $76,036 | $83,137 | $11,945 |

| Corrections and Rehabilitation | $13,749 | $13,635 | $13,203 | -$546 |

| TK-14 Education (Proposition 98) | $82,612 | $85,053 | $84,603 | $1,990 |

| Higher Education (Non-Prop. 98) | $20,170 | $20,252 | $19,574 | -$596 |

| Labor and Workforce Development | $949 | $1,121 | $963 | $14 |

| Government Operations | $2,467 | $3,473 | $3,340 | $873 |

| General Government | $821 | $4,377 | $5,339 | $4,518 |

| Capital Outlay | $567 | $850 | $485 | -$82 |

| Debt Service | $5,856 | $5,635 | $6,183 | $327 |

| Total, General Fund Expenditures | $211,504 | $232,051 | $228,892 | $17,388 |

| ||||

Major Deficits Persist Throughout Forecast. The Governor’s multiyear forecast also indicates the state will have annual operating deficits ranging from $13 billion to $19 billion each year through 2028‑29, as illustrated in the chart on the next page. If left unaddressed, these deficits would generate a cumulative deficit of $43 billion by 2028-29. In spite of this dismal projection, the Governor proposes no budget solutions to establish a structurally balanced budget.

As noted above, the nonpartisan LAO projects lower revenues than does the Governor. The LAO’s forecast also indicates annual operating deficits will be higher than the Governor estimates. The chart below compares these annual deficit forecasts.

Reserves Severely Diminished After Recent Withdrawals. The proposed budget would withdraw $7.1 billion from the state’s reserves in 2025-26, as planned during last year’s budget process. This would leave $17 billion in remaining reserves, which is a relatively low 6.8 percent of General Fund resources in 2025-26. The proposed changes and remaining reserve balances include the following:

- Withdrawal of $7.1 billion from the state’s Rainy Day Fund in 2025-26, in addition to the current year withdrawal of $4.9 billion. These withdrawals would leave $11 billion remaining in the Rainy Day Fund.

- A deposit of $376 million into the Proposition 98 Rainy Day Fund, leaving a balance of $1.5 billion in that account, which can only be used for education funding.

- A $4.5 billion balance in the discretionary reserve (the Special Fund for Economic Uncertainty).

Total State Funds Increase from Prior Enacted Budget. When counting all state funds, the 2025-26 budget would reach $322 billion, a decline of about $10 billion from the current year, as shown in the table below. However, when compared to the enacted 2024-25 budget, total state funds increase by 8.2 percent. Federal funds would add another $171 billion to the budget in 2025‑26, an increase of nearly 12 percent from the enacted current year. Adding all these funds, the amount of total spending through the state would increase by 9.3 percent from the enacted 2024-25 budget level.

Expenditures by Fund Category | ||||||||||||

| Dollars in Billions | ||||||||||||

2024-25 | 2024-25 Revised | 2025-26 Proposed | ||||||||||

$ | % of Total | $ | % of Total | $ | % of Total | |||||||

| General Fund | $212 | 47% | $232 | 46% | $229 | 46% | ||||||

| Special Funds | $84 | 19% | $96 | 19% | $87 | 18% | ||||||

| Bond Funds | $2 | 1% | $4 | 1% | $7 | 1% | ||||||

| Total, State Funds | $298 | 66% | $332 | 66% | $322 | 65% | ||||||

| Change from enacted | | | 12% | | 8.2% | | ||||||

| Federal Funds | $153 | 34% | $168 | 34% | $171 | 35% | ||||||

| Total, All Funds | $451 | 100% | $500 | 100% | $493 | 100% | ||||||

| Change from enacted | | 11% | 9.3% | |||||||||

Federal Funds Uncertain for Health Mandate, Other Programs. The Governor’s budget is counting on the federal government to provide $6 billion for the state’s recently enacted health facility wage mandate (SB 525, Durazo). Despite the deficit last year, the Governor and legislative Democrats foolishly pushed ahead with implementation of this misguided policy in the Fall of 2024. The budget counts on an expansion of a hospital-based fee to generate $6 billion in federal funds to pay the costs, but the scheme requires approval from the Trump administration. Without this federal funding, it is unclear how the state would pay these costs, which it has already begun incurring. Republicans at the national level have discussed placing conditions on federal funds for other programs as well. California is assuming $171 billion in federal funds in its proposed budget for 2025-26, and most of those funds flow through the Medi-Cal program. Even if Congress makes cuts, most of the current federal funding to Medi-Cal is likely to continue, but the $6 billion for the wage mandate may be most at risk. California can no longer assume automatic financial support from the federal government for many of its misguided policies.

Tax Policy

Key Points

- Budget Increases Taxes on Businesses Again. Proposes tax changes that would increase tax revenue by $330 million even as projected General Fund revenues increase.

- Provides Financial Relief to Retired Military Personnel. Proposes to exclude military retirement and survivor benefit payments from consideration as state taxable income.

- Expands the Hollywood Film Tax Credit. Prioritizes the Film and Television Tax credit program for expansion, increasing the annual tax credits from $330 million to $750 million.

- Extension of Pass-Through Entity Elective Tax Tied to Federal Action. Proposes to extend the pass-through elective tax if the federal government extends certain changes enacted in the federal Tax Cut and Jobs Act of 2017.

- Wildfire Settlements Income Exclusion. Proposes to exempt all wildfire settlements from state taxation for settlements paid in tax years 2025 through 2029, consistent with legislation proposed by Senator Seyarto.

Single Sales Factor Would Increase Taxes on Corporations. The Governor’s budget would increase General Fund revenues by $330 million in 2025-26 by requiring multi-state financial firms to use a mandatory single sales factor policy instead of the currently required three-factor formula, which is equally weighted using sales, property and payroll data. With this change, a California-based financial corporation with significant payroll and property in the state could potentially reduce its tax bill with the proposed switch to a single sales factor, but an out-of-state corporation that has relatively high sales in California compared to its property and payroll would likely have a higher tax liability.

Note that California previously switched to using single sales factor with the passage of Proposition 39 in November 2012. California voters approved the initiative measure, which removed three-factor apportionment as an option for all except extraction, agricultural and financial firms. As a result, taxpayers, other than the excluded industries, must use a single-sales factor apportionment to determine tax liability. This new proposal would now expand the policy to financial services firms, but extraction and agricultural firms would continue to be excluded from the required use of the single sales factor for tax apportionment.

Retirement Income Exclusion for Veterans. The budget includes a reduction of $130 million in General Fund tax revenue ($85 million General Fund annually thereafter) as a result of excluding from veterans’ taxable income military retirement and survivor benefit payments. The proposal would exclude up to $20,000 and would be limited to taxpayers with up to $250,000 in income for joint filers and $125,000 in income for single filers. Along with Montana, Rhode Island, Utah, and Vermont, California has been one of five states that tax military retirement pay fully, offering little to no tax benefit for retirement. Republicans are encouraged by the Governor’s proposal, which is consistent with recent Senate Republican efforts led by Senator Seyarto (SB 1), to provide some level of financial relief to the brave Californians serving our country.

Expands the Hollywood Film Tax Credit. The Governor’s January budget prioritizes the Film and Television Tax credit program, increasing the annual tax credits from $330 million to $750 million from 2025-26 through 2029-30. The budget assumes a tax revenue loss of $15 million in 2025-26, growing to more than $200 million annually, significantly less than the authorized $750 million. This revenue loss estimate is due to the fact the production companies cannot claim the credit until the film commission gives them final certification, which occurs after the production is completed, and even once certified, most taxpayers will claim the credits over multiple years.

Additionally, the 2023 Budget Act included SB 132, a budget trailer bill, which made the tax credit refundable, meaning businesses without sufficient tax liability to offset the credit would now be able to participate in the program. Although several other states, as well as several other countries, offer 100 percent refundable tax credits, this expansion was the first business tax credit program that California made refundable. During budget deliberations, it was noted that making the tax credit refundable could result in an accelerated loss of state revenue as companies would be able to claim the credits without a tax liability. As a result of the recent change that made the tax credit refundable, the Administration’s estimate of $200 million in revenue loss annually could be understated.

The nonpartisan Legislative Analyst’s Office provided a brief on the 2023-24 budget proposal and opined that the film tax credit makes the motion picture industry bigger, but the program’s effect on the state’s overall economy is unclear. Given this uncertainty, the Legislature should require the Administration to provide further analysis of the program’s economic impact as compared to the status quo. It is possible that the investment of these funds in other programs could result in a higher investment return to the economy.

Extension of Pass-Through Entity Elective Tax. The budget proposes to extend the state’s pass‑through elective tax (PTE) if the federal government extends the state and local tax payment changes enacted in the federal Tax Cut and Jobs Act of 2017. These tax policies are set to expire after 2025.

The PTE tax was created in 2021 to provide a tax benefit to Californians who were negatively impacted by the Tax Cut and Jobs Act. The program allows certain pass-through entities to elect to pay an elective tax of the entity’s partners, who would then receive a tax credit equal to the elective tax amount. The pass‑through entities that can participate are S corporations, general partnerships, limited liability partnerships, or limited partnerships. The pass-through entity cannot have a partnership as an owner and cannot be a publicly traded partnership.

The PTE tax has been financially beneficial both to the individuals participating in the program and the state’s General Fund. Generally speaking, increased participation in the PTE results in revenue gains to the state because there are some taxpayers who do not have enough tax liability to use all of the allowable tax credits, but these individuals still participate because the reduction in their federal taxes is greater than the amount of credit they use at the state level. Over the past two years, the PTE has led to a net positive revenue gain of $300 million General Fund.

Wildfire Settlements Proposed for Income Exclusion. The budget proposes to exempt all wildfire settlements from state taxation for settlements paid in tax years 2025 through 2029, regardless of when the fire occurred. This proposal is similar to some made by Republicans in the past that were not enacted, such as SB 542 by then Senator Brian Dahle in 2024, which would have excluded settlement payments made in connection with the 2021 Dixie Fire or the 2022 Mill Fire. This proposal is a welcome move to align with those previous efforts, but the policy should also apply to Californians victimized by past fires.

Housing and Homelessness

Key Points

- Facing an Insurance and Housing Crisis, Budget Fails Californians. Governor Newsom fails to prioritize housing amid an insurance crisis, proposing no insurance policy reforms or new funding for housing production.

- New Housing and Homelessness Agency. Proposes yet another bureaucratic expansion with the creation of a new agency, the California Housing and Homelessness Agency.

- Housing Policy Principles Outlined. Budget outlines “policy principles” intended to increase housing development, but no specific details are provided.

- Homeless Population Continues to Grow. New federal data shows California has 187,000 homeless individuals, an increase of three percent over 2023.

- Homelessness Worsening Despite Billions Spent. A 58 percent increase in homelessness since the Governor took office, despite spending $27 billion during that time.

- Lack of Funding for Local Governments. Budget fails to provide flexible funding for local governments’ homeless programs, resulting in fiscal and program uncertainty.

- Behavioral Health Program Provides Rent to the Homeless. The state has recently received approval to provide a new set of behavioral health services to the homeless.

Housing

Governor Fails to Prioritize Housing or Reform Amid Insurance Crisis. The homeowners’ insurance crisis is making it more difficult to build and buy affordable homes in California. Access to homeowners insurance and mortgage insurance provides access to mortgage credit for homebuyers. After disasters like the recent Southern California wildfires, a homeowner’s insurance claim payout can help the homeowner rebuild, preserving hard-earned home equity after a traumatic event.

As home prices remain elevated at historically high levels, rising insurance premiums are also contributing to the growing costs of housing development and homeownership. Lack of insurance availability is restricting the supply of housing, driving up housing costs and restricting low-price options, such as condominiums and multi-family housing. This only gets worse after each wildfire disaster, as the state will soon experience in Southern California.

Although Insurance Commissioner Lara recently released regulations intended to improve the financial viability of insurance providers, changes in the marketplace will be slow to materialize, and it could be several years before the market improves sufficiently to positively impact housing development. It is likely these regulatory changes will not be enough to fix the mess that Commissioner Lara has made, and more will need to be done to shore up the state’s insurer of last resort (the FAIR Plan, see information below), reduce risk of exposure for insurance providers, and reduce costs to consumers.

California FAIR Plan - State’s Insurer of Last Resort. Californians unable to find or afford insurance elsewhere in the market may turn to the state’s insurer of last resort, the California Fair Access to Insurance Requirements Plan (FAIR Plan), a not-for-profit catastrophe insurer that currently holds more than 400,000 policies as of June 2024. The FAIR Plan was created by state law in 1968. It is funded primarily through the policies it sells and is jointly backed by all carriers in the admitted market (companies licensed and backed by the state to write policies in the state). Each member company shares in the profits, losses, and expenses of the FAIR Plan in direct proportion to its market share of business written in California. FAIR Plan policies provide basic, “bare bones” coverage of property damage due to fire, lightning, smoke, or internal explosions. The FAIR plan does not receive any General Fund support at this time, and it is not clear how much financial exposure the FAIR plan has for LA-area fires.

Budget Fails to Provide New Funding for Housing Programs. The January budget does not include any new funding for the state’s housing programs. Several of the state’s housing programs have federal or bond funding provided in 2025-26, such as $275 million for the Multi‑Family Housing program, but these funds are minimal compared to the billions of General Fund dollars provided over the past four years.

Continued Bureaucratic Growth with New Housing and Homelessness Agency. Although the budget does not prioritize funding for housing programs, Governor Newsom does propose yet another bureaucratic expansion with the creation of the California Housing and Homelessness Agency. The proposal would move through the formal governmental organization process overseen by the Little Hoover Commission, and few details are available at this time. It is refreshing to see the Administration utilize the Little Hoover Commission’s Planned Reorganization process, as the Commission will provide a thorough analysis of the proposed new organization, but continuing to expand bureaucracy (a common theme of this Governor’s tenure) will likely result in higher ongoing costs.

No Details, but Housing Policy Principles Outlined. The budget outlines “policy principles” intended to increase housing development as a way to reduce the cost to build, improve accountability, and advance policies that promote climate change initiatives, such as transit‑oriented housing development. It remains to be seen, however if the Governor will release specific language aimed at these principles or if the budget rhetoric is just intended to mitigate the obvious concerns for the lack of progress in addressing the state’s housing crisis.

Homelessness

Billions Spent and Homeless Continue to Grow. In an August 8, 2024, release from Governor Newsom’s press office, the Administration estimates the state has spent more than $27 billion on homelessness prevention efforts since the Governor took office. Yet despite the exorbitant amount spent on the issue, the state’s homeless population continues to increase. In 2016, California had just over 118,000 homeless, ballooning to more than 187,000 by January 2024, an increase of nearly 68,000 Californians (as noted in a December 2024 report by the federal Housing and Urban Development). To recap his time in office, the Governor has spent $27 billion dollars and the state’s homeless population has increased 58 percent, recording the highest number of homeless individuals ever.

Budget Fails to Provide New Flexible Funding for Local Governments’ Homelessness Programs. The Governor’s budget fails to include any new General Fund in 2025-26 for the Homeless Housing Assistance and Prevention program, which provides flexible funding necessary to support local governments’ homelessness efforts. The budget states that the Administration will increase accountability efforts around further implementation of these flexible homeless funds, and outlines examples such as in-depth local reviews, regional meetings, and increased enforcement.

While the budget does not include specifics on additional accountability metrics, or how the measures would improve long-term outcomes, the Governor indicates that if the Legislature supports additional funding for homelessness efforts, stricter accountability measures would be required for approval of the funding. Improving accountability of state and local efforts, and identifying how tens of billions of dollars have been spent is a laudable goal. In fact, Senate Republicans have been calling for improved accountability within the program for years, and recently, a report provided by the California State Auditor identified significant concerns with the state’s lack of an actionable homelessness plan, as well as failure on the state’s part to collect accurate, complete, and comparable financial and outcome information from homelessness programs.

Accountability works best in tandem with targeted and continuous support, and the Governor fails to provide this reassurance to the state’s local governments, nor does his budget propose improvements in the state’s ability to provide actionable intelligence on homelessness spending to date or a long-term plan to improve outcomes across all programs.

Encampment Resolution Grant Program. The budget includes $100 million General Fund for the Encampment Resolution Grant Program, which provides grant funding to assist local governments with resolving critical encampment concerns and transitioning individuals into safe and stable housing. Combined with new legal tools available following the U.S. Supreme Court’s recent Grants Pass ruling, the program could provide local governments with resources necessary to enable the prioritization of clean-up efforts, but ongoing oversight of performance and outcome measures will be critical in subsequent years to ensure the program is an effective tool in supporting efforts to reduce homelessness.

Since 2022, the state has provided more than $735 million to local entities for the encampment resolution program, and yet the number of chronically homeless living on the streets continues to increase. Recent federal 2024 data shows 66 percent of California’s homeless are unsheltered, meaning in 2024, more than 123,000 homeless were living on the streets. Unfortunately, the percent of unsheltered homeless has remained unchanged in California since 2016, despite the state spending $27 billion to manage the crisis. Californians deserve safe streets where families can walk without encountering homeless tent cities on every street corner, and the state needs to ensure that the billions of dollars spent on homelessness efforts are making strides towards that goal.

Federally Funded Behavioral Health Program Provides Six Months’ Rent to the Homeless. The Department of Health Care Services recently received approval from the federal government to provide a new set of behavioral health services over the next five years. The program is called Behavioral Health CONNECT, and the majority of the program’s funding is coming from the federal government. Of these new services, the most notable is the requirement for Medi-Cal managed care plans to pay up to six months of rent for certain high‑need enrollees who are homeless or are at risk of homelessness. This new benefit becomes available on July 1, 2025. While this benefit has the potential to provide temporary stability to individuals in need of care who are currently living in dangerous encampments, it also perpetuates the rigid “housing first” mentality, whereby addictions are ignored in the name of finding shelter. Given the ever-growing danger of fentanyl overdoses in California, moving an individual’s mental illness or drug problem indoors may do very little to improve their outcome.

Health

Key Points

- Higher Caseload, Pharmacy Spending Result in Record Medi-Cal Costs. General Fund expenditures in Medi-Cal increase by more than $7 billion over 2024 Budget Act.

- Medi-Cal Expansion to the Undocumented More Costly than Expected. Democrats’ expansion of Medi-Cal to 1.5 million undocumented individuals adds billions more in spending than planned.

- Troubling Delay in Implementation of Proposition 35 Medi-Cal Rates. Governor chooses to delay until 2026 the proposition’s requirement to fully use Managed Care Organization tax (MCO tax) revenues for increased Medi-Cal provider rates.

- New Federal Funds for Hospitals to Pay for Wage Mandate. The Governor relies on $6 billion in new federal funds to cover costly healthcare wage mandate.

- Free Diapers for All Newborns. Governor creates a new state program to give three months of free diapers to all families with newborns, regardless of income level.

Caseload and Pharmacy Spending Drive Medi-Cal Costs Upward. The 2024 Budget Act projected a Medi-Cal caseload of 14.5 million individuals at a cost of $161 billion ($35 billion General Fund). The Governor’s budget now projects caseload for the current 2024-25 fiscal year to be 15 million individuals at a cost of $175 billion ($38 billion General Fund). In the upcoming 2025-26 budget year, the Governor estimates costs to balloon to $188 billion ($42 billion General Fund, $7 billion more than the amount in the June 2024 budget). In addition to the caseload growth, the Governor predicts $1.5 billion in new Medi-Cal pharmaceutical costs through 2025-26, citing the popularity in new anti-obesity drugs. As reflected in the chart below, although much of the program cost growth is attributable to a massive influx in federal funds into the program, the General Fund impact in 2025-26 is now at a record $42 billion. During the Newsom administration, total costs for Medi-Cal have grown by $88 billion, including General Fund cost growth of an astounding 85 percent.

Costs of Medi-Cal Eligibility Expansion to the Undocumented Greater than Estimated. Over the past 10 years, the Democrats have incrementally (by age cohort) authorized full-scope Medi-Cal eligibility (including In Home Supportive Services) to an estimated 1.5 million individuals residing in California illegally. The 2024 Budget Act estimated $5.6 billion in General Fund costs to cover this expansion. Now the Governor is estimating that the annual General Fund costs are $2.8 billion higher than planned at $8.4 billion for 2025-26, citing higher-than-anticipated enrollment and increased pharmacy costs. The chart below displays the estimated cost growth of funding this expansion over time. Had this expansion never occurred, it can be argued that the Governor’s budget would not need to rely on a $7.1 billion withdrawal from the Budget Stabilization Account (the state’s rainy day fund) to be balanced. Notably, Governor Newsom and legislative Democrats proceeded with these expansions with no delays even after realizing the budget surpluses had disappeared.

Delay of Full Proposition 35 Implementation Could Irk Some Medi-Cal Providers. Proposition 35, the November 2024 election ballot proposition approved by the voters and supported by a large coalition of Medi-Cal providers, permanently authorizes the state to impose a Manage Care Organization tax (MCO tax), but restricts the use of the MCO tax proceeds to Medi-Cal provider reimbursement rate increases, thereby barring future legislatures and governors from shifting the MCO tax funds for a General Fund budget solution. With its approval, many Medi-Cal providers, such as primary care physicians and hospitals, will earn more for serving Medi-Cal patients.

However, despite 68 percent of voters supporting Proposition 35, the Governor’s budget fails to present a full implementation plan for the provider rate increases. Instead, the Governor proposes to defer any plan to the decisions of a Medi-Cal provider stakeholder group, with any negotiated rate increases taking effect in 2026. In doing so, the Governor uses this delay to take an additional $1 billion of MCO tax revenue for General Fund relief in the current 2024-25 fiscal year, basically one last grab at the money. This could be challenged by the coalition that brought Proposition 35 to the ballot, as it seems to violate the spirit of the proposition. Senate Republicans call on the Governor and Democrats to stop the fund raids and use the money for improving Medi-Cal as the voters intended.

Federal Funds from Hospital Quality Fee to Cover Minimum Wage Mandate and Potentially Help Stabilize At-Risk Hospitals. In 2024, the Governor and the Democrats delayed implementation of the minimum wage mandate imposed on hospitals in SB 525 (2023) until October 2024 due to the estimated $2 billion annual cost. They also announced that an expanded Hospital Quality Assurance Fee (HQAF) would be collected in 2025 in order to increase the drawdown of federal funds to pay for the mandate.

The Governor’s budget estimates that this expanded HQAF will generate $6 billion in enhanced federal funding in 2025, enough to both cover the cost of the minimum wage increases and to improve the operational stability of hospitals through directed payments. While help for hospitals is long overdue, the reliance on another federal funding mechanism is not sustainable in the long term, especially since the wage mandates are permanent and that President Trump has signaled that unlimited federal spending must be curtailed. If the federal government does not approve of the HQAF, the General Fund could be on the hook for the costs of SB 525, and many hospitals would continue to be in a precarious financial situation. Senate Republicans will fight for at-risk hospitals by rejecting costly mandates and ensuring that state resources are being prioritized to avoid hospital closures and financial instability.

Free Diapers for All Newborns. The Governor proposes the creation of a new state program to supply three months of diapers for every family with a newborn baby. The Governor proposes using $7.4 million in General Fund in 2025-26 and $13 million in future years to cover this new benefit, which would be implemented through state contracts with hospitals. Legislators may question whether this program should be open to all Californians or should be limited to those families truly in economic need. It is also unclear how this proposal would overlap with existing health and human services entitlements and recent state efforts to fund non-profit diaper banks.

Behavioral Health

Key Points

- $900 Million More for Behavioral Health from “Millionaires’ Tax” Revenue. Increases in the Personal Income Tax revenue expands the amount of funding available for the Behavioral Health Services Act (BHSA).

- Funding for Proposition 1 Implementation Included in Governor’s Budget, but Nothing for Proposition 36. The Governor’s budget funds the counties’ Proposition 1 implementation costs for new treatment services, but fails to provide specific funding for court mandated drug treatments arising from Proposition 36 related arrests.

- Six Months of Rent Available to the Homeless. The state’s new Behavioral Health CONNECT program, funded largely with federal dollars, will provide transitional rent to eligible mentally ill homeless individuals.

More Behavioral Health Funding from “Millionaires’ Tax” Revenue. The Mental Health Services Act, passed as Proposition 63 in 2004 (and reformed by Proposition 1 in 2024 as the Behavioral Health Services Act [BHSA]), imposes a 1 percent tax on personal income in excess of $1 million in order to fund state and county behavioral health programs. The forecast within the Governor’s budget displays a significant increase in BHSA revenues as compared to the June 2024 Budget Act, as shown in the following chart.

| Increase in Projected BHSA "Millionaires" Tax Revenue | |||

| (Dollars in Billions) | 2023-24 | 2024-25 | 2025-26 |

| Estimates at 2024 Budget Act | $2.50 | $2.80 | $2.90 |

| Governor’s Proposed 2025-26 Budget | $2.80 | $3.20 | $3.60 |

Because of the increase in BHSA revenue, the Governor’s budget estimates that nearly $900 million more is available for behavioral health programs than estimated in June 2024. Despite this positive news, it should be noted that the recent spike in personal income tax revenue is largely driven by capital gains realizations, a very volatile revenue source. As such, the Governor is proposing reforms to the BHSA reserve requirements in an upcoming budget trailer bill, but details of these reforms are not yet available.

Counties Get Proposition 1 Funding, but No Dollars for Proposition 36. The 2024 Budget Act provided $85 million ($50 million General Fund) for counties to begin administering the behavioral health treatment reforms found within Proposition 1, which was crafted and heavily backed by the Governor and approved by the voters in March 2024. The Governor’s budget for 2025-26 continues to provide implementation funding at an amount of $94 million ($55 million General Fund). As outlined in Proposition 1, these funds will be used to focus behavioral health treatment services on the homeless or those at risk of homelessness.

While the Prop. 1 funding for counties is welcome, unfortunately the Governor’s budget does not provide any new funding to implement Proposition 36, the public safety-focused proposition opposed by the Governor, but approved overwhelmingly by nearly 70 percent of the voters in November 2024. Proposition 36 permits courts to mandate drug treatment for criminal offenders with substance use disorders. Most counties will rely on their behavioral health departments to administer the mandatory treatment.

Given the tremendous need to help treat tens of thousands of mentally ill and addicted individuals living on California’s streets, total behavioral health funding is likely a fraction of what is actually needed for the counties. The Governor appears to be cynically funding the proposition he supported and neglecting the one he did not. Senate Republicans heard the clear message from the voters and will work to secure Proposition 36 implementation funding for mandatory drug treatment.

New Behavioral Health Program Provides Six Months’ Rent to the Homeless. The Department of Health Care Services recently received approval from the federal government to provide a new set of behavioral health services over the next five years. The program is called Behavioral Health CONNECT, and the majority of the program’s funding is coming from the federal government. Of these new services, the most notable is the requirement for Medi-Cal managed care plans to pay up to six months of rent for certain high-need enrollees who are homeless or are at risk of homelessness. This new benefit becomes available on July 1, 2025.

While this benefit has the potential to provide temporary stability to individuals in need of care who are current living in dangerous encampments, it also perpetuates the rigid “housing first” policy, whereby addictions are ignored in the name of finding shelter. Given the ever-growing danger of fentanyl overdoses in California, moving an individual’s mental illness or drug problem indoors may do very little to improve their outcome. Despite this, it is unlikely that the benefit will be going away in five years, putting the General Fund at risk for future costs.

Department of State Hospitals’ Caseload Down, Costs Flat. The Department of State Hospitals (DSH) is responsible for the daily care and mental health treatment of more than 8,500 patients in five main hospital campuses and in dozens of contracted facilities throughout the state. Over the last decade, the population demographic has shifted from primarily civil court commitments to a forensic population committed through the criminal court system.

While the 2025-26 budget estimates that caseload will decrease to 8,527 patients from 9,267 in 2024-25, the Governor projects costs of $3.4 billion ($3.2 billion General Fund), $3.4 million higher than the 2024 Budget Act. The department attributes the caseload decrease to a decline in transfers of mentally ill inmates from the Department of Corrections and Rehabilitation. Given the caseload decline, there is enough physical bed space at the state hospitals to serve the 675 patients still pending placement. Sadly, the department’s staff position vacancy rate is so high, there are not enough personnel to activate the treatment beds. Despite the overwhelming political support from state public employee unions representing nurses and psychiatrists, the Democrats still persist in neglecting the staff vacancy rate problem at the Department.

Human Services

Key Points

- Expansions from Recent Years Continue to Drive Costs Up. Reflects billions of dollars in cost increases from expansions of recent years, including to the In-Home Supportive Services and Child Care programs.

- Modest Increases Proposed. Proposes several small increases, including a cost adjustment for CalWORKs aid payments and system improvements for CalFresh.

- CalWORKs Federal Pilot Program. California was selected to participate in a six-year federal pilot to test performance and accountability alternatives in the CalWORKs program.

- IHSS Cost and Caseload Growth. The budget includes $29 billion ($11 billion General Fund) in 2025-26 for the IHSS program, with a projected average caseload of 771,650 in 2025-26.

Department of Social Services

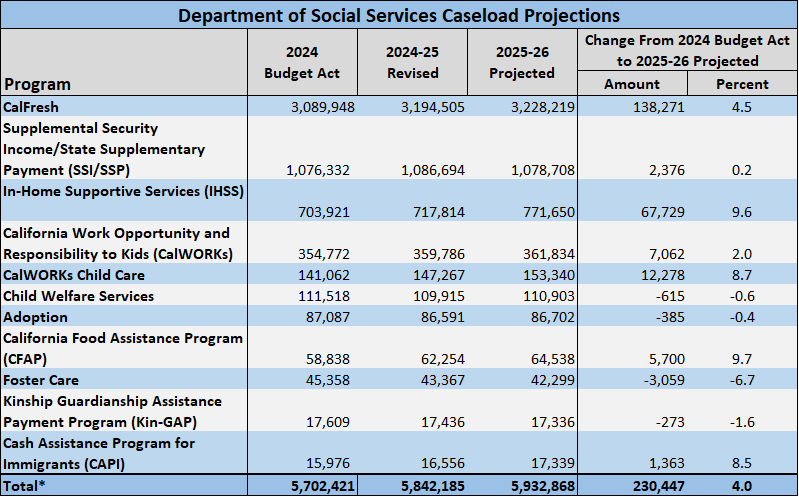

The 2025-26 local assistance budget for Department of Social Services (DSS) is projected to be over $62 billion ($23 billion General Fund). This is $5 billion ($3.1 billion General Fund) more than the 2024 Budget Act. The department notes that benefits are currently provided to over 7.9 million Californians. Several programs now are experiencing enrollment growth near or exceeding 9 percent, as seen the chart below:

*Note: The total projected caseload is not unduplicated. This means that an individual could be included twice if they are receiving benefits from more than one program. The total caseload for programs such as CalWORKs and CalFresh do not account for how many individuals are being served per case. The table also does not include figures for services such as non-CalWORKs Child Care and Development programs, Housing and Homelessness programs, and Immigration Legal Services.

The Governor’s budget foregoes substantial new proposals for Human Services programs, but major expansions authorized in recent years continue to drive costs higher by billions of dollars annually. These expansions and new proposals are detailed below:

In-Home Supportive Services (IHSS)

Caseload and Cost Growth in IHSS. The budget includes $29 billion ($11 billion General Fund) in 2025-26 for the IHSS program, reflecting a $3.3 billion ($1.4 billion General Fund) increase compared to the 2024 Budget Act. The department notes that the increase in costs reflects continued projected caseload growth, cost per hour, and number of hours per case for IHSS overall. Estimates put the projected caseload at 771,650 in 2025-26, representing a 9.6 percent increase over the 2024 Budget Act. The average individual provider hours per case are projected at 123.7 in 2025-26. For comparison, at the 2021-22 Governor’s budget, the average individual provider hours per case were 115.2 for 2020‑21.

California Work Opportunity and Responsibility for Kids (CalWORKs)

CalWORKs Budget and Caseload. The budget proposes $6.4 billion total funds ($961 million General Fund) in 2025-26 for CalWORKs program expenditures, an increase of $50 million total funds ($536 million General Fund) from the 2024 Budget Act. The average monthly caseload is estimated at 361,834 families. This represents a 2 percent increase over the 2024 Budget Act caseload of 354,772. The total CalWORKs funding does not include CalWORKs Stage One Child Care and CalWORKs housing programs, which area accounted for in the child care and social services housing sections. The increase in General Fund is due to a lower amount of Federal Temporary Assistance for Needy Family (TANF) carryforward funds available in 2025‑26.

CalWORKs Grant Increase. The Governor’s budget includes a 0.2 percent increase to CalWORKs Maximum Aid Payment levels, estimated to cost $9 million. This increase is supposed to be funded entirely by the Child Poverty and Family Supplemental Support Subaccount, a fund source that the state previously realigned to counties. While this expansion is being covered by the subaccount, it should be noted that if the subaccount ever has insufficient funding to cover this increase or any prior grant increases, General Fund will be used to backfill the difference.

CalWORKs Federal Pilot Program. California was selected as one of five states to participate in a federal pilot program that seeks to test alternative benchmarks to work participation rates. This means California’s entire CalWORKs program will be operating under alternative accountability measures. The pilot will be in place for six federal fiscal years, with first year being used to establish benchmark data and negotiate performance targets. The following five years will be used to measure the programs performance against those new targets. While details are still being worked out on how the state will advance the goals of the pilot project, prior authorizations were provided to DSS to consider proposals to modify the existing welfare-to-work process, limit sanctions, and repeal the federal work participation rate penalty pass-through.

Over the past decade, numerous policy changes have been passed that have significantly altered accountability metrics in CalWORKs, including the elimination of the Maximum Family Grant rule, extension of the lifetime limits for adult recipients from 48 to 60 months, and increased “flexibility” in work participation requirements. That said, with the selection of California for the pilot program, the state will have an opportunity to test alternative benchmarks without the threat penalties for failing to meet work participation rates. The alternative benchmarks could potentially provide a better picture of CalWORKs outcomes, shortcomings, and what works to improve family outcomes.

Food and Nutrition Programs

CalFresh Program Integrity Improvements. The Governor’s budget includes $7.6 million ($2.7 million General Fund) for automation costs related to utilizing the Supplemental Nutritional Assistance Program (SNAP) National Accuracy Clearinghouse (NAC). The federal government is requiring that all states utilize the NAC to enhance SNAP integrity, known as CalFresh in California. The program uses interstate data matching to help prevent households from receiving benefits in multiple states at the same time. The department anticipates using the NAC beginning in November 2026.

Children and Family Services

Tiered Rate Structure Implementation Preparation. The Governor’s budget includes $1.7 million ($1.2 million General Fund) for Child and Adolescent Needs and Strengths (CANS) Fidelity and Training activities. These activities will be in preparation for the rollout of the new permanent tiered rate structure for foster care. Under the new structure, rates will be based on the needs and strengths of a child or youth, rather than their placement type. The CANS tool will be used to determine the tier of the child or youth, and ensuring proper training is essential to maintaining reliability in the use of the tool.

Child Care and Early Education

Key Points